REIT Watch - Demand Boosts Hotel RevPAR for Hospitality S-REITs

REIT Watch - Demand Boosts Hotel RevPAR for Hospitality S-REITs

Among the seven S-Reit sub-sectors, hospitality S-Reits are the fourth largest in terms of combined market capitalisation.

在S-Reit的七個子行業中,酒店S-Reits的總市值排名第四。

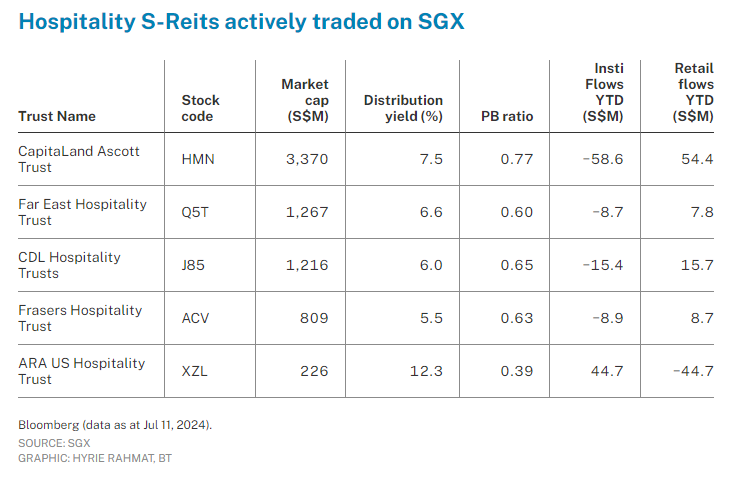

The five actively traded hospitality trusts have an average price-to-book ratio of 0.61 times and an average distribution yield of 7.6 per cent, the second highest across sub-sectors (by market capitalisation-weighted average distribution yields). The five, in terms of market capitalisation, are: CapitaLand Ascott Trust, Far East Hospitality Trust, CDL Hospitality Trusts, Frasers Hospitality Trust, and ARA US Hospitality Trust.

這五家活躍交易的酒店信託基金的平均市值賬面比率爲0.61倍,平均分配收益率爲7.6%,在各子行業中排名第二(按市值加權平均分配收益率計算)。就市值而言,這五家信託基金是:凱德置地雅詩閣信託、遠東酒店信託基金、CDL酒店信託基金、弗雷澤酒店信託基金和ARA美國酒店信託基金。

The majority of the five trusts have diversified exposure to international markets, with the exception of two – Far East Hospitality Trust, which has a Singapore-focused hotel and serviced residence portfolio, and ARA US Hospitality Trust, which is a pure-play US hospitality trust.

五家信託基金中的大多數都對國際市場進行了多元化投資,唯一的例外是遠東酒店信託基金,其投資組合以新加坡爲重點,以及純粹的美國酒店信託基金ARA US Hospitality Trust。

Most of the hospitality trusts reported higher RevPAR (revenue per available room) across various geographical markets in their latest round of business updates and earnings reports, driven by the continued international travel recovery and stronger demand drivers such as Mice (meetings, incentives, conferences and exhibitions), sports events, and concerts.

大多數酒店信託基金在其最新一輪業務更新和收益報告中報告說,受國際旅行持續復甦以及會展(會議、激勵措施、會議和展覽)、體育賽事和音樂會等強勁需求驅動力的推動,各個地域市場的RevPAR(每間可用客房的收入)均有所提高。

CapitaLand Ascott Trust's (Clas) gross profit in Q1 2024 rose 15 per cent year on year (yoy) on stronger operating performance and contributions from new properties. All its key markets posted positive RevPAU (revenue per available unit) growth yoy, led by Japan, which grew 31 per cent, the UK at 11 per cent and Australia at 8 per cent. Clas recently updated that it has fully acquired a freehold student accommodation property in South Carolina, US, which is expected to generate about 7 per cent Ebitda yield. The property has a pre-leased occupancy rate of 99 per cent for the upcoming academic year with rental growth of 4 per cent and is one of the best-performing accommodation serving the University of South Carolina. Clas will report its H1FY2024 results on Jul 26.

