Home Depot Unusual Options Activity For July 12

Home Depot Unusual Options Activity For July 12

Deep-pocketed investors have adopted a bullish approach towards Home Depot (NYSE:HD), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in HD usually suggests something big is about to happen.

深口袋的投資者對紐交所家得寶 (NYSE: HD) 採取了看好的策略,市場玩家不應忽視這一點。我們在Benzinga跟蹤公開期權記錄時發現了這一重大舉動。這些投資者的身份尚不清楚,但HD的如此重大舉動通常意味着即將發生某些重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 28 extraordinary options activities for Home Depot. This level of activity is out of the ordinary.

我們從觀察今天的Benzinga期權掃描器時獲得了這些信息,它突出了家得寶的28項非凡期權活動。這種活動水平是不尋常的。

The general mood among these heavyweight investors is divided, with 46% leaning bullish and 32% bearish. Among these notable options, 3 are puts, totaling $87,317, and 25 are calls, amounting to $1,737,199.

這些重量級投資者的整體情緒分爲兩派,其中46%看好,32%看淡。在這些顯著的期權中,有3個看跌,總金額爲$87,317,而有25個看漲,總金額爲$1,737,199。

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $330.0 to $380.0 for Home Depot over the recent three months.

根據交易活動,看起來這些重要的投資者正在針對家得寶近三個月的價格區間從$330.0到$380.0。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

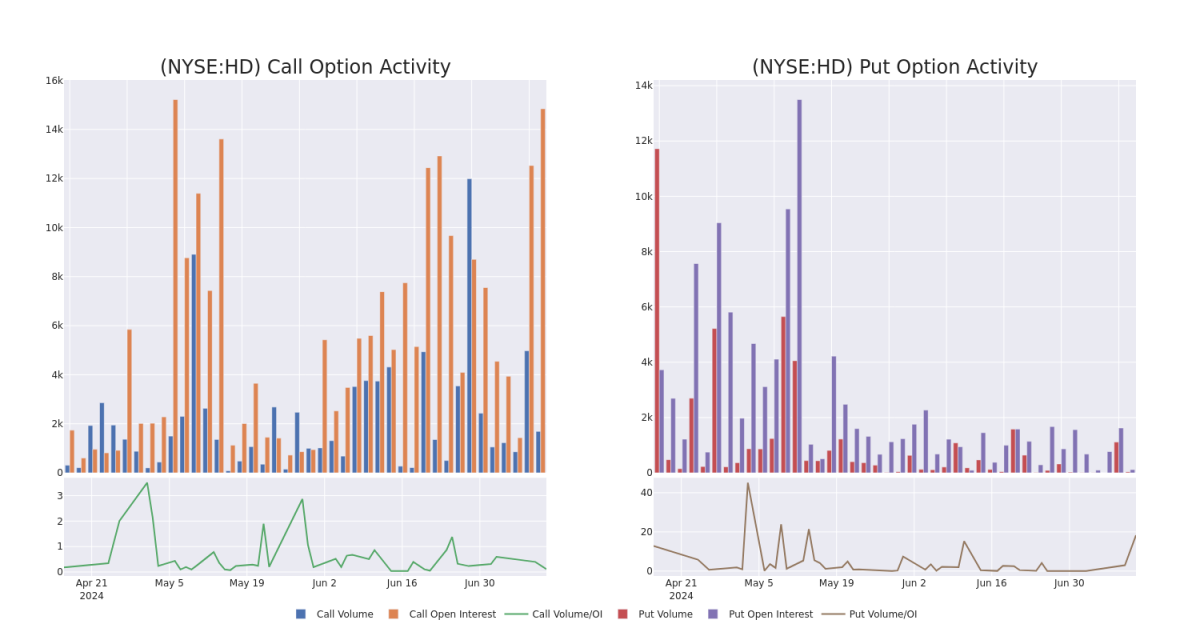

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Home Depot's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Home Depot's substantial trades, within a strike price spectrum from $330.0 to $380.0 over the preceding 30 days.

