Smart Money Is Betting Big In Micron Technology Options

Smart Money Is Betting Big In Micron Technology Options

Financial giants have made a conspicuous bearish move on Micron Technology. Our analysis of options history for Micron Technology (NASDAQ:MU) revealed 17 unusual trades.

有關美光科技的期權歷史,金融巨頭已明顯看淡。我們的分析顯示,有17筆飛凡期權交易異常。

Delving into the details, we found 29% of traders were bullish, while 47% showed bearish tendencies. Out of all the trades we spotted, 5 were puts, with a value of $307,286, and 12 were calls, valued at $691,798.

具體而言,我們發現29%的交易者看漲,而47%表現出看淡的傾向。在我們發現的所有交易中,有5個看跌期權,價值爲307,286美元,有12個看漲期權,價值爲691,798美元。

What's The Price Target?

目標價是多少?

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $40.0 and $160.0 for Micron Technology, spanning the last three months.

經過對交易量和未平倉合約的評估,顯然,主要的市場推動者正將美光科技價格區間限制在40.0美元至160.0美元之間,該區間爲近三個月。

Volume & Open Interest Trends

成交量和未平倉量趨勢

In terms of liquidity and interest, the mean open interest for Micron Technology options trades today is 1885.46 with a total volume of 724.00.

就流動性和市場興趣而言,美光科技期權交易的平均未平倉合約爲1885.46,總量爲724.00。

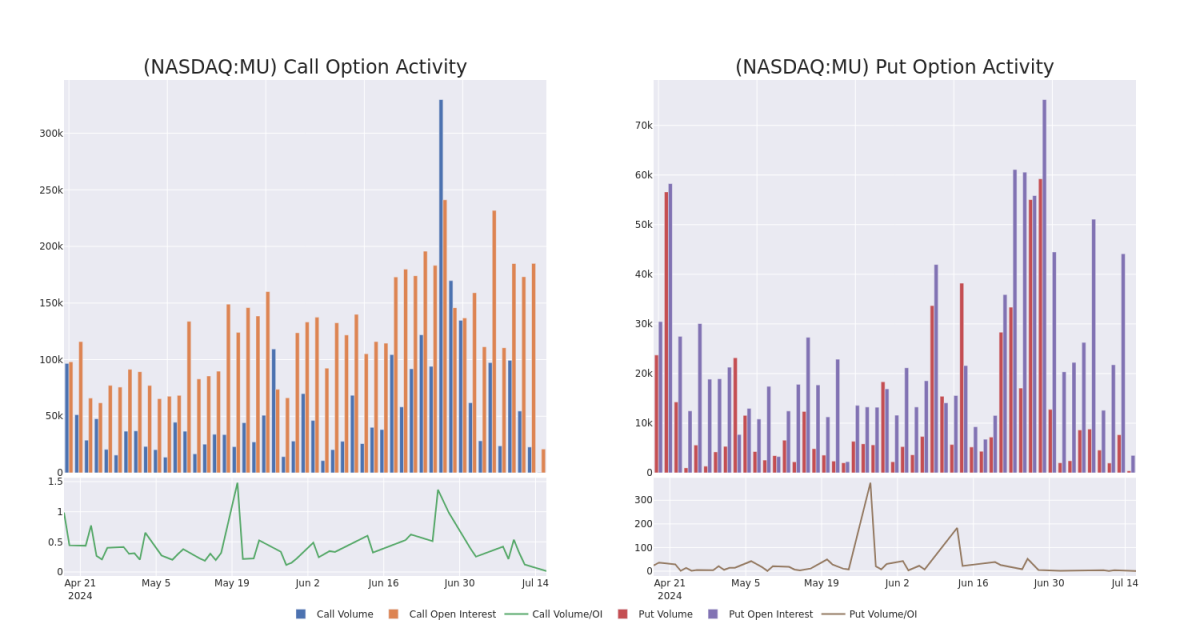

In the following chart, we are able to follow the development of volume and open interest of call and put options for Micron Technology's big money trades within a strike price range of $40.0 to $160.0 over the last 30 days.

