Market Whales and Their Recent Bets on CVS Options

Market Whales and Their Recent Bets on CVS Options

Financial giants have made a conspicuous bullish move on CVS Health. Our analysis of options history for CVS Health (NYSE:CVS) revealed 10 unusual trades.

金融巨頭對西維斯健康採取了明顯的看好行動。我們對西維斯健康(紐交所:CVS)期權歷史進行分析後發現了10次非凡交易。

Delving into the details, we found 50% of traders were bullish, while 50% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $303,820, and 7 were calls, valued at $615,689.

深入了解詳情,我們發現50%的交易者看漲,而50%的交易者看跌。我們發現的所有交易中,有3筆看跌期權,價值303,820美元,有7筆看漲期權,價值615,689美元。

What's The Price Target?

目標價是多少?

Analyzing the Volume and Open Interest in these contracts, it seems that the big players have been eyeing a price window from $50.0 to $70.0 for CVS Health during the past quarter.

分析這些期權合約的成交量和未平倉利益,似乎這些大玩家已經將西維斯健康的價格窗口定在$50.0到$70.0之間。這一確定在過去的一個季度內進行。

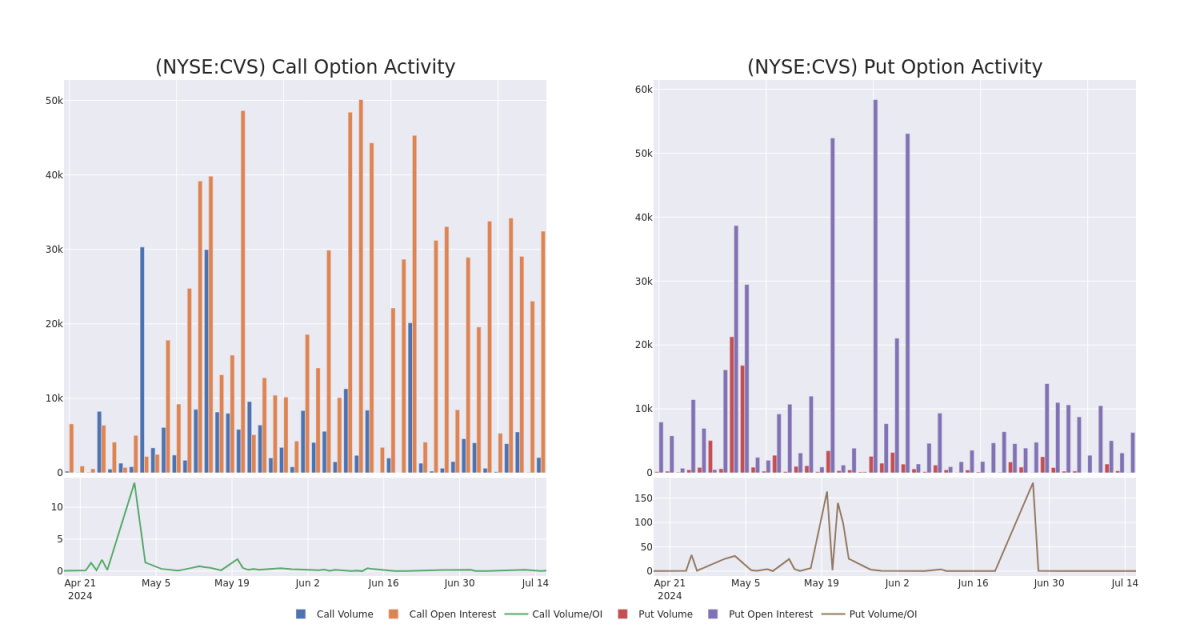

Volume & Open Interest Trends

成交量和未平倉量趨勢

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in CVS Health's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to CVS Health's substantial trades, within a strike price spectrum from $50.0 to $70.0 over the preceding 30 days.

