Behind the Scenes of ServiceNow's Latest Options Trends

Behind the Scenes of ServiceNow's Latest Options Trends

Financial giants have made a conspicuous bearish move on ServiceNow. Our analysis of options history for ServiceNow (NYSE:NOW) revealed 20 unusual trades.

金融巨頭在ServiceNow上做了一次顯眼的看淡舉動。我們對ServiceNow(NYSE:NOW)期權歷史分析結果顯示,有20次飛凡交易。

Delving into the details, we found 40% of traders were bullish, while 45% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $993,171, and 15 were calls, valued at $1,080,968.

具體來看,我們發現40%的交易者看好,而45%的交易者表現出看淡傾向。在我們發現的所有交易中,有5次看跌期權,價值993,171美元,15次看漲期權,價值1,080,968美元。

What's The Price Target?

價格目標是什麼?

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $670.0 to $860.0 for ServiceNow over the recent three months.

根據交易活動表現,近三個月來,一些重要的投資者似乎在以670.0到860.0美元的價格區間內尋求ServiceNow的塔吉特價格。

Volume & Open Interest Trends

成交量和未平倉量趨勢

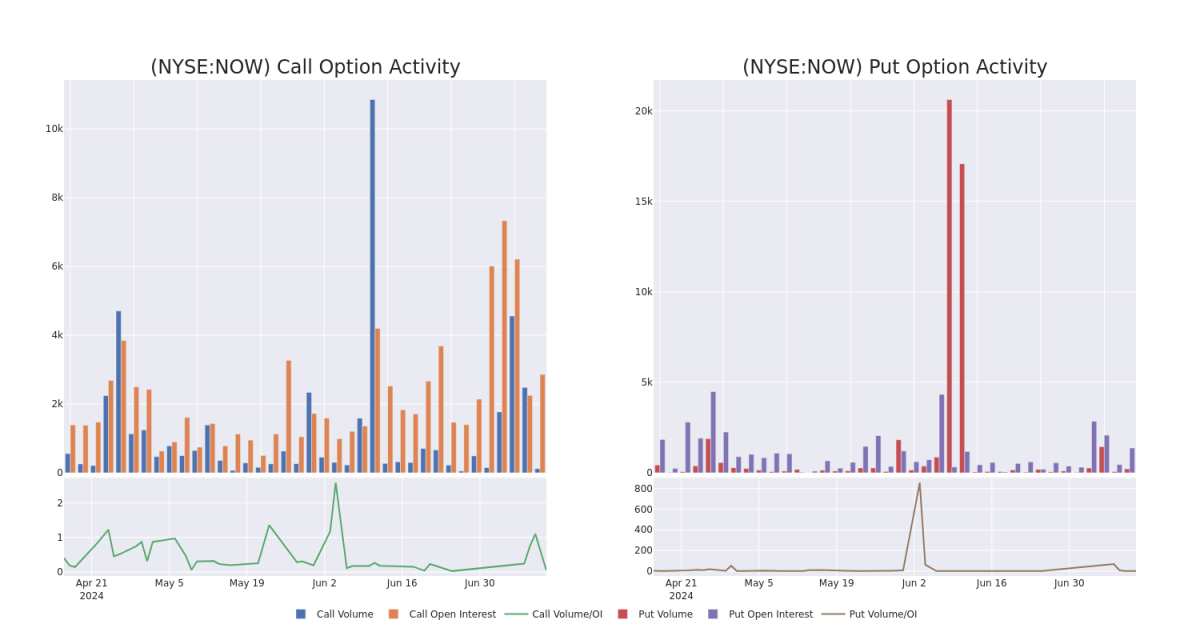

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for ServiceNow's options for a given strike price.

這些數據可以幫助您追蹤ServiceNow某個行權價的期權流動性和趨勢。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of ServiceNow's whale activity within a strike price range from $670.0 to $860.0 in the last 30 days.

