Centurion CEO Kong Chee Min Adds to Interest at S$0.59 per Share

Centurion CEO Kong Chee Min Adds to Interest at S$0.59 per Share

Institutions were net buyers of Singapore stocks over the five trading sessions to Jul 11, with S$192 million of net institutional inflow, following the similar pace of S$188 million of net inflow for the preceding five sessions to Jul 4. In the first nine sessions of July, institutions reversed just over one-third of the net outflows booked in the first half of 2024.

在截至7月11日的五個交易日中,機構是新加坡股票的淨買家,機構淨流入額爲1.92億新元,而截至7月4日的前五個交易日的淨流入速度爲1.88億新元。在7月的前九個交易日中,各機構扭轉了2024年上半年略超過三分之一的淨流出量。

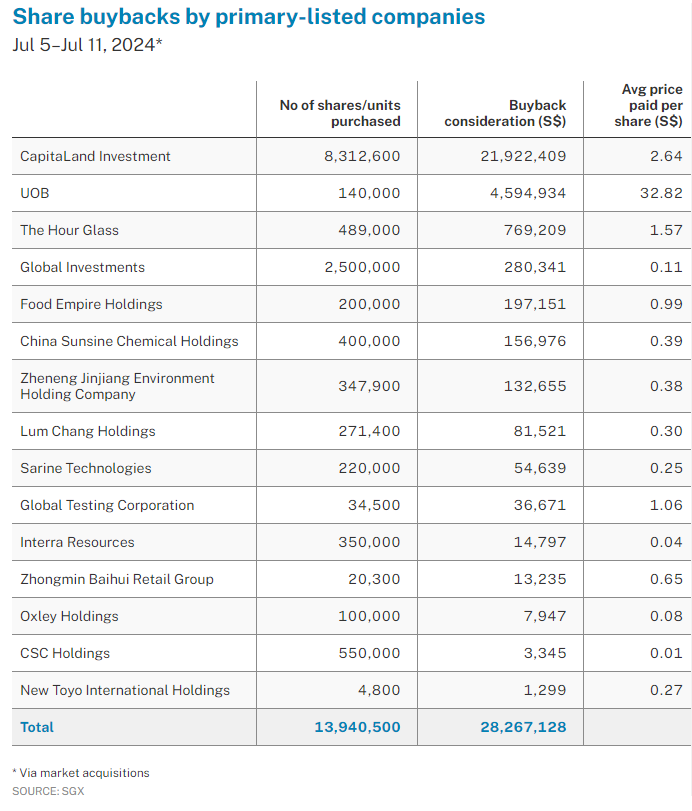

The five sessions till Jul 11 also had 15 primary-listed companies conduct buybacks with a total consideration of S$28.3 million.

截至7月11日的五個交易日中,還有15家主要上市公司進行了回購,總對價爲2830萬新元。

CapitaLand Investment led the buyback consideration tally, acquiring 8,312,600 shares at an average price of S$2.64 per share. This brings the percentage of shares acquired on the current mandate to 1.64 per cent of the issued shares (excluding treasury shares) as of the date of the share buyback resolution.

凱德置地投資在回購對價中名列前茅,以每股2.64新元的平均價格收購了8,312,600股股票。這使得截至股票回購決議通過之日,根據當前授權收購的股份佔已發行股份(不包括庫存股)的1.64%。

For the contingent of non-STI primary-listed companies that conducted buybacks over the five sessions, The Hour Glass : AGS 0% led the consideration tally with 489,000 shares acquired at an average price of S$1.57 per share.

對於在五個交易日進行回購的非STI主要上市公司而言,The Hour Glass:AGS 0%在對價總額中處於領先地位,以每股1.57新元的平均價格收購了489,000股股票。

Leading the net institutional inflow were DBS, UOB, ARA US Hospitality Trust, Singtel, Sats, ST Engineering, OCBC, Singapore Exchange, Great Eastern Holdings and Venture Corp.

