Wells Fargo's Options Frenzy: What You Need to Know

Wells Fargo's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bullish stance on Wells Fargo.

有很多資金的鯨魚已經明顯看好富國銀行。

Looking at options history for Wells Fargo (NYSE:WFC) we detected 28 trades.

查看Wells Fargo (紐交所:WFC)期權歷史數據,我們發現有28次交易。

If we consider the specifics of each trade, it is accurate to state that 50% of the investors opened trades with bullish expectations and 35% with bearish.

如果我們考慮每個交易的具體情況,可以準確地說,50%的投資者持牛市預期開倉,35%的投資者持看跌預期開倉。

From the overall spotted trades, 20 are puts, for a total amount of $825,195 and 8, calls, for a total amount of $470,537.

從所有交易中,有20次看跌期權,共計825,195美元,以及8次看漲期權,共計470,537美元。

Expected Price Movements

預期價格波動

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $50.0 to $65.0 for Wells Fargo over the last 3 months.

考慮到這些合同的成交量和未平倉量,過去3個月,鯨魚們似乎將Wells Fargo的目標價位區間定在50.0到65.0美元。

Insights into Volume & Open Interest

成交量和持倉量分析

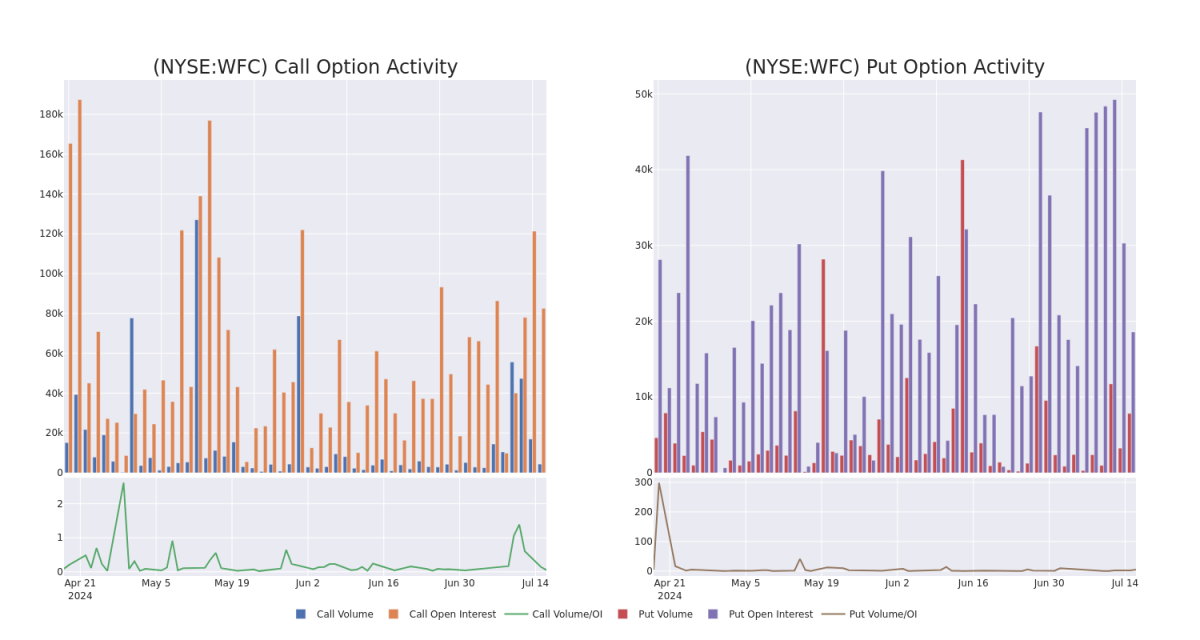

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for Wells Fargo's options for a given strike price.

這些數據可以幫助您跟蹤給定執行價格的富國銀行期權的流動性和興趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Wells Fargo's whale activity within a strike price range from $50.0 to $65.0 in the last 30 days.

