Market Whales and Their Recent Bets on LRCX Options

Market Whales and Their Recent Bets on LRCX Options

High-rolling investors have positioned themselves bullish on Lam Research (NASDAQ:LRCX), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in LRCX often signals that someone has privileged information.

高端投資者看好拉姆研究(納斯達克:LRCX),散戶交易者應予以關注。\通過彭博社公開的期權數據追蹤,我們關注到這一活動。儘管這些投資者的身份尚不明確,但LRCX的如此巨大變動往往表明有人擁有內部信息。

Today, Benzinga's options scanner spotted 18 options trades for Lam Research. This is not a typical pattern.

今天,Benzinga的期權掃描器發現了18筆關於拉姆研究的期權交易,這不是一個典型的模式。

The sentiment among these major traders is split, with 50% bullish and 22% bearish. Among all the options we identified, there was one put, amounting to $48,690, and 17 calls, totaling $712,782.

這些主要交易商的情緒分裂,50%看好,22%看淡。在我們所確認的所有期權當中,有一筆看跌期權,金額爲$48,690,17筆看漲期權,總額爲$712,782。

Expected Price Movements

預期價格波動

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $700.0 to $1260.0 for Lam Research during the past quarter.

分析這些合約中的成交量和持倉量,似乎大玩家正在關注拉姆研究在過去一個季度期間$700.0到$1260.0的價格區間。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

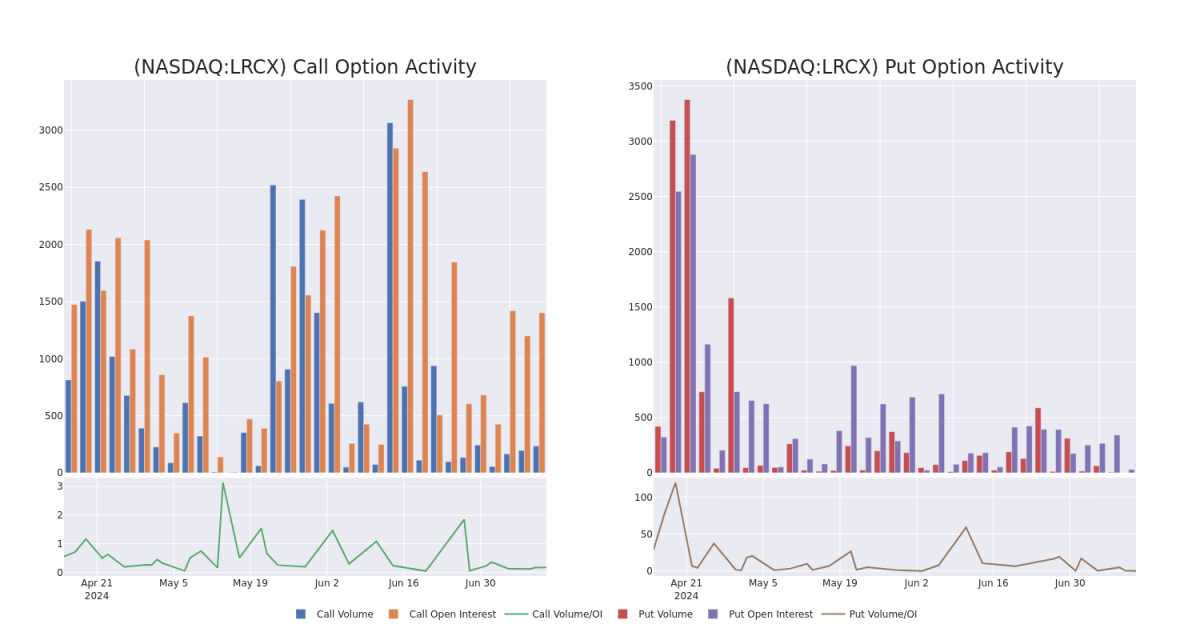

In today's trading context, the average open interest for options of Lam Research stands at 100.07, with a total volume reaching 235.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Lam Research, situated within the strike price corridor from $700.0 to $1260.0, throughout the last 30 days.