領先的機構淨流入量是星展銀行、大華銀行、ARA美國酒店信託基金、新加坡電信、Sats、Sats、St Engineering、華僑銀行、新加坡交易所、大東方控股和風險投資公司

During the week, Acrophyte completed the acquisition of a 19 per cent stapled security interest in ARA US Hospitality Trust, increasing the stapled security holdings owned by the Tang Group in ARA US Hospitality Trust to 28.3 per cent. Acrophyte is a multinational conglomerate with expertise spanning the entire real estate spectrum and the hospitality sector. The company operates and invests in hospitality assets in various locations, boasting a proven track record in both operations and investments.

本週,Acrophyte完成了對ARA美國酒店信託基金19%的合訂證券權益的收購,使唐集團在ARA美國酒店信託基金中持有的合訂證券增至28.3%。Acrophyte是一家跨國企業集團,其專業知識涵蓋整個房地產領域和酒店業。該公司在不同地點運營和投資酒店資產,在運營和投資方面都有良好的記錄。

Meanwhile, Singapore Airlines, Jardine Cycle & Carriage, Wilmar International, Seatrium, Mapletree Industrial Trust, Sembcorp Industries, CapitaLand Ascendas Reit, Mapletree Logistics Trus, Genting Singapore, and CapitaLand Ascott Trust led the net institutional outflow.

同時,新加坡航空、怡和運輸、豐益國際、Seatrium、豐樹工業信託、勝科工業、凱德騰飛房地產投資信託、豐樹物流信託、新加坡雲頂和凱德置地雅詩閣信託基金帶動了機構淨流出。

In the five trading sessions, 70 director interests and substantial shareholdings filed for more than 30 primary-listed stocks. Directors or CEOs filed 14 acquisitions, and no disposals, while substantial shareholders filed eight acquisitions and three disposals.

在五個交易日中,70股董事權益和大量持股申請了30多隻初級上市股票。董事或首席執行官提交了14項收購,沒有進行任何出售,而大股東則進行了8次收購和3次出售。

Hiap Hoe

嗨 Hoe

Between Jul 3 and 4, Hiap Hoe executive chairman Teo Ho Beng acquired 500,000 shares at an average price of S$0.603 per share. With a consideration of S$301,250, this increased his total interest in the regional premium real estate group from 75.07 per cent to 75.18 per cent.

7月3日至4日之間,協和執行主席張浩明以每股0.603新元的平均價格收購了50萬股股票。以301,250新元的對價計算,這使他在該區域高端房地產集團的總權益從75.07%增加到75.18%。

Teo has been gradually increasing his total interest from 74.86 per cent in early June. He has more than 42 years of experience in the construction and property industries, and over 27 years of experience in the leisure industry. He is responsible for the formulation of corporate strategies and policies for the group. In addition, he sits on the board of Ley Choon Group Holdings as non-executive director.

Teo一直在逐步提高其總利息從6月初的74.86%。他在建築和房地產行業擁有超過42年的經驗,在休閒行業擁有超過27年的經驗。他負責制定集團的企業戰略和政策。此外,他是Ley Choon Group Holdings的董事會成員,擔任非執行董事。

The group noted in February that it is concentrating on enhancing the rental yields and occupancy rates of its properties to bolster its steady income stream. The two newly rebranded hotels in Singapore are anticipated to positively impact the group's financial outcomes, despite the competitive nature of the hotel industry.

該集團在二月份指出,它正集中精力提高其物業的租金收益率和入住率,以增強其穩定的收入來源。儘管酒店業競爭激烈,但預計新加坡兩家新更名的酒店將對集團的財務業績產生積極影響。

The group has since completed the acquisition of the Great Eastern Motor Lodge in Western Australia in March and the sale of the Four Points by Sheraton in Melbourne Docklands in April.

此後,該集團於3月完成了對西澳大利亞大東方汽車旅館的收購,並於4月完成了對墨爾本港區福朋喜來登酒店的出售。

Centurion Corp

百夫長公司

On Jul 4, Centurion Corp CEO Kong Chee Min acquired 115,000 shares, at an average price of S$0.59 cents per share. This increased his direct interest in the global provider of specialised accommodation from 0.04 per cent to 0.06 per cent. His preceding acquisitions were on May 10, with 75,000 shares acquired at an average price of S$0.498 per share, and Mar 1 with 72,000 shares acquired at an average price of S$0.425 per share.

