Unpacking the Latest Options Trading Trends in Amgen

Unpacking the Latest Options Trading Trends in Amgen

Financial giants have made a conspicuous bearish move on Amgen. Our analysis of options history for Amgen (NASDAQ:AMGN) revealed 18 unusual trades.

金融巨頭對安進採取了明顯的看跌舉動。我們對安進(納斯達克股票代碼:AMGN)期權歷史的分析顯示了18筆不尋常的交易。

Delving into the details, we found 22% of traders were bullish, while 38% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $131,787, and 15 were calls, valued at $561,349.

深入研究細節,我們發現22%的交易者看漲,而38%的交易者表現出看跌趨勢。在我們發現的所有交易中,有3筆是看跌期權,價值爲131,787美元,15筆是看漲期權,價值561,349美元。

Expected Price Movements

預期的價格走勢

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $210.0 to $370.0 for Amgen during the past quarter.

分析這些合約的交易量和未平倉合約,大型企業似乎一直在關注安進在過去一個季度的價格範圍從210.0美元到370.0美元不等。

Volume & Open Interest Trends

交易量和未平倉合約趨勢

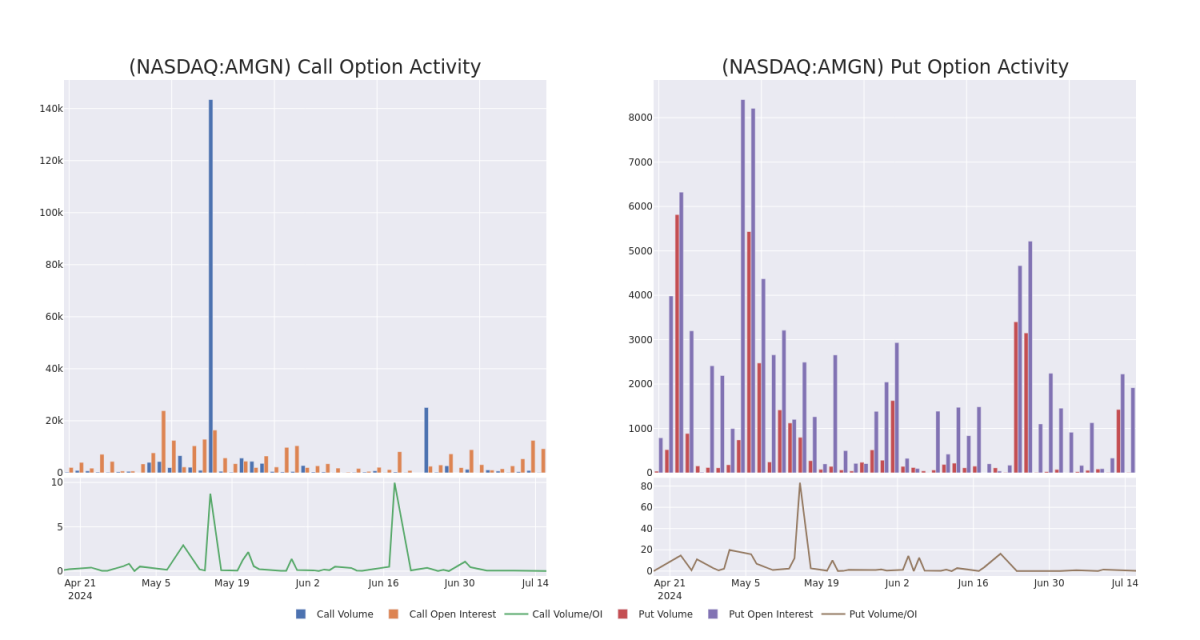

Looking at the volume and open interest is a powerful move while trading options. This data can help you track the liquidity and interest for Amgen's options for a given strike price. Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Amgen's whale trades within a strike price range from $210.0 to $370.0 in the last 30 days.

交易期權時,查看交易量和未平倉合約是一個強有力的舉動。這些數據可以幫助您跟蹤給定行使價下安進期權的流動性和利息。下面,我們可以觀察到過去30天內安進所有鯨魚交易的看漲期權和看跌期權交易量和未平倉合約的變化,其行使價在210.0美元至370.0美元之間。

