Behind the Scenes of American Express's Latest Options Trends

Behind the Scenes of American Express's Latest Options Trends

Financial giants have made a conspicuous bullish move on American Express. Our analysis of options history for American Express (NYSE:AXP) revealed 35 unusual trades.

金融巨頭們在美國運通股上留下了明顯的看漲印記。我們對美國運通(NYSE:AXP)期權歷史的分析顯示了35次飛凡交易。

Delving into the details, we found 74% of traders were bullish, while 14% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $169,700, and 33 were calls, valued at $3,861,573.

進一步分析發現,74%的交易者看漲,而14%的交易者看淡。在我們發現的所有交易中,有2次購買看跌期權,價值爲$169,700,有33次購買看漲期權,價值爲$3,861,573。

What's The Price Target?

目標價是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $170.0 to $260.0 for American Express during the past quarter.

分析這些合同的成交量和未平倉量,似乎大戶們在過去一個季度一直在關注美國運通170.0至260.0美元的價格區間。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

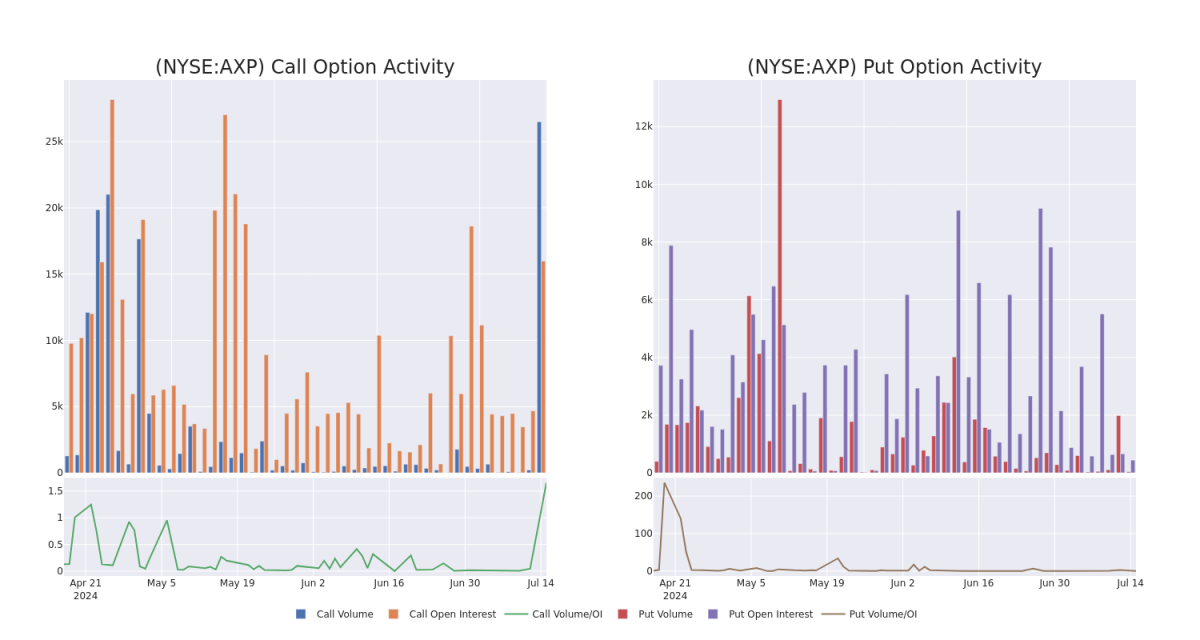

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in American Express's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to American Express's substantial trades, within a strike price spectrum from $170.0 to $260.0 over the preceding 30 days.

評估成交量和未平倉量是期權交易中的戰略步驟。這些指標揭示了特定行權價格下,投資者對美國運通期權的流動性和興趣狀況。即將公佈的數據可視化呈現了在過去30天內,與美國運通重要交易有關的看跌期權和看漲期權的成交量和未平倉量的波動情況,涵蓋了170.0至260.0美元行權價區間。