在今天的交易背景下,拉姆研究期權的平均持倉量爲100.07,總成交量達到235.00。伴隨圖表勾畫出了在過去30天內,範圍在$700.0到$1260.0行權價走廊內的拉姆研究看漲和看跌期權成交量和持倉量的進展。

Lam Research Option Volume And Open Interest Over Last 30 Days

Lam Research 期權交易最近30天的成交量和持倉量

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LRCX | CALL | SWEEP | BEARISH | 09/20/24 | $17.35 | $16.5 | $16.5 | $1260.00 | $80.8K | 224 | 99 |

| LRCX | CALL | SWEEP | NEUTRAL | 07/26/24 | $32.8 | $31.15 | $32.1 | $1080.00 | $64.1K | 30 | 0 |

| LRCX | CALL | SWEEP | BEARISH | 07/19/24 | $28.35 | $27.0 | $27.0 | $1060.00 | $54.0K | 200 | 2 |

| LRCX | PUT | TRADE | NEUTRAL | 01/16/26 | $83.95 | $78.35 | $81.15 | $880.00 | $48.6K | 30 | 1 |

| LRCX | CALL | TRADE | BULLISH | 08/16/24 | $161.85 | $159.6 | $161.85 | $930.00 | $48.5K | 299 | 2 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LRCX | 看漲 | SWEEP | 看淡 | 09/20/24 | $17.35 | $16.5 | $16.5 | $1260.00 | $80.8K | 224 | 99 |

| LRCX | 看漲 | SWEEP | 中立 | 07/26/24 | $32.8 | $31.15 | $32.1 | $1080.00 | $64.1K | 30 | 0 |

| LRCX | 看漲 | SWEEP | 看淡 | 07/19/24 | $28.35 | $27.0 | $27.0 | $1060.00 | $54.0K | 200 | 2 |

| LRCX | 看跌 | 交易 | 中立 | 01/16/26 | $83.95 | $78.35 | $81.15 | $880.00 | $48.6K | 30 | 1 |

| LRCX | 看漲 | 交易 | 看好 | 08/16/24 | $161.85 | $159.6 | $161.85 | $930.00 | $48.5K | 299 | 2 |

About Lam Research

關於拉姆研究

Lam Research is one of the largest semiconductor wafer fabrication equipment, or WFE, manufacturers in the world. It specializes in the market segments of deposition and etch, which entail the buildup of layers on a semiconductor and the subsequent selective removal of patterns from each layer. Lam holds the top market share in etch and holds the clear cut second share in deposition. It is more exposed to memory chipmakers for DRAM and NAND chips. It counts as top customers the largest chipmakers in the world, including TSMC, Samsung, Intel, and Micron.

拉姆研究是全球最大的半導體硅片製造設備(WFE)製造商之一。它專注於沉積和刻蝕市場領域,即在半導體上構建層,隨後選擇性地從每層中去除不需要的蝕刻模式。拉姆在刻蝕領域佔據着最高市場份額,並在沉積領域佔據了明確的第二份額。它更多地面向DRAM和NAND芯片的存儲器芯片製造商。其頂級客戶包括台積電、三星、英特爾和英飛凌等全球最大的芯片製造商。

In light of the recent options history for Lam Research, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考慮到拉姆研究最近的期權歷史,現在適合關注公司本身。我們旨在探討其當前的表現。

Where Is Lam Research Standing Right Now?

拉姆研究的當前狀況如何?

- Trading volume stands at 299,451, with LRCX's price up by 2.5%, positioned at $1086.39.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 19 days.

- 交易量爲299,451,LRCX的股價上漲2.5%,位於$1086.39。

- RSI指標顯示該股票可能接近超買。

- 預計19天后公佈收益報告。

Expert Opinions on Lam Research

拉姆研究的專家意見

Over the past month, 2 industry analysts have shared their insights on this stock, proposing an average target price of $1212.5.

在過去一個月中,有2位行業分析師分享了他們對這支股票的見解,提出了平均目標價爲$1212.5。

- Maintaining their stance, an analyst from B. Riley Securities continues to hold a Buy rating for Lam Research, targeting a price of $1325.

- Maintaining their stance, an analyst from Wells Fargo continues to hold a Equal-Weight rating for Lam Research, targeting a price of $1100.

- 根據B. Riley Securities的分析師的持續立場,他們繼續持有Lam Research的買入評級,目標價爲1325美元。

- 根據富國銀行證券(Wells Fargo Securities)分析師的持續立場,他們繼續持有Lam Research的等權重評級,目標價爲1100美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Lam Research options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在收益。精明的交易者通過不斷學習,調整策略,監控多個因子,密切關注市場動向來管理這些風險。通過Benzinga Pro的實時警報及時了解最新的拉姆研究期權交易情況。