下面我們可以觀察ServiceNow所有鯨魚活動在670.0至860.0美元的行權價區間內看漲期權和看跌期權的成交量和未平倉量的演變趨勢,時長爲30天。

ServiceNow Option Activity Analysis: Last 30 Days

ServiceNow期權活動分析:過去30天

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| NOW | PUT | TRADE | BULLISH | 01/16/26 | $162.5 | $158.0 | $159.5 | $860.00 | $797.5K | 4 | 0 |

| NOW | CALL | SWEEP | BULLISH | 07/19/24 | $61.6 | $55.7 | $59.32 | $700.00 | $178.3K | 188 | 3 |

| NOW | CALL | TRADE | NEUTRAL | 01/17/25 | $62.9 | $60.2 | $61.79 | $800.00 | $123.5K | 414 | 8 |

| NOW | CALL | TRADE | BULLISH | 03/21/25 | $106.0 | $105.0 | $106.0 | $740.00 | $106.0K | 103 | 1 |

| NOW | CALL | SWEEP | BULLISH | 07/19/24 | $25.1 | $23.9 | $25.03 | $740.00 | $86.8K | 392 | 19 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| servicenow | 看跌 | 交易 | 看好 | 01/16/26 | $162.5 | $158.0 | $159.5 | $860.00 | $797.5K | 4 | 0 |

| servicenow | 看漲 | SWEEP | 看好 | 07/19/24 | $61.6 | $55.7 | $59.32 | $700.00 | $178.3K | 188 | 3 |

| servicenow | 看漲 | 交易 | 中立 | 01/17/25 | $62.9 | 60.2 | $61.79 | $800.00 | 123500美元 | 414 | 8 |

| servicenow | 看漲 | 交易 | 看好 | 03/21/25 | 106.0美元 | $105.0 | 106.0美元 | $740.00 | $106.0K | 103 | 1 |

| servicenow | 看漲 | SWEEP | 看好 | 07/19/24 | $25.1 | $23.9 | $25.03 | $740.00 | $ 86.8K | 392 | 19 |

About ServiceNow

關於servicenow

ServiceNow Inc provides software solutions to structure and automate various business processes via a SaaS delivery model. The company primarily focuses on the IT function for enterprise customers. ServiceNow began with IT service management, expanded within the IT function, and more recently directed its workflow automation logic to functional areas beyond IT, notably customer service, HR service delivery, and security operations. ServiceNow also offers an application development platform as a service.

ServiceNow Inc提供軟件解決方案,通過SaaS交付模式構建和自動化各種業務流程。該公司主要關注企業客戶的IT功能。ServiceNow始於IT服務管理,在IT功能內部擴展,並最近將其工作流自動化邏輯擴展到IT以外的功能領域,尤其是客戶服務、HR服務交付和安全運營。ServiceNow還提供作爲服務的應用程序開發平台。

In light of the recent options history for ServiceNow, it's now appropriate to focus on the company itself. We aim to explore its current performance.

考慮到ServiceNow的近期期權歷史,現在應該關注公司本身。我們旨在探索其當前的表現。

Present Market Standing of ServiceNow

servicenow當前市場地位

- Currently trading with a volume of 482,548, the NOW's price is up by 1.7%, now at $761.9.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 12 days.

- 目前成交量爲482,548,NOW的價格上漲1.7%,現在爲761.9美元。

- RSI讀數表明該股目前可能接近超買水平。

- 預期收益將於 12 天內發佈。

What Analysts Are Saying About ServiceNow

關於ServiceNow的分析師看法

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $836.0.

在過去30天中,共有5位專業分析師對該股票發表了意見,設定了一個平均目標價爲836.0美元。

- Reflecting concerns, an analyst from Needham lowers its rating to Buy with a new price target of $900.

- In a cautious move, an analyst from Guggenheim downgraded its rating to Sell, setting a price target of $640.

- An analyst from Keybanc persists with their Overweight rating on ServiceNow, maintaining a target price of $920.

- An analyst from Stifel persists with their Buy rating on ServiceNow, maintaining a target price of $820.

- An analyst from Needham has revised its rating downward to Buy, adjusting the price target to $900.

- 鑑於擔憂,來自Needham的分析師將評級下調爲買入,並設定了新的價格目標爲900美元。

- Guggenheim的一位分析師以謹慎的態度將評級降級爲賣出,並設定了640美元的塔吉特價格。

- Keybanc的一位分析師堅持對ServiceNow的超重評級,維持目標價爲920美元。

- Stifel的一位分析師堅持買入評級,維持820美元的目標價。

- Needham的一位分析師已經將評級下調到買入,調整價格目標至900美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for ServiceNow with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高的利潤潛力。精明的交易員通過持續的教育、策略性的交易調整、利用各種因子和保持敏銳的市場動態來減少這些風險。通過Benzinga Pro實時警報,了解ServiceNow的最新期權交易。