Hong Kong Viable Stocks – PCCW, Zhaojin Mining Industry

Hong Kong Viable Stocks – PCCW, Zhaojin Mining Industry

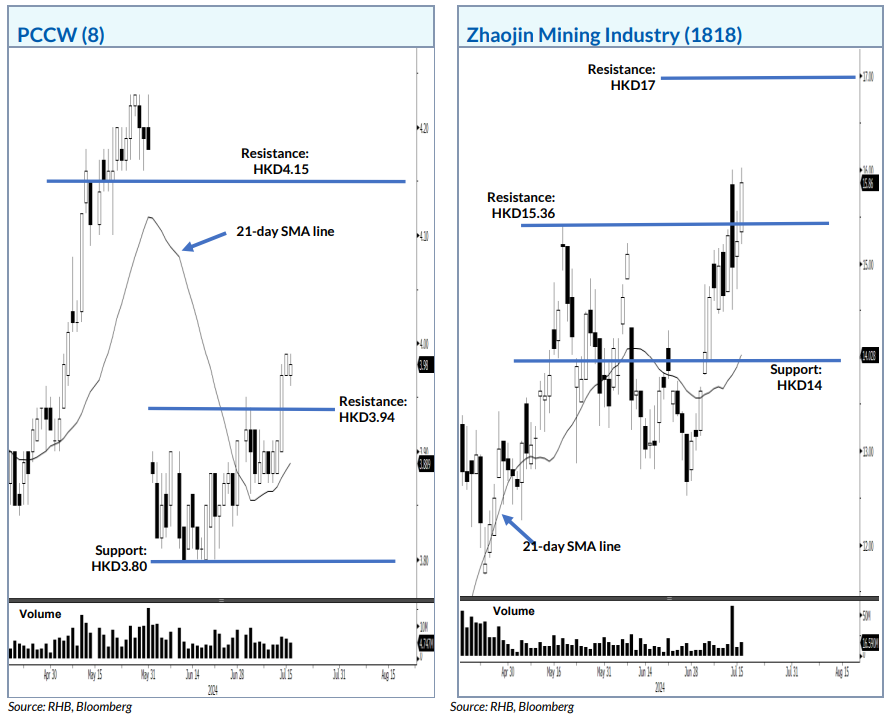

PCCW is posing a bullish setup after breaking past the resistance with a "higher high" candlestick.

PCCW在以 “更高的高點” 突破阻力位後,呈看漲格局。

RHB Retail Research (RHB) in a note today (July 17) said the stock has climbed above the HKD3.94 resistance to confirm a bullish setup.

興業銀行零售研究(RHB)在今天(7月17日)的一份報告中表示,該股已攀升至3.94港元的阻力位上方,以確認看漲行情。

It is trading above the 21-day SMA line, showing bullish momentum is gaining traction.

它的交易價格高於21天均線,表明看漲勢頭正在增強。

The momentum would lift the stock towards the next resistance at HKD4.15, followed by HKD4.40.

這一勢頭將使該股升至下一個阻力位4.15港元,其次是4.40港元。

On the flipside, breaching the HKD3.80 support would negate the bullish setup.

另一方面,突破3.80港元的支撐位將否定看漲格局。

Zhaojin Mining Industry is eyeing to extend the upwards movement after staging a bullish breakout.

招金礦業在上演看漲突破後,正考慮延續上漲走勢。

The counter has charted a bullish candlestick and closed above the HKD15.36 resistance.

該計數器繪製了看漲的K線圖,收於15.36港元的阻力位上方。

The 21-day SMA line is pointing upwards, showing the short-term trend is bullish.

21天均線指向上方,顯示短期趨勢看漲。

If it stays above the breakout point, the counter will travel towards the next resistance at HKