Stock Of The Day: NVIDIA Has Another Bearish Engulfing Pattern

Stock Of The Day: NVIDIA Has Another Bearish Engulfing Pattern

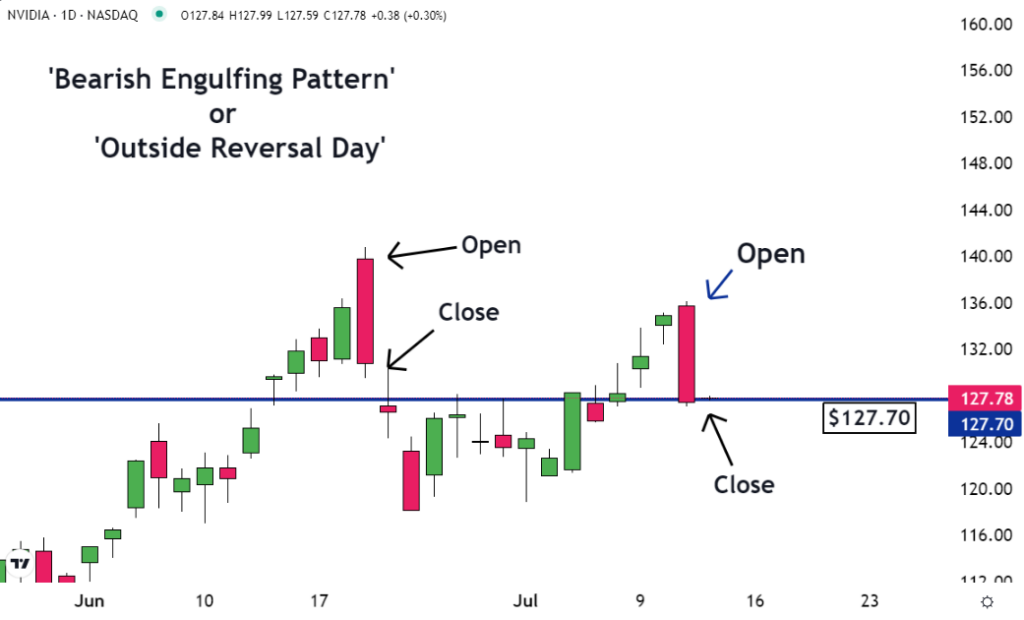

The last time a "bearish engulfing pattern" formed on the chart of NVIDIA Corp (NASDAQ:NVDA) a large move lower followed. Now another one of these patterns has formed — and it may also mean a move lower is coming.

上一次在NVIDIA公司(納斯達克股票代碼:NVDA)的圖表上形成 “看跌吞沒模式” 時,隨後出現了大幅下跌。現在,其中另一種模式已經形成——這也可能意味着下跌即將到來。

Many technical analysts attempt to identify chart patterns without understanding the price action that creates them. That's why Nvidia is our trading team's Stock of the Day.

許多技術分析師試圖在不了解形成圖表模式的價格走勢的情況下識別這些模式。這就是爲什麼 Nvidia 成爲我們交易團隊的每日股票。

The chart illustrates two important technical analysis lessons.

該圖表說明了兩個重要的技術分析課程。

Reversals in markets happen when the leadership changes from bulls to bears or bears to bulls. If the change is slow and gradual, a "rounded top" or "rounded bottom" pattern may appear on the chart. If the change takes place over a couple of sessions, it may form a "V top" or "inverted V bottom" pattern.

當領導層從多頭變爲空頭或從空頭變爲多頭時,市場就會發生逆轉。如果變化緩慢且漸進,則圖表上可能會出現 “頂部圓形” 或 “底部圓形” 的圖案。如果更改發生在幾個會話中,則可能形成 “V 形頂部” 或 “倒置的 V 形底部” 模式。

And when the change in leadership takes place in just one day, an "engulfing pattern" may appear.

而且,當領導層更迭在短短一天內發生時,可能會出現 “吞沒模式”。

Bearish Pattern for Nvidia

英偉達的看跌模式

The important thing about this bearish engulfing pattern for Nvidia is the price action that caused it to form. In the morning it looked like it was going to be another up day. The opening price was higher than the previous day's close. It looked like the uptrend was going to continue.

對於Nvidia來說,這種看跌吞沒模式的重要之處在於導致其形成的價格走勢。早上好像又要起牀了。開盤價高於前一天的收盤價。看來上升趨勢將繼續。

But by the end of the day, something important happened. The sellers overpowered the buyers. They even pushed the price below the previous day's opening price.

但歸根結底,重要的事情發生了。賣家壓倒了買家。他們甚至將價格推低至前一天的開盤價以下。

The open was higher than the previous close, and the close was lower than the previous open. The price action "engulfed" the prior day's action.

開盤價高於前一收盤價,收盤價低於前一開盤價。價格走勢 “吞沒” 了前一天的走勢。

Most volume trades on the open and the close. Because of this there, is typically support at these levels. The fact that the stock fell right through them shows the sellers are extremely aggressive.

大多數交易量都是在開盤和收盤時進行的。因此,通常會在這些級別上提供支持。股票直接下跌的事實表明賣方極具侵略性。

Support for Nvidia

對 Nvidia 的支持

There's another lesson on this chart.

這張圖表上還有另一節課。

As you can see, after yesterday's sell-off, the shares closed just below $128.00. This isn't a coincidence. There is support here for Nvidia because these levels were previously resistance.

如您所見,在昨天的拋售之後,該股收盤略低於128.00美元。這不是巧合。這裏有對Nvidia的支持,因爲這些水平以前是阻力。

Many traders who sold while the shares were at the resistance decided they made a mistake when the price moved higher. Some of them decided to buy their shares back if they could get them for the same price that they were sold for.

許多在股票處於阻力位時賣出的交易者認爲,當價格上漲時,他們犯了一個錯誤。他們中的一些人決定回購股票,前提是他們能以與出售價格相同的價格獲得股票。

As a result, now that the price has fallen back to these levels, buy orders are placed. And if there are enough of these orders, it will create support at what had been resistance.

結果,既然價格已經回落到這些水平,就下了買入訂單。而且,如果這些訂單足夠多,它將爲曾經的阻力提供支撐。

To understand technical analysis, traders need to understand what chart patterns are. More importantly, they need to understand the price action that creates them.

要了解技術分析,交易者需要了解什麼是圖表模式。更重要的是,他們需要了解造成他們的價格走勢。

The image was created using artificial intelligence by MidJourney.

該圖像是由MidJourney使用人工智能創建的。