American Express Call and Put Volume: 30-Day Overview

美國運通看漲和看跌期權的成交量:30天總覽

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AXP | CALL | SWEEP | BULLISH | 06/20/25 | $20.2 | $20.15 | $20.2 | $260.00 | $892.8K | 4.7K | 0 |

| AXP | CALL | SWEEP | BEARISH | 06/20/25 | $20.3 | $19.85 | $19.85 | $260.00 | $343.4K | 4.7K | 1.9K |

| AXP | CALL | SWEEP | BULLISH | 06/20/25 | $20.25 | $20.0 | $20.25 | $260.00 | $321.9K | 4.7K | 552 |

| AXP | CALL | SWEEP | BULLISH | 06/20/25 | $20.15 | $20.1 | $20.15 | $260.00 | $213.5K | 4.7K | 1.6K |

| AXP | CALL | SWEEP | BULLISH | 06/20/25 | $20.05 | $19.9 | $20.05 | $260.00 | $204.5K | 4.7K | 1.7K |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AXP | 看漲 | SWEEP | 看好 | 06/20/25 | $20.2 | $20.15 | $20.2 | $260.00 | $892.8K | 4.7千 | 0 |

| AXP | 看漲 | SWEEP | 看淡 | 06/20/25 | $20.3 | $19.85 | $19.85 | $260.00 | $343.4K | 4.7千 | 1.9K |

| AXP | 看漲 | SWEEP | 看好 | 06/20/25 | $20.25 | $20.0 | $20.25 | $260.00 | $321.9K | 4.7千 | 552 |

| AXP | 看漲 | SWEEP | 看好 | 06/20/25 | $20.15 | $20.1 | $20.15 | $260.00 | $213.5K | 4.7千 | 1.6K |

| AXP | 看漲 | SWEEP | 看好 | 06/20/25 | 20.05美元 | $19.9 | 20.05美元 | $260.00 | $204.5K | 4.7千 | 1.7K |

About American Express

關於美國運通

American Express is a global financial institution, operating in about 130 countries, that provides consumers and businesses charge and credit card payment products. The company also operates a highly profitable merchant payment network. Since 2018, it has operated in three segments: global consumer services, global commercial services, and global merchant and network services. In addition to payment products, the company's commercial business offers expense management tools, consulting services, and business loans.

美國運通是一家全球性的金融機構,在大約130個國家經營,爲消費者和企業提供信用卡和借記卡支付產品。該公司還經營着一個非常賺錢的商家支付網絡。自2018年以來,它在三個板塊上運營:全球消費者服務、全球商業服務和全球商家和網絡服務。除了支付產品外,該公司的商業業務還提供費用管理工具、諮詢服務和商業貸款。

Having examined the options trading patterns of American Express, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

經過分析,我們現在將我們的注意力直接轉向該公司。這種轉變允許我們深入探討其當前的市場地位和表現。

American Express's Current Market Status

美國運通的當前市場狀態

- With a volume of 421,407, the price of AXP is up 1.08% at $241.2.

- RSI indicators hint that the underlying stock may be overbought.

- Next earnings are expected to be released in 4 days.

- 成交量爲421,407單,AXP的價格上漲了1.08%,達到241.2美元。

- RSI因子暗示底層股票可能被超買。

- 下一季度收益預計將在4天內發佈。

What The Experts Say On American Express

關於美國運通的專家意見

In the last month, 5 experts released ratings on this stock with an average target price of $258.2.

在過去一個月中,有5位專家對這隻股票發佈了評級,平均目標價爲258.2美元。

- Maintaining their stance, an analyst from JP Morgan continues to hold a Overweight rating for American Express, targeting a price of $268.

- Consistent in their evaluation, an analyst from Wells Fargo keeps a Overweight rating on American Express with a target price of $285.

- Maintaining their stance, an analyst from Keefe, Bruyette & Woods continues to hold a Outperform rating for American Express, targeting a price of $280.

- Maintaining their stance, an analyst from Jefferies continues to hold a Hold rating for American Express, targeting a price of $235.

- Consistent in their evaluation, an analyst from Barclays keeps a Equal-Weight rating on American Express with a target price of $223.

- JP摩根的分析師繼續持有美國運通的超配評級,目標價爲268美元。

- 富國銀行的分析師一致看好美國運通,目標價爲285美元。

- 巴克萊銀行的分析師維持美國運通的等權評級,目標價爲223美元。

- 傑富瑞的分析師繼續持有美國運通的持有評級,目標價爲235美元。

- 保持他們的立場,巴克萊銀行的分析師維持美國運通的等權評級,目標價爲223美元。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for American Express with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供更高的利潤潛力。精明的交易者通過持續的教育、戰略性的交易調整、利用各種因子以及保持對市場動態的關注來緩解這些風險。通過Benzinga Pro,隨時了解美國運通的最新期權交易信息。