凱德置地雅詩閣信託(Clas)2024年第一季度的毛利同比增長15%,這要歸因於經營業績的強勁和新物業的貢獻。其所有主要市場均實現了RevPAU(單位可用單位收入)的正增長,其中日本增長了31%,英國增長了11%,澳大利亞增長了8%。Clas最近更新說,它已完全收購了位於美國南卡羅來納州的永久產權學生宿舍,預計該物業的息稅折舊攤銷前利潤收益率將達到約7%。該物業下學年的預租入住率爲99%,租金增長4%,是爲南卡羅來納大學提供服務表現最好的宿舍之一。Clas 將於 7 月 26 日公佈其 H1FY2024 業績。

Far East Hospitality Trust's (FEHT) hotel RevPAR grew 6.7 per cent in Q1 2024 with a 1.5 per cent decline in RevPAU for its smaller serviced residence portfolio, due to the expiration of a few long-stay contracts during the earlier part of the quarter. However, average daily rate for both its hotel and serviced residences remained resilient and grew 8.8 per cent and 2.9 per cent, respectively. FEHT will report its H1FY2024 results on Jul 30.

遠東酒店信託基金(FEHT)的酒店RevPAR在2024年第一季度增長了6.7%,其規模較小的服務公寓投資組合的RevPAU下降了1.5%,這是由於本季度早些時候幾份長期住宿合同到期。但是,其酒店和服務式公寓的平均每日房價保持彈性,分別增長了8.8%和2.9%。FeHT 將於 7 月 30 日公佈其 H1FY2024 結果。

CDL Hospitality Trusts (CDLHT) registered positive RevPAR growth across all its geographical markets in Q1 2024, largely driven by increased occupancies. Markets which led growth were Japan, which grew 32.6 per cent; Italy, up 27.5 per cent; and Singapore, which grew 16.6 per cent in RevPAR yoy. CDLHT notes that international tourism recovery is well on its path towards pre-Covid levels, but headwinds from geopolitical uncertainties continue. For core market Singapore, CDLHT's managers see a promising outlook, and believe the recovery of Chinese arrivals will help create demand compression in the market. CDLHT will report its H1FY2024 results on Jul 30.

2024年第一季度,CDL酒店信託基金(CDLHT)在所有地域市場均實現了正的RevPAR增長,這主要是由入住人數增加所推動的。引領增長的市場是日本,增長32.6%;意大利,增長27.5%;以及新加坡,按RevPAR同比增長16.6%。CDLHT 指出,國際旅遊業復甦正朝着疫情前水平邁進,但地緣政治不確定性帶來的不利因素仍在繼續。對於新加坡核心市場,CDLHT的經理人認爲前景樂觀,並認爲中國入境者的復甦將有助於抑制市場需求。CDLHT 將於 7 月 30 日公佈其 H1FY2024 結果。

Frasers Hospitality Trust, which reported its H1FY2024 results earlier this year, observed higher gross revenue of 1.7 per cent yoy due to a slight improvement in hospitality portfolio performance. However, distribution per stapled security declined 13.7 per cent due mainly to higher finance costs.

弗雷澤酒店信託基金今年早些時候公佈了 H1FY2024 業績,由於酒店投資組合表現略有改善,總收入同比增長1.7%。但是,每張合訂證券的分配下降了13.7%,這主要是由於財務成本上漲。

Pure-play US upscale select-service hospitality trust, ARA US Hospitality Trust updated that its Q1 2024 gross operating profit and net property income margins for the portfolio improved marginally to 29.5 per cent and 17.8 per cent, respectively. During the quarter, its portfolio occupancy decreased 2.2 percentage points to 59.5 per cent, due to demand displacement from asset enhancement improvement projects at four properties, which are expected to be in a better position to drive revenues and profits moving forward.

純粹的美國高檔精選服務酒店信託公司ARA US Hospitality Trust更新稱,其2024年第一季度該投資組合的總營業利潤率和淨房地產收入利潤率分別小幅提高至29.5%和17.8%。在本季度,其投資組合佔用率下降了2.2個百分點至59.5%,這是由於四處物業的資產增強改善項目導致需求轉移,預計這些項目將更有能力推動收入和利潤向前發展。

REIT Watch is a regular column on The Business Times, read the original version.

房地產投資信託基金觀察是《商業時報》的定期專欄文章,請閱讀原始版本。

Enjoying this read?

喜歡這本書嗎?

- Subscribe now to the SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.

- 立即訂閱新加坡交易所 My Gateway 時事通訊,了解最新的市場新聞、行業表現、新產品發佈更新以及新加坡交易所上市公司的研究報告。

- 隨時關注我們的新加坡證券交易所投資電報頻道的最新動態。

Most of the hospitality trusts reported higher RevPAR (revenue per available room) across various geographical markets in their latest round of business updates and earnings reports, driven by the continued international travel recovery and stronger demand drivers such as Mice (meetings, incentives, conferences and exhibitions), sports events, and concerts.

Most of the hospitality trusts reported higher RevPAR (revenue per available room) across various geographical markets in their latest round of business updates and earnings reports, driven by the continued international travel recovery and stronger demand drivers such as Mice (meetings, incentives, conferences and exhibitions), sports events, and concerts.