Delta Air Lines Options Trading: A Deep Dive Into Market Sentiment

Delta Air Lines Options Trading: A Deep Dive Into Market Sentiment

Financial giants have made a conspicuous bullish move on Delta Air Lines. Our analysis of options history for Delta Air Lines (NYSE:DAL) revealed 25 unusual trades.

金融巨頭對達美航空採取了顯眼的看好舉措。我們對達美航空(NYSE:DAL)期權歷史的分析顯示有25個不尋常的交易。

Delving into the details, we found 40% of traders were bullish, while 36% showed bearish tendencies. Out of all the trades we spotted, 15 were puts, with a value of $836,066, and 10 were calls, valued at $479,635.

深入了解後,我們發現40%的交易者看漲,而36%呈現看淡趨勢。我們發現所有交易中,15個是認購期權,價值爲836,066美元,10個是認沽期權,價值爲479,635美元。

Predicted Price Range

預測價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $15.0 and $57.5 for Delta Air Lines, spanning the last three months.

經過對交易成交量和持倉量的評估,顯而易見的是,主要市場動力者正關注達美航空股價在15.0美元至57.5美元之間的價格區間,涵蓋過去三個月。

Insights into Volume & Open Interest

成交量和持倉量分析

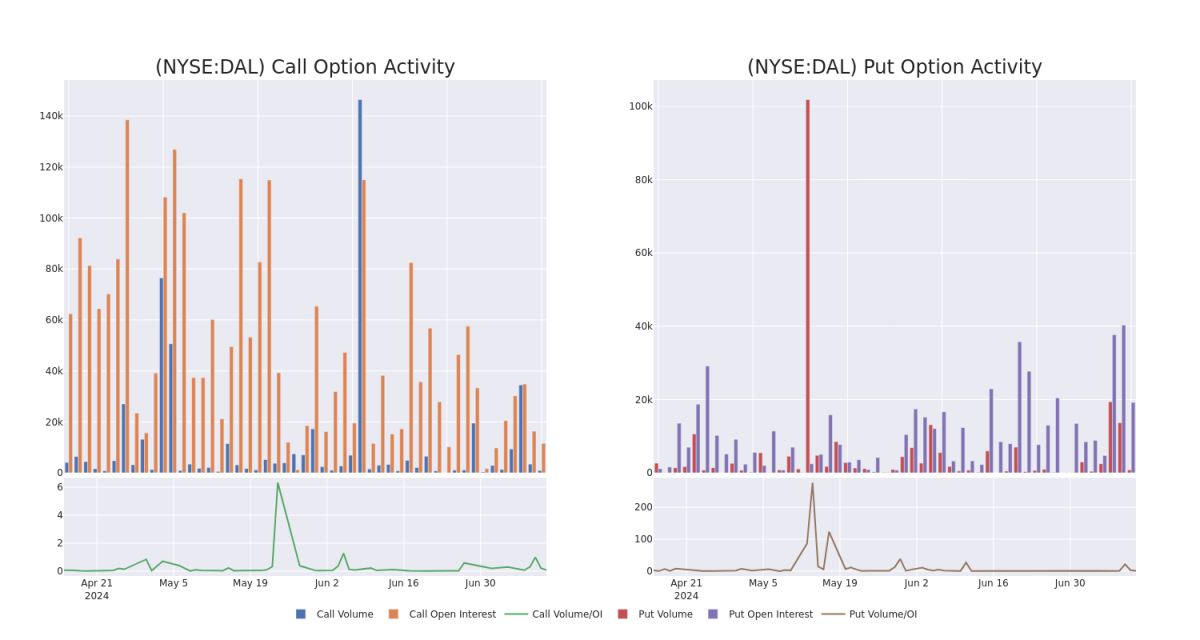

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Delta Air Lines's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Delta Air Lines's significant trades, within a strike price range of $15.0 to $57.5, over the past month.

審查成交量和持倉量爲股票研究提供了重要的見解。這些信息對於評估達美航空的特定行權價的認購和認沽期權的流動性和興趣水平至關重要。在下文中,我們介紹了過去一個月內在15.0至57.5美元的行權價範圍內的對於達美航空的認購和認沽期權的成交量和持倉量趨勢的快照。

Delta Air Lines Call and Put Volume: 30-Day Overview

達美航空看漲和看跌期權的成交量:30天總覽

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DAL | PUT | SWEEP | BULLISH | 12/20/24 | $10.95 | $10.85 | $10.85 | $55.00 | $172.5K | 231 | 0 |