Amgen Option Volume And Open Interest Over Last 30 Days

過去 30 天的安進期權交易量和未平倉合約

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | CALL | TRADE | NEUTRAL | 07/19/24 | $20.7 | $18.6 | $19.57 | $315.00 | $97.8K | 1.4K | 13 |

| AMGN | PUT | TRADE | BEARISH | 07/26/24 | $5.35 | $5.0 | $5.23 | $335.00 | $52.3K | 9 | 2 |

| AMGN | PUT | SWEEP | NEUTRAL | 01/16/26 | $7.15 | $0.1 | $3.95 | $210.00 | $47.3K | 114 | 0 |

| AMGN | CALL | TRADE | BEARISH | 01/17/25 | $20.3 | $19.35 | $19.35 | $355.00 | $38.7K | 40 | 20 |

| AMGN | CALL | TRADE | BEARISH | 01/17/25 | $20.3 | $19.3 | $19.3 | $355.00 | $38.6K | 40 | 40 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | 打電話 | 貿易 | 中立 | 07/19/24 | 20.7 美元 | 18.6 美元 | 19.57 美元 | 315.00 美元 | 97.8 萬美元 | 1.4K | 13 |

| AMGN | 放 | 貿易 | 粗魯的 | 07/26/24 | 5.35 美元 | 5.0 美元 | 5.23 美元 | 335.00 美元 | 52.3 萬美元 | 9 | 2 |

| AMGN | 放 | 掃 | 中立 | 01/16/26 | 7.15 美元 | 0.1 美元 | 3.95 美元 | 210.00 美元 | 47.3 萬美元 | 114 | 0 |

| AMGN | 打電話 | 貿易 | 粗魯的 | 01/17/25 | 20.3 美元 | 19.35 美元 | 19.35 美元 | 355.00 美元 | 38.7 萬美元 | 40 | 20 |

| AMGN | 打電話 | 貿易 | 粗魯的 | 01/17/25 | 20.3 美元 | 19.3 美元 | 19.3 美元 | 355.00 美元 | 38.6 萬美元 | 40 | 40 |

About Amgen

關於安進

Amgen is a leader in biotechnology-based human therapeutics. Flagship drugs include red blood cell boosters Epogen and Aranesp, immune system boosters Neupogen and Neulasta, and Enbrel and Otezla for inflammatory diseases. Amgen introduced its first cancer therapeutic, Vectibix, in 2006 and markets bone-strengthening drug Prolia/Xgeva (approved 2010) and Evenity (2019). The acquisition of Onyx bolstered the firm's therapeutic oncology portfolio with Kyprolis. Recent launches include Repatha (cholesterol-lowering), Aimovig (migraine), Lumakras (lung cancer), and Tezspire (asthma). The 2023 Horizon acquisition brings several rare-disease drugs, including thyroid eye disease drug Tepezza. Amgen also has a growing biosimilar portfolio.

安進是基於生物技術的人體療法的領導者。旗艦藥物包括紅細胞增強劑Epogen和Aranesp、免疫系統增強劑Neupogen和Neulasta以及治療炎症性疾病的Enbrel和Otezla。安進於2006年推出了其首款癌症療法Vectibix,並銷售強化骨骼的藥物Prolia/Xgeva(2010年獲得批准)和Evenity(2019年)。對Onyx的收購加強了該公司與Kyprolis合作的治療腫瘤學產品組合。最近推出的產品包括Repatha(降膽固醇)、Aimovig(偏頭痛)、Lumakras(肺癌)和Tezspire(哮喘)。2023年Horizon的收購帶來了幾種罕見疾病藥物,包括甲狀腺眼病藥物Tepezza。安進的生物仿製藥產品組合也在不斷增長。

Having examined the options trading patterns of Amgen, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了安進的期權交易模式之後,我們的注意力現在直接轉向了該公司。這種轉變使我們能夠深入研究其目前的市場地位和表現

Amgen's Current Market Status

安進目前的市場地位

- With a trading volume of 279,645, the price of AMGN is up by 1.19%, reaching $334.07.

- Current RSI values indicate that the stock is may be overbought.

- Next earnings report is scheduled for 16 days from now.

- AMGN的交易量爲279,645美元,上漲了1.19%,達到334.07美元。

- 當前的RSI值表明該股可能已被超買。

- 下一份收益報告定於16天后發佈。

What Analysts Are Saying About Amgen

分析師對安進的看法

In the last month, 2 experts released ratings on this stock with an average target price of $321.5.

上個月,兩位專家發佈了該股的評級,平均目標價爲321.5美元。

- An analyst from Morgan Stanley persists with their Equal-Weight rating on Amgen, maintaining a target price of $303.

- Maintaining their stance, an analyst from Argus Research continues to hold a Buy rating for Amgen, targeting a price of $340.

- 摩根士丹利的一位分析師堅持對安進的同等權重評級,將目標價維持在303美元。

- 阿格斯研究的一位分析師保持立場,繼續維持安進的買入評級,目標價格爲340美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。