在下面的圖表中,我們可以追蹤美光科技從40.0美元到160.0美元的看漲和看跌期權的成交量和未平倉合約的發展情況,時間跨度爲30天之內的大宗交易。

Micron Technology Call and Put Volume: 30-Day Overview

美光科技的看漲和看跌交易量:30天概覽

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MU | PUT | SWEEP | BEARISH | 08/09/24 | $5.5 | $5.4 | $5.5 | $130.00 | $165.0K | 825 | 1 |

| MU | CALL | TRADE | BEARISH | 08/16/24 | $6.6 | $6.55 | $6.55 | $130.00 | $131.0K | 7.0K | 100 |

| MU | CALL | TRADE | BEARISH | 08/23/24 | $4.65 | $4.5 | $4.55 | $137.00 | $91.0K | 369 | 0 |

| MU | CALL | SWEEP | BULLISH | 08/23/24 | $7.5 | $7.4 | $7.5 | $130.00 | $75.0K | 152 | 0 |

| MU | CALL | SWEEP | NEUTRAL | 08/16/24 | $4.85 | $4.75 | $4.8 | $135.00 | $72.0K | 8.1K | 135 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 美光 | 看跌 | SWEEP | 看淡 | 08/09/24 | $5.5 | $5.4 | $5.5 | $130.00 | $165.0K | 825 | 1 |

| 美光 | 看漲 | 交易 | 看淡 | 08/16/24 | 6.6 | $ 6.55 | $ 6.55 | $130.00 | $131.0K | 7.0K | 100 |

| 美光 | 看漲 | 交易 | 看淡 | 08/23/24 | $4.65 | $4.5 | 4.55 | $137.00 | 91000 美元 | 369 | 0 |

| 美光 | 看漲 | SWEEP | 看好 | 08/23/24 | $7.5 | $7.4 | $7.5 | $130.00 | $75.0K | 152 | 0 |

| 美光 | 看漲 | SWEEP | 中立 | 08/16/24 | $4.85 | $4.75 | $4.8 | $135.00 | $72.0K | 8.1千 | 135 |

About Micron Technology

關於美光科技

Micron is one of the largest semiconductor companies in the world, specializing in memory and storage chips. Its primary revenue stream comes from dynamic random access memory, or DRAM, and it also has minority exposure to not-and or NAND, flash chips. Micron serves a global customer base, selling chips into data centers, mobile phones, consumer electronics, and industrial and automotive applications. The firm is vertically integrated.

美光科技是世界上最大的半導體公司之一,專門從事存儲芯片。其主要營業收入來自動態隨機存取存儲器(DRAM),它還少量接觸與或非(NAND)閃存芯片。美光科技服務於全球用戶,將芯片銷售到數據中心、移動電話、消費電子、工業和汽車應用中。該公司具有垂直一體化優勢。

Following our analysis of the options activities associated with Micron Technology, we pivot to a closer look at the company's own performance.

在我們對美光科技期權活動的分析之後,我們轉而更近距離地關注該公司的表現。

Micron Technology's Current Market Status

美光科技當前市場狀態

- With a trading volume of 2,854,293, the price of MU is down by -0.79%, reaching $129.83.

- Current RSI values indicate that the stock is may be approaching oversold.

- Next earnings report is scheduled for 71 days from now.

- 在成交量爲2,854,293的情況下,MU的價格下跌了-0.79%,達到129.83美元。

- 當前RSI值表明該股票可能即將超賣。

- 下一個業績將於71天后發佈。

What Analysts Are Saying About Micron Technology

分析師對美光科技股票的評價

In the last month, 5 experts released ratings on this stock with an average target price of $178.0.

在過去的一個月中,有5位專家發佈了對該股票的評級,平均目標價爲178.0美元。

- Consistent in their evaluation, an analyst from Morgan Stanley keeps a Equal-Weight rating on Micron Technology with a target price of $140.

- An analyst from Keybanc persists with their Overweight rating on Micron Technology, maintaining a target price of $160.

- Consistent in their evaluation, an analyst from Keybanc keeps a Overweight rating on Micron Technology with a target price of $165.

- An analyst from Wolfe Research has decided to maintain their Outperform rating on Micron Technology, which currently sits at a price target of $200.

- An analyst from Rosenblatt persists with their Buy rating on Micron Technology, maintaining a target price of $225.

- 摩根士丹利的一位分析師保持對美光科技的等重評級,目標價爲140美元。

- Keybanc的分析師堅持對美光科技給予超配評級,並保持目標價160美元不變。

- Keybanc的一位分析師保持對美光科技的跑贏大盤評級,目標價爲165美元。

- 沃爾夫研究公司的分析師決定維持對美光科技的跑贏大盤評級,目前市場價爲200美元。

- Rosenblatt的分析師仍堅持對美光科技的買入評級,保持目標價225美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Micron Technology options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在收益。 精明的交易者通過不斷學習,調整策略,監控多個因子並密切關注市場動向來管理這些風險。 通過Benzinga Pro的實時警報了解最新的Micron Technology期權交易情況。