7月4日,Centurion Corp首席執行官孔志敏收購了11.5萬股股票,平均價格爲每股0.59新元。這使他對這家全球專業住宿提供商的直接興趣從0.04%增加到0.06%。他之前的收購是在5月10日,收購了7.5萬股股票,平均價格爲每股0.498新元;3月1日,收購了72,000股股票,平均價格爲每股0.425新元。

The rally in the share price has seen the price-to-book ratio of the stock increase from 0.4 times at the end of 2023 to 0.6 times the previous week. For the first quarter of this year, Centurion reported revenue of S$61.1 million. This represented growth of 30 per cent over its Q1 2023 revenue of S$47.1 million. Prior to Q1FY24, Centurion had a 26 per cent compound annual growth rate in its accommodation revenue from its FY11 to FY23.

股價的上漲使該股的市面比率從2023年底的0.4倍上升到前一週的0.6倍。今年第一季度,Centurion公佈的收入爲6,110萬新元。這意味着其2023年第一季度的4,710萬新元收入增長了30%。在 Q1FY24 之前,從2011財年到23財年,Centurion的住宿收入複合年增長率爲26%。

From a geographical perspective, Singapore contributes around two-thirds of the group's revenue. From a business segment perspective, roughly 75 per cent of its revenue comes from purpose built workers accommodation (PBWA), while the remaining 25 per cent is attributed to purpose built student accommodation (PBSA). The group expects the current growth drivers of the PBWA sector to include positive regulatory factors and a demand-supply dynamic characterised by a high global demand for migrant workers, an increasing recognition of the need for better welfare for migrant workers, and a market that is undersupplied with purpose-built, professionally managed dormitory beds.

從地理角度來看,新加坡貢獻了該集團收入的三分之二左右。從業務板塊的角度來看,其收入中約有75%來自專用員工宿舍(PBWA),其餘25%來自專門建造的學生宿舍(PBSA)。該組織預計,PBWA行業當前的增長驅動力將包括積極的監管因素和供需動態,其特徵是全球對移民工人的需求旺盛,人們越來越認識到需要爲移民工人提供更好的福利,以及專門建造的、專業管理的宿舍牀位供應不足。

While Centurion's share price has gained 46 per cent in the year to Jul 11, the average daily turnover of the stock is up 140 per cent from 2023 levels. In 2023, Centurion completed its voluntary withdrawal of its dual listing on the main board of The Stock Exchange of Hong Kong. It announced on Jul 3 that its indirect 60 per cent-owned subsidiary, Centurion-Lionrock (HK), through Centurion Overseas Investments, signed a master lease with Abercorn Investments to lease 50 residential flats in Hong Kong, with plans to convert them into worker accommodation for 550 beds. The joint venture company is also partly owned (40 per cent) by LionRock Property, an independent third party and joint venture partner.

儘管Centurion的股價在截至7月11日的一年中上漲了46%,但該股的平均每日成交量比2023年的水平增長了140%。2023年,Centurion完成了自願撤回其在香港聯合交易所主板的雙重上市。該公司在7月3日宣佈,其間接持有60%股權的子公司Centurion-Lionrock(香港)通過Centurion Overseas Investments與Abercorn Investments簽署了在香港租賃50套住宅公寓的主租約,並計劃將其改建爲可容納550張牀位的員工宿舍。這家合資公司還由獨立第三方和合資夥伴LionRock Property部分持有(40%)。

Kong joined the group in March 1996 and was appointed to the board in March 2000. He served as a board member until May 2015. In August 2011, he became the CEO, taking charge of the group's operations, business strategies, and long-term growth. Before his CEO role, he was the regional CEO and finance director, assisting the former group CEO in strategic development and growth of the optical disc business. In January 2022, Kong was appointed a member of the executive committee.