下面,我們可以觀察過去30天內,所有Wells Fargo鯨魚活動期權的看漲和看跌期權的成交量和未平倉量的變化,均在50.0到65.0美元的行權價格範圍內。

Wells Fargo Option Volume And Open Interest Over Last 30 Days

富國銀行過去30天的期權成交量和持倉量

Significant Options Trades Detected:

檢測到重大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| WFC | CALL | SWEEP | BEARISH | 12/20/24 | $6.45 | $6.4 | $6.45 | $55.00 | $153.5K | 4.9K | 2 |

| WFC | CALL | SWEEP | BEARISH | 07/19/24 | $1.45 | $1.37 | $1.38 | $57.00 | $99.4K | 5.2K | 48 |

| WFC | PUT | SWEEP | BULLISH | 12/20/24 | $2.63 | $2.6 | $2.6 | $57.50 | $66.0K | 1.2K | 10 |

| WFC | PUT | SWEEP | BULLISH | 10/18/24 | $7.25 | $6.95 | $6.95 | $65.00 | $61.1K | 695 | 130 |

| WFC | PUT | SWEEP | BEARISH | 03/21/25 | $1.5 | $1.4 | $1.5 | $50.00 | $60.0K | 1.3K | 0 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 富國銀行 | 看漲 | SWEEP | 看淡 | 12/20/24 | $6.45 | 6.4美元 | $6.45 | $55.00 | $153.5K | 4.9K | 2 |

| 富國銀行 | 看漲 | SWEEP | 看淡 | 07/19/24 | $1.45 | $1.37 | $1.38應翻譯爲1.38美元 | 57.00美元 | $99.4K | 5.2K | 48 |

| 富國銀行 | 看跌 | SWEEP | 看好 | 12/20/24 | $2.63 | $2.6 | $2.6 | $57.50 | $66.0K | 1.2K | 10 |

| 富國銀行 | 看跌 | SWEEP | 看好 | 10/18/24 | $7.25 | $6.95 | $6.95 | $65.00 | $61.1K | 695 | 130 |

| 富國銀行 | 看跌 | SWEEP | 看淡 | 03/21/25 | $1.5 | $1.4 | $1.5 | $50.00 | $60.0K | 1.3K | 0 |

About Wells Fargo

關於富國銀行

Wells Fargo is one of the largest banks in the United States, with approximately $1.9 trillion in balance sheet assets. The company has four primary segments: consumer banking, commercial banking, corporate and investment banking, and wealth and investment management. It is almost entirely focused on the U.S.

富國銀行是美國最大的銀行之一,資產負債表總額約爲1.9萬億美元。該公司有四個主要業務部門:消費銀行,商業銀行,公司和投資銀行以及財富和投資管理。 它幾乎完全集中在美國。

Following our analysis of the options activities associated with Wells Fargo, we pivot to a closer look at the company's own performance.

在分析與富國銀行相關的期權活動後,我們轉向更仔細地研究該公司的業績。

Where Is Wells Fargo Standing Right Now?

Wells Fargo現在的狀況如何?

- With a trading volume of 4,320,308, the price of WFC is up by 2.39%, reaching $59.11.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 87 days from now.

- WFC的交易量爲4,320,308,漲幅爲2.39%,目前報價59.11美元。

- 當前RSI值表明該股票可能接近超買狀態。

- 下一次業績發佈將在87天后。

Professional Analyst Ratings for Wells Fargo

富國銀行的專業分析師評級

Over the past month, 5 industry analysts have shared their insights on this stock, proposing an average target price of $64.2.

上個月,有5位行業分析師分享了他們對這支股票的見解,提出了平均目標價爲64.2美元。

- An analyst from Jefferies persists with their Hold rating on Wells Fargo, maintaining a target price of $64.

- Maintaining their stance, an analyst from Evercore ISI Group continues to hold a Outperform rating for Wells Fargo, targeting a price of $70.

- An analyst from Evercore ISI Group has revised its rating downward to Outperform, adjusting the price target to $67.

- Maintaining their stance, an analyst from Keefe, Bruyette & Woods continues to hold a Market Perform rating for Wells Fargo, targeting a price of $61.

- Consistent in their evaluation, an analyst from BMO Capital keeps a Market Perform rating on Wells Fargo with a target price of $59.

- Jefferies的一位分析師堅持對Wells Fargo保持持有評級,目標價爲64美元。

- Evercore ISI Group的分析師堅持對Wells Fargo持續看好評級,目標價爲70美元。

- Evercore ISI Group的一位分析師將其評級下調爲看好,將目標價調整爲67美元。

- Keefe、Bruyette & Woods的分析師保持Wells Fargo的市場表現評級,目標價爲61美元。

- BMO Capital的分析師一直認爲Wells Fargo的市場表現爲中性,目標價爲59美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Wells Fargo options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在回報。敏銳的交易者通過持續教育自己、調整策略、監控多種因子並密切關注市場走勢來管理這些風險。通過Benzinga Pro實時警報,了解最新的Wells Fargo期權交易信息。