What the Options Market Tells Us About United Airlines Holdings

What the Options Market Tells Us About United Airlines Holdings

Financial giants have made a conspicuous bullish move on United Airlines Holdings. Our analysis of options history for United Airlines Holdings (NASDAQ:UAL) revealed 8 unusual trades.

金融巨頭對聯合航空控股公司採取了明顯的看漲舉動。我們對聯合航空控股公司(納斯達克股票代碼:UAL)期權歷史的分析顯示了8筆不尋常的交易。

Delving into the details, we found 50% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $195,805, and 5 were calls, valued at $224,765.

深入研究細節,我們發現50%的交易者看漲,而50%的交易者表現出看跌的趨勢。在我們發現的所有交易中,有3筆是看跌期權,價值爲195,805美元,5筆是看漲期權,價值224,765美元。

Predicted Price Range

預測的價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $43.0 to $60.0 for United Airlines Holdings over the recent three months.

根據交易活動,主要投資者的目標似乎是聯合航空控股公司在最近三個月的價格區間內從43.0美元到60.0美元不等。

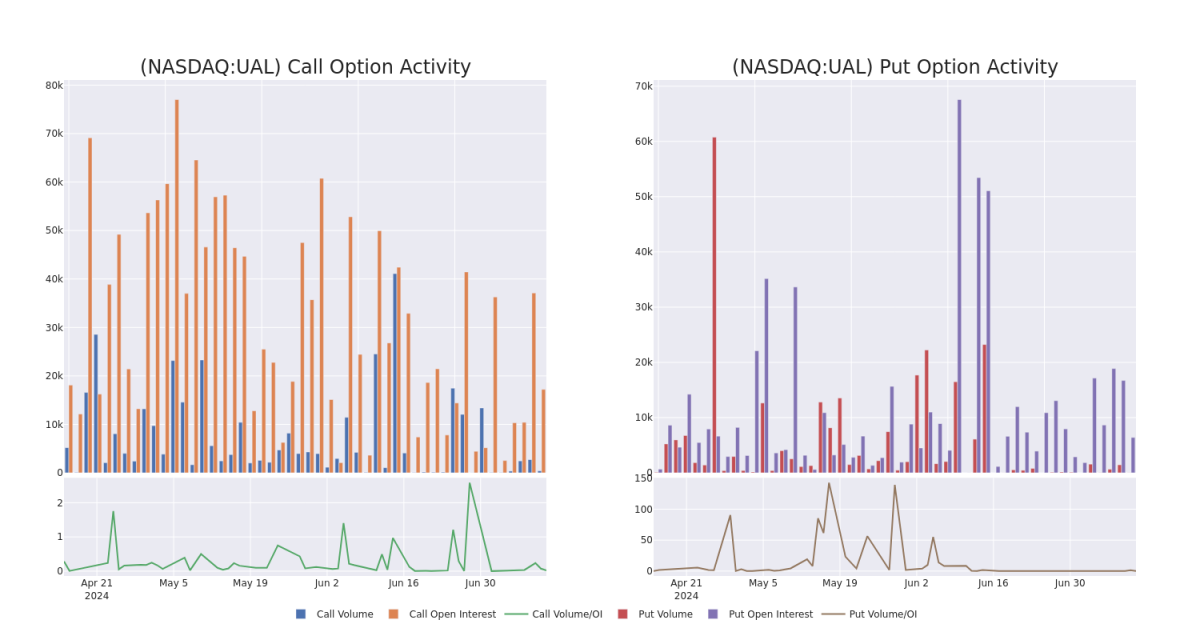

Analyzing Volume & Open Interest

分析交易量和未平倉合約

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in United Airlines Holdings's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to United Airlines Holdings's substantial trades, within a strike price spectrum from $43.0 to $60.0 over the preceding 30 days.

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了聯合航空控股公司在指定行使價下期權的流動性和投資者對該期權的興趣。即將發佈的數據可視化了與聯合航空控股公司大量交易相關的看漲期權和看跌期權交易量和未平倉合約的波動,行使價在前30天從43.0美元到60.0美元不等。

United Airlines Holdings Option Volume And Open Interest Over Last 30 Days

聯合航空控股過去30天的期權交易量和未平倉合約

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UAL | PUT | SWEEP | BULLISH | 01/17/25 | $15.7 | $15.6 | $15.6 | $60.00 | $102.9K | 513 | 0 |

| UAL | CALL | TRADE | BEARISH | 07/19/24 | $0.54 | $0.51 | $0.51 | $50.00 | $76.3K | 16.0K | 123 |

| UAL | PUT | SWEEP | BULLISH | 09/20/24 | $8.45 | $8.35 | $8.35 | $52.50 | $55.9K | 5.4K | 3 |

| UAL | CALL | SWEEP | BULLISH | 07/26/24 | $2.23 | $2.2 | $2.23 | $45.00 | $49.6K | 100 | 30 |

| UAL | CALL | SWEEP | BEARISH | 09/20/24 | $2.82 | $2.79 | $2.79 | $46.00 | $40.7K | 329 | 101 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| UAL | 放 | 掃 | 看漲 | 01/17/25 | 15.7 美元 | 15.6 美元 | 15.6 美元 | 60.00 美元 | 102.9 萬美元 | 513 | 0 |

| UAL | 打電話 | 貿易 | 粗魯的 | 07/19/24 | 0.54 美元 | 0.51 美元 | 0.51 美元 | 50.00 美元 | 76.3 萬美元 | 16.0K | 123 |

| UAL | 放 | 掃 | 看漲 | 09/20/24 | 8.45 美元 | 8.35 美元 | 8.35 美元 | 52.50 美元 | 55.9 萬美元 | 5.4K | 3 |

| UAL | 打電話 | 掃 | 看漲 | 07/26/24 | 2.23 美元 | 2.2 美元 | 2.23 美元 | 45.00 美元 | 49.6 萬美元 | 100 | 30 |

| UAL | 打電話 | 掃 | 粗魯的 | 09/20/24 | 2.82 美元 | 2.79 美元 | 2.79 美元 | 46.00 美元 | 40.7 萬美元 | 329 | 101 |

About United Airlines Holdings

關於聯合航空控股公司

United Airlines is a major us network carrier with hubs in San Francisco, Chicago, Houston, Denver, Los Angeles, New York/Newark, and Washington, D.C. United operates a hub-and-spoke system that is more focused on international and long-haul travel than its large U.S. peers.

聯合航空是美國主要的網絡運營商,在舊金山、芝加哥、休斯頓、丹佛、洛杉磯、紐約/紐瓦克和華盛頓特區設有樞紐。美聯航運營的樞紐輻射系統比美國大型同行更側重於國際和長途旅行。

After a thorough review of the options trading surrounding United Airlines Holdings, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對圍繞聯合航空控股公司的期權交易進行了全面審查之後,我們將對該公司進行更詳細的審查。這包括評估其當前的市場狀況和表現。

Current Position of United Airlines Holdings

聯合航空控股公司目前的狀況

- Trading volume stands at 3,629,407, with UAL's price down by -1.82%, positioned at $44.81.

- RSI indicators show the stock to be may be oversold.

- Earnings announcement expected in 5 days.

- 交易量爲3,629,407美元,UAL的價格下跌了-1.82%,爲44.81美元。

- RSI指標顯示該股可能被超賣。

- 預計將在5天內公佈業績。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for United Airlines Holdings with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高利潤的潛力。精明的交易者通過持續的教育、戰略貿易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解聯合航空控股公司的最新期權交易,以獲取實時提醒。