評估成交量和未平倉利益是期權交易中的戰略步驟。這些指標揭示了在指定行權價格下,投資者對西維斯健康期權的流動性和投資者興趣。即將到來的數據將展示過去30天內,與$50.0到$70.0的行權價格範圍內的西維斯健康大規模交易相關的看跌和看漲期權成交量和未平倉利益的波動。

CVS Health Option Activity Analysis: Last 30 Days

西維斯健康期權活動分析:最近30天

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVS | CALL | SWEEP | BEARISH | 01/16/26 | $4.7 | $2.91 | $4.7 | $70.00 | $304.6K | 20.5K | 44 |

| CVS | PUT | SWEEP | BEARISH | 01/17/25 | $5.15 | $5.05 | $5.15 | $60.00 | $153.4K | 4.8K | 17 |

| CVS | CALL | SWEEP | BEARISH | 01/16/26 | $5.4 | $4.2 | $4.65 | $70.00 | $122.3K | 20.5K | 692 |

| CVS | PUT | SWEEP | BEARISH | 11/15/24 | $3.55 | $3.5 | $3.55 | $57.50 | $88.7K | 839 | 1 |

| CVS | CALL | SWEEP | BULLISH | 11/15/24 | $5.75 | $5.7 | $5.75 | $57.50 | $73.6K | 990 | 8 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CVS | 看漲 | SWEEP | 看淡 | 01/16/26 | $4.7 | $2.91 | $4.7 | 70.00美元 | $304.6K | 20.5千 | 44 |

| CVS | 看跌 | SWEEP | 看淡 | 01/17/25 | $5.15 | $5.05 | $5.15 | $60.00 | $153.4K | 4.8千 | 17 |

| CVS | 看漲 | SWEEP | 看淡 | 01/16/26 | $5.4 | $4.2 | $4.65 | 70.00美元 | $122.3K | 20.5千 | 692 |

| CVS | 看跌 | SWEEP | 看淡 | 11/15/24 | $3.55 | $3.5 | $3.55 | $57.50 | $88.7K | 839 | 1 |

| CVS | 看漲 | SWEEP | 看好 | 11/15/24 | $5.75 | $5.7 | $5.75 | $57.50 | 73.6K | 990 | 8 |

About CVS Health

關於西維斯健康

CVS Health offers a diverse set of healthcare services. Its roots are in its retail pharmacy operations, where it operates over 9,000 stores primarily in the us. CVS is also a large pharmacy benefit manager (acquired through Caremark), processing about 2 billion adjusted claims annually. It also operates a top-tier health insurer (acquired through Aetna) where it serves about 26 million medical members. The company's recent acquisition of Oak Street adds primary care services to the mix, which could have significant synergies with all its existing business lines.

CVS Health提供多樣化的醫療保健服務。它的根源在於其零售藥店業務,主要在美國擁有超過9,000家門店。CVS還是大型藥店效益管理者(通過Caremark收購),每年處理約20億個調整後的索賠。它還運營着一家頂尖的健康保險公司(通過Aetna收購),爲大約2,600萬名醫療成員提供服務。其最近收購的Oak Street爲混合服務增加了初級保健服務,這可能與其所有現有業務線具有重要的協同效應。

Following our analysis of the options activities associated with CVS Health, we pivot to a closer look at the company's own performance.

在我們分析與CVS Health相關的期權活動後,我們將轉向對公司自身業績的更深入了解。

CVS Health's Current Market Status

西維斯健康的當前市場狀況

- With a volume of 3,907,432, the price of CVS is up 1.67% at $59.65.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 22 days.

- CVS的成交量爲3,907,432,價格上漲1.67%,爲59.65美元。

- RSI指標暗示該標的股票目前處於超買和超賣的中立區間。

- 下一輪業績預計將於22天后公佈。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for CVS Health with Benzinga Pro for real-time alerts.

期權交易涉及更大的風險,但也提供了更高的利潤潛力。精明的交易者通過持續的教育、戰略性的交易調整、利用各種因子和保持對市場動態的敏銳態度來減輕這些風險。請使用Benzinga Pro實時警報來了解西維斯健康的最新期權交易情況。