評估成交量和未平倉合約量是期權交易的戰略步驟。這些指標揭示了特定行權價格下家得寶期權的流動性和投資者興趣。即將到來的數據可視化了在$330.0到$380.0行權價格範圍內與家得寶重要交易相關的看跌和看漲的成交量和未平倉合約量的波動情況,在過去的30天內。

Home Depot Call and Put Volume: 30-Day Overview

家得寶看漲和看跌的成交量:30天總覽

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HD | CALL | SWEEP | NEUTRAL | 08/16/24 | $23.45 | $21.3 | $22.2 | $340.00 | $222.0K | 1.0K | 104 |

| HD | CALL | TRADE | BULLISH | 08/16/24 | $21.8 | $20.15 | $21.8 | $340.00 | $218.0K | 1.0K | 0 |

| HD | CALL | SWEEP | BEARISH | 01/17/25 | $17.4 | $16.4 | $16.63 | $380.00 | $164.7K | 1.2K | 4 |

| HD | CALL | SWEEP | NEUTRAL | 08/16/24 | $16.15 | $15.1 | $15.54 | $350.00 | $155.9K | 1.6K | 11 |

| HD | CALL | TRADE | NEUTRAL | 01/17/25 | $38.8 | $37.15 | $38.0 | $340.00 | $114.0K | 1.1K | 5 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| HD | 看漲 | SWEEP | 中立 | 08/16/24 | $23.45 | $21.3 | $22.2 | $340.00 | $222.0K | 1.0K | 104 |

| HD | 看漲 | 交易 | 看好 | 08/16/24 | $21.8美元 | $20.15 | $21.8美元 | $340.00 | $218.0K | 1.0K | 0 |

| HD | 看漲 | SWEEP | 看淡 | 01/17/25 | $17.4 | $16.4 | $16.63 | $380.00 | 164.7K美元 | 1.2K | 4 |

| HD | 看漲 | SWEEP | 中立 | 08/16/24 | $16.15 | $15.1 | $15.54 | $350.00 | $155.9K | 1.6K | 11 |

| HD | 看漲 | 交易 | 中立 | 01/17/25 | $38.8 | $37.15 | $38.0 | $340.00 | $114.0K | 1.1千 | 5 |

About Home Depot

關於家得寶

Home Depot is the world's largest home improvement specialty retailer, operating more than 2,300 warehouse-format stores offering more than 30,000 products in store and 1 million products online in the US, Canada, and Mexico. Its stores offer numerous building materials, home improvement products, lawn and garden products, and decor products and provide various services, including home improvement installation services and tool and equipment rentals. The acquisition of Interline Brands in 2015 allowed Home Depot to enter the MRO business, which has been expanded through the tie-up with HD Supply (2020). The additions of the Company Store brought textiles to the lineup, and Redi Carpet added multifamily flooring, while the recent tie-up with SRS helps grow professional demand.

家得寶是全球最大的家居用品專賣零售商,在美國、加拿大和墨西哥經營超過2,300家倉庫式超市,在店內提供超過30,000種商品,在網上提供超過100萬種商品。其商店提供許多建築材料、家居改進產品、草坪與花園產品和裝飾品,並提供各種服務,包括家居改進安裝服務和工具和設備租賃。通過收購Interline Brands(2015年),家得寶進入了MRO業務,並通過與HD Supply(2020年)合作擴大業務。同時還收購了Company Store,增加了紡織品的產品線,Redi Carpet則增加了多戶家庭的地板產品,而與SRS的最近合作則有助於增加專業需求。

Having examined the options trading patterns of Home Depot, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在審查家得寶的期權交易模式之後,我們的注意力現在直接轉向公司。這個轉變使我們可以深入研究它目前在市場上的位置和表現

Current Position of Home Depot

家得寶當前的位置

- With a trading volume of 1,380,061, the price of HD is up by 2.15%, reaching $361.41.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 32 days from now.

- HD的交易量爲1,380,061,價格上漲2.15%,達到$361.41。

- 當前RSI值表明該股票可能接近超買狀態。

- 距離下一次盈利報告還有32天。

Professional Analyst Ratings for Home Depot

家得寶的專業分析師評級

1 market experts have recently issued ratings for this stock, with a consensus target price of $395.0.

1個市場專家最近對該股票發表了評級,目標價爲395.0美元,達成共識。

- An analyst from DA Davidson has elevated its stance to Buy, setting a new price target at $395.

- DA Davidson的一位分析師將其立場提升爲看漲,並將新的目標價設定在$395。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Home Depot with Benzinga Pro for real-time alerts.

期權交易涉及更大的風險,但也提供了更高的利潤潛力。精明的交易者通過持續教育、策略性的交易調整、利用各種指標、保持市場動態等方面來減輕這些風險。使用Benzinga Pro即時獲得紐約交易所家得寶的最新期權交易警報。