| DAL | PUT | TRADE | BULLISH | 10/18/24 | $3.05 | $2.92 | $2.93 | $45.00 | $87.9K | 1.6K | 56 |

| DAL | PUT | TRADE | BULLISH | 01/16/26 | $7.6 | $7.45 | $7.45 | $47.00 | $80.4K | 2.1K | 1 |

| DAL | CALL | TRADE | BEARISH | 07/19/24 | $1.58 | $1.53 | $1.53 | $43.00 | $69.6K | 665 | 41 |

| DAL | PUT | SWEEP | NEUTRAL | 01/16/26 | $11.05 | $10.7 | $10.9 | $52.50 | $65.4K | 295 | 3 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 請覈對註冊人是否符合1933年證券法規則405(17 CFR 230.405)或1934年證券交易法規則12b-2(17 CFR 240.12b-2)中定義的成長企業的要求。 | 看跌 | SWEEP | 看好 | 12/20/24 | $10.95 | $10.85 | $10.85 | $55.00 | $172.5K | 231 | 0 |

| 請覈對註冊人是否符合1933年證券法規則405(17 CFR 230.405)或1934年證券交易法規則12b-2(17 CFR 240.12b-2)中定義的成長企業的要求。 | 看跌 | 交易 | 看好 | 10/18/24 | $3.05 | $2.92 | $2.93 | $45.00 | $87.9K | 1.6K | 56 |

| 請覈對註冊人是否符合1933年證券法規則405(17 CFR 230.405)或1934年證券交易法規則12b-2(17 CFR 240.12b-2)中定義的成長企業的要求。 | 看跌 | 交易 | 看好 | 01/16/26 | $7.6 | $7.45 | $7.45 | $47.00 | $80.4K | 2.1K | 1 |

| 請覈對註冊人是否符合1933年證券法規則405(17 CFR 230.405)或1934年證券交易法規則12b-2(17 CFR 240.12b-2)中定義的成長企業的要求。 | 看漲 | 交易 | 看淡 | 07/19/24 | $1.58 | $1.53 | $1.53 | 據TipRanks.com稱,Carcache是一名5星級分析師,平均回報率爲19.0%,成功率爲68.5%,涵蓋了金融板塊,重點關注Bread Financial Holdings、第一資本信貸和Ryan Specialty Group等股票。 | 69,600美元 | 665 | 41 |

| 請覈對註冊人是否符合1933年證券法規則405(17 CFR 230.405)或1934年證券交易法規則12b-2(17 CFR 240.12b-2)中定義的成長企業的要求。 | 看跌 | SWEEP | 中立 | 01/16/26 | $11.05 | $10.7 | $10.9 | $52.50 | $65.4千美元 | 295 | 3 |

About Delta Air Lines

關於達美航空

Atlanta-based Delta Air Lines is one of the world's largest airlines, with a network of over 300 destinations in more than 50 countries. Delta operates a hub-and-spoke network, where it gathers and distributes passengers across the globe through its biggest hubs in Atlanta, New York, Salt Lake City, Detroit, Seattle, and Minneapolis-St. Paul. Delta has historically earned the greatest portion of its international revenue and profits from flying passengers over the Atlantic Ocean.

總部位於亞特蘭大的達美航空是全球最大的航空公司之一,擁有覆蓋50多個國家的300多個目的地網絡。達美通過其在亞特蘭大、紐約、鹽湖城、底特律、西雅圖和明尼阿波利斯 - 聖保羅等最大樞紐上收集和分發全球乘客。達美的歷史收入和利潤的最大部分來自於飛越大西洋運送乘客。

Following our analysis of the options activities associated with Delta Air Lines, we pivot to a closer look at the company's own performance.

在對達美航空的期權活動進行分析後,我們轉而更詳細地觀察公司的業績。

Present Market Standing of Delta Air Lines

達美航空目前市場地位

- Currently trading with a volume of 11,610,011, the DAL's price is down by -2.46%, now at $43.88.

- RSI readings suggest the stock is currently may be oversold.

- Anticipated earnings release is in 90 days.

- 當前交易量爲11,610,011股,DAL的價格下跌了-2.46%,現在是43.88美元。

- RSI讀數表明該股票目前可能被超賣。

- 預計90天內發佈收益報告。

What Analysts Are Saying About Delta Air Lines

關於達美航空的分析師意見

3 market experts have recently issued ratings for this stock, with a consensus target price of $59.666666666666664.

3位市場專家最近對這個股票發出了評級,一致目標價爲59.666666666666664美元。

- An analyst from TD Cowen has decided to maintain their Buy rating on Delta Air Lines, which currently sits at a price target of $61.

- An analyst from Jefferies has decided to maintain their Buy rating on Delta Air Lines, which currently sits at a price target of $56.

- An analyst from Bernstein has decided to maintain their Outperform rating on Delta Air Lines, which currently sits at a price target of $62.

- TD Cowen的一位分析師決定維持他們對達美航空的買入評級,目前的價格目標爲61美元。

- Jefferies的一位分析師決定維持他們對達美航空的買入評級,目前的價格目標爲56美元。

- Bernstein的一位分析師決定維持他們對達美航空的跑贏評級,目前的價格目標爲62美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Delta Air Lines options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在回報。精明的交易者通過不斷地自我教育、調整策略、監控多個因素並密切關注市場的變化來管理這些風險。通過Benzinga Pro實時獲取有關最新達美航空期權交易的提醒,保持信息更新。