Kong 於 1996 年 3 月加入該集團,並於 2000 年 3 月被任命爲董事會成員。他一直擔任董事會成員直到 2015 年 5 月。2011年8月,他成爲首席執行官,負責集團的運營、業務戰略和長期增長。在擔任首席執行官之前,他曾擔任區域首席執行官兼財務董事,協助前集團首席執行官進行光盤業務的戰略發展和增長。2022年1月,孔被任命爲執行委員會成員。

Zico Holdings

Zico 控股

On Jul 4, Zico Holdings group CEO Ng Hock Heng acquired 1,791,000 shares at S$0.04 per share. With a consideration of S$77,246, this increased his direct interest in the Catalist-listed stock from 2.97 per cent to 3.41 per cent. His preceding acquisition was on Mar 12, with 1,050,198 shares acquired at S$0.04 per share. Ng has been the executive director at Zico Holdings since 2014 and was appointed as the group CEO in May 2023, as part of the company's planned leadership transition. His key responsibilities include overseeing overall operations, managing the advisory and transaction services, the management of support services and licensing services segments, as well as developing and managing the group's new services.

7月4日,Zico Holdings集團首席執行官吳福亨以每股0.04新元的價格收購了179.1萬股股票。對價爲77,246新元,這使他在Catalist上市股票的直接權益從2.97%增加到3.41%。他之前的收購是在3月12日,以每股0.04新元的價格收購了1,050,198股股票。吳自2014年起擔任Zico Holdings的執行董事,並於2023年5月被任命爲集團首席執行官,這是公司計劃中的領導層交接的一部分。他的主要職責包括監督整體運營、管理諮詢和交易服務、管理支持服務和許可服務部門,以及開發和管理集團的新服務。

Accrelist

Accrelist

Between Jul 4 and 10, Accrelist executive chairman and managing director Terence Tea Yeok Kian acquired 633,600 shares at an average price of S$0.05 per share. With a consideration of S$31,708, this increased his total interest in the Catalist-listed company from 26.18 per cent to 26.38 per cent. Dr Tea has gradually increased his total interest from 23.13 per cent at the end of 2023. He is tasked with guiding the group's expansion and strategic direction by identifying and fostering new business opportunities. His extensive corporate experience and strategic insights are invaluable to the board, particularly in advising on corporate affairs and driving business strategy implementation.

7月4日至10日期間,Accrelist執行董事長兼董事總經理Terence Tea Yeok Kian以每股0.05新元的平均價格收購了633,600股股票。對價爲31,708新元,這使他在這家Catalist上市公司的總權益從26.18%增加到26.38%。Tea博士的總利息已從2023年底的23.13%逐漸增加。他的任務是通過發現和培育新的商機來指導集團的擴張和戰略方向。他豐富的企業經驗和戰略見解對董事會來說是無價之寶,尤其是在就公司事務提供建議和推動業務戰略實施方面。

Accrelist is vigorously exploring new ventures, with an intensified emphasis on medical aesthetics. Its wholly owned subsidiaries, operating under the Accrelist Medical Aesthetics umbrella and known as AM Aesthetics, along with AM Skincare, are at the forefront of this initiative. Accrelist also holds a majority 53.31 per cent stake in Jubilee Industries Holdings, a comprehensive provider in the electronic manufacturing services (EMS) sector, through its mechanical business unit. This unit specialises in precision plastic injection moulding and mould design and fabrication services, catering to the EMS industry's needs.

Accrelist正在大力探索新企業,更加註重醫學美學。其全資子公司在Accrelist醫學美學旗下運營,名爲Am Aesthetics,以及Am Skincare,處於該計劃的最前沿。Accrelist還通過其機械業務部門持有電子製造服務(EMS)領域的綜合供應商銀禧工業控股公司53.31%的多數股權。該部門專門從事精密注塑成型和模具設計與製造服務,以滿足EMS行業的需求。

Inside Insights is a weekly column on The Business Times, read the original version.

Inside Insights是《商業時報》的每週專欄文章,請閱讀原始版本。

Enjoying this read?

喜歡這本書嗎?

- Subscribe now to the SGX My Gateway newsletter for a compilation of latest market news, sector performances, new product release updates, and research reports on SGX-listed companies.

- Stay up-to-date with our SGX Invest Telegram channel.

- 立即訂閱新加坡交易所 My Gateway 時事通訊,了解最新的市場新聞、行業表現、新產品發佈更新以及新加坡交易所上市公司的研究報告。

- 關注我們的 SGX Invest Telegram 頻道的最新動態。