Salesforce Options Trading: A Deep Dive Into Market Sentiment

Salesforce Options Trading: A Deep Dive Into Market Sentiment

Financial giants have made a conspicuous bearish move on Salesforce. Our analysis of options history for Salesforce (NYSE:CRM) revealed 31 unusual trades.

金融巨頭對Salesforce持看淡態度。我們對Salesforce(紐交所:CRM)期權歷史進行分析,發現31筆異常交易。

Delving into the details, we found 45% of traders were bullish, while 48% showed bearish tendencies. Out of all the trades we spotted, 6 were puts, with a value of $266,673, and 25 were calls, valued at $2,421,480.

具體地說,我們發現45%的交易者看漲,而48%的人呈看淡態度。在我們觀察到的所有交易中,有6筆看跌期權,價值266,673美元,而有25筆看漲期權,價值2,421,480美元。

What's The Price Target?

價格目標是什麼?

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $155.0 to $320.0 for Salesforce over the last 3 months.

考慮到這些合約的成交量和未平倉量,過去3個月內鯨魚一直在以155.0美元到320.0美元的價格區間爲目標。

Volume & Open Interest Trends

成交量和未平倉量趨勢

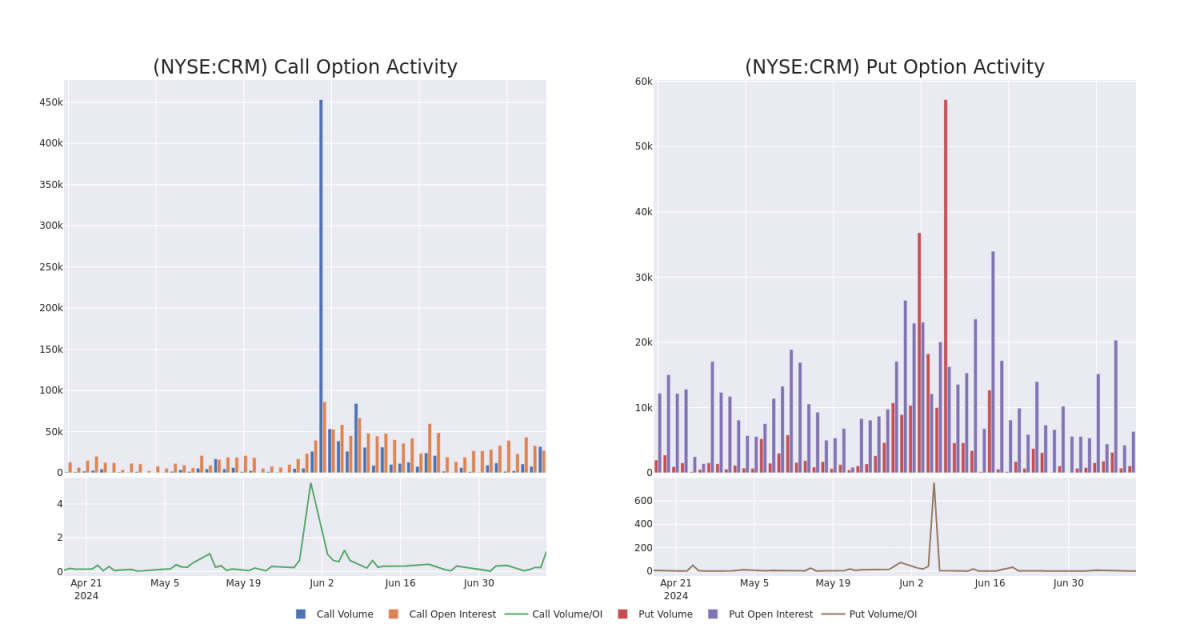

In terms of liquidity and interest, the mean open interest for Salesforce options trades today is 1676.0 with a total volume of 33,019.00.

就流動性和關注度而言,今天的Salesforce期權交易的平均未平倉量爲1676.0,總成交量爲33,019.00。

In the following chart, we are able to follow the development of volume and open interest of call and put options for Salesforce's big money trades within a strike price range of $155.0 to $320.0 over the last 30 days.

在下面的圖表中,我們可以跟蹤過去30天內Salesforce的看漲和看跌期權的成交量和未平倉量的發展情況,其行權價格區間爲155.0美元到320.0美元。

Salesforce 30-Day Option Volume & Interest Snapshot

Salesforce 30天期權成交量和持倉量摘要

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRM | CALL | TRADE | BULLISH | 07/12/24 | $52.6 | $50.55 | $52.6 | $200.00 | $526.0K | 300 | 100 |

| CRM | CALL | SWEEP | BULLISH | 07/12/24 | $51.5 | $49.25 | $51.5 | $200.00 | $494.4K | 300 | 0 |

| CRM | CALL | TRADE | BULLISH | 07/26/24 | $2.86 | $2.73 | $2.86 | $260.00 | $171.6K | 595 | 97 |

| CRM | CALL | TRADE | BULLISH | 07/19/24 | $15.05 | $14.7 | $15.05 | $240.00 | $120.4K | 4.0K | 114 |

| CRM | CALL | SWEEP | BEARISH | 08/16/24 | $11.25 | $11.1 | $11.1 | $250.00 | $110.6K | 6.3K | 141 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRM | 看漲 | 交易 | 看好 | 07/12/24 | $52.6 | $50.55 | $52.6 | 。 | $526.0K | 300 | 100 |

| CRM | 看漲 | SWEEP | 看好 | 07/12/24 | $51.5 | $49.25 | $51.5 | 。 | $494.4K | 300 | 0 |

| CRM | 看漲 | 交易 | 看好 | 07/26/24 | $2.86 | $2.73 | $2.86 | $260.00 | $171.6K | 595 | 97 |

| CRM | 看漲 | 交易 | 看好 | 07/19/24 | $15.05 | $14.7 | $15.05 | $240.00 | $120.4K | 4.0K | 114 |

| CRM | 看漲 | SWEEP | 看淡 | 08/16/24 | $11.25 | 11.1美元 | 11.1美元 | $250.00 | $110.6K | 6.3K | 141 |

About Salesforce

關於賽富時

Salesforce provides enterprise cloud computing solutions. The company offers customer relationship management technology that brings companies and customers together. Its Customer 360 platform helps the group to deliver a single source of truth, connecting customer data across systems, apps, and devices to help companies sell, service, market, and conduct commerce. It also offers Service Cloud for customer support, Marketing Cloud for digital marketing campaigns, Commerce Cloud as an e-commerce engine, the Salesforce Platform, which allows enterprises to build applications, and other solutions, such as MuleSoft for data integration.

賽富時提供企業級雲計算解決方案。該公司提供客戶關係管理技術,將公司和客戶聯繫在一起。其客戶360平台幫助集團提供單一的數據來源,連接客戶數據跨系統、應用和設備,幫助公司銷售、服務、市場和開展商業。它還爲客戶支持提供服務雲,爲數字營銷活動提供營銷雲,作爲電子商務引擎的商業雲,提供賽富時平台,以允許企業構建應用程序和其他解決方案,例如用於數據集成的MuleSoft。

Following our analysis of the options activities associated with Salesforce, we pivot to a closer look at the company's own performance.

在分析與Salesforce相關的期權活動後,我們轉向更加深入地了解該公司的業績。

Present Market Standing of Salesforce

Salesforce目前的市場地位

- Trading volume stands at 1,916,874, with CRM's price up by 0.98%, positioned at $253.59.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 47 days.

- 交易量爲1,916,874,CRM的價格上漲了0.98%,位於253.59美元。

- RSI指標顯示該股票可能接近超買。

- 業績公佈還有47天。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。