China Baoan Group Co., Ltd.'s (SZSE:000009) Stock Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong?

China Baoan Group Co., Ltd.'s (SZSE:000009) Stock Has Shown Weakness Lately But Financial Prospects Look Decent: Is The Market Wrong?

With its stock down 22% over the past three months, it is easy to disregard China Baoan Group (SZSE:000009). But if you pay close attention, you might find that its key financial indicators look quite decent, which could mean that the stock could potentially rise in the long-term given how markets usually reward more resilient long-term fundamentals. Specifically, we decided to study China Baoan Group's ROE in this article.

中國寶安(SZSE:000009)的股票在過去三個月中下跌了22%,易被忽略。但是,如果您關注一下,您可能會發現其關鍵的財務指標看起來相當不錯,這可能意味着在長期市場通常獎勵更強大的長期基本面的情況下,股票有可能潛在上漲。具體來說,我們決定在本文中研究中國寶安的roe。

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. Put another way, it reveals the company's success at turning shareholder investments into profits.

股本回報率或roe是一項關鍵指標,用於評估公司管理層使用公司資本的效率。換句話說,它揭示了公司將股東的投資轉化爲利潤的成功。

How Is ROE Calculated?

淨資產收益率怎麼計算?

The formula for ROE is:

roe的公式是:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

淨資產收益率 = 淨利潤(從持續經營中獲得)÷ 股東權益

So, based on the above formula, the ROE for China Baoan Group is:

因此,根據上述公式,中國寶安的roe爲:

6.9% = CN¥1.5b ÷ CN¥21b (Based on the trailing twelve months to March 2024).

6.9%=CN¥15億÷CN¥210億(基於截至2024年3月的過去十二個月)。

The 'return' is the profit over the last twelve months. Another way to think of that is that for every CN¥1 worth of equity, the company was able to earn CN¥0.07 in profit.

'收益'是過去十二個月的利潤。另一種考慮方法是,對於每元人民幣的股本淨值,公司能夠獲得0.07元的利潤。

Why Is ROE Important For Earnings Growth?

ROE爲什麼對淨利潤增長很重要?

Thus far, we have learned that ROE measures how efficiently a company is generating its profits. We now need to evaluate how much profit the company reinvests or "retains" for future growth which then gives us an idea about the growth potential of the company. Generally speaking, other things being equal, firms with a high return on equity and profit retention, have a higher growth rate than firms that don't share these attributes.

到目前爲止,我們已經知道ROE評估了公司利潤生成效率。現在我們需要評估公司回報率或“保留”了多少利潤以供未來增長,從而可以了解公司的增長潛力。總的來說,其他條件相同的情況下,具有高ROE和利潤保留的公司比沒有這些屬性的公司有更高的增長率。

China Baoan Group's Earnings Growth And 6.9% ROE

中國寶安的盈利增長和6.9%的roe。

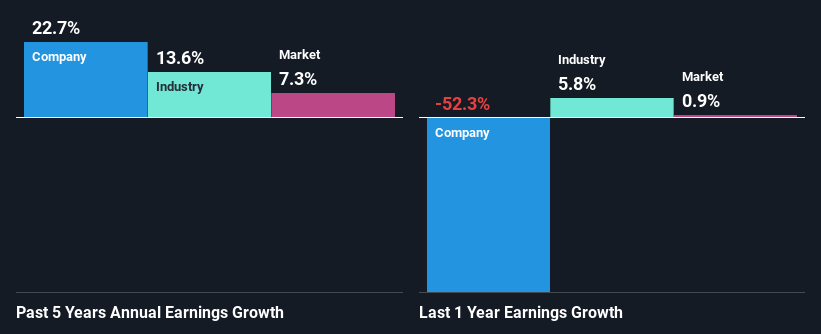

On the face of it, China Baoan Group's ROE is not much to talk about. Yet, a closer study shows that the company's ROE is similar to the industry average of 8.0%. Moreover, we are quite pleased to see that China Baoan Group's net income grew significantly at a rate of 23% over the last five years. Given the slightly low ROE, it is likely that there could be some other aspects that are driving this growth. For example, it is possible that the company's management has made some good strategic decisions, or that the company has a low payout ratio.

乍一看,中國寶安的roe並不值得一提。 然而,更近一步的研究表明,該公司的ROE與8.0%行業平均水平相似。 此外,我們很高興看到中國寶安的淨利潤在過去五年中以23%的速度顯著增長。 鑑於ROE略低,很可能有一些其他方面推動着這種增長。 例如,公司管理層可能已經作出了一些良好的戰略決策,或者公司的紓解率較低。

Next, on comparing with the industry net income growth, we found that China Baoan Group's growth is quite high when compared to the industry average growth of 14% in the same period, which is great to see.

接下來,通過與行業淨利潤增長的比較,我們發現與行業平均增長14%相比,中國寶安的增長相當高,這是非常好的。

Earnings growth is an important metric to consider when valuing a stock. It's important for an investor to know whether the market has priced in the company's expected earnings growth (or decline). Doing so will help them establish if the stock's future looks promising or ominous. If you're wondering about China Baoan Group's's valuation, check out this gauge of its price-to-earnings ratio, as compared to its industry.

盈利增長是考慮股票價值時需要考慮的重要指標。 對於投資者來說,了解市場是否已經定價了公司預期的盈利增長或下降非常重要。 這樣做將有助於他們確定股票的未來看起來是有前途還是不吉利的。 如果您想了解中國寶安的估值,請查看其市盈率與行業相比的儀表盤。

Is China Baoan Group Making Efficient Use Of Its Profits?

中國寶安是否有效利用其利潤?

China Baoan Group has a really low three-year median payout ratio of 8.8%, meaning that it has the remaining 91% left over to reinvest into its business. This suggests that the management is reinvesting most of the profits to grow the business as evidenced by the growth seen by the company.

中國寶安的三年中位數紅利支付率非常低,爲8.8%,這意味着它剩餘91%的利潤用於再投資業務。 這表明管理層正在重新投資大部分利潤來增長業務,這是公司增長的證據。

Additionally, China Baoan Group has paid dividends over a period of at least ten years which means that the company is pretty serious about sharing its profits with shareholders.

此外,中國寶安在至少十年的時間內支付股息,這意味着公司非常重視與股東分享利潤。

Conclusion

結論

Overall, we feel that China Baoan Group certainly does have some positive factors to consider. Despite its low rate of return, the fact that the company reinvests a very high portion of its profits into its business, no doubt contributed to its high earnings growth. While we won't completely dismiss the company, what we would do, is try to ascertain how risky the business is to make a more informed decision around the company. You can see the 1 risk we have identified for China Baoan Group by visiting our risks dashboard for free on our platform here.

總的來說,我們認爲中國寶安肯定有一些需要考慮的積極因素。 儘管回報率較低,但公司將其利潤的大部分高比例重新投入業務中,無疑有助於其高盈利增長。 雖然我們不會完全排除公司,但我們會嘗試確定業務的風險,以便更明智地作出有關公司的決策。 您可以在此處免費訪問我們的風險儀表板以了解我們爲中國寶安集團確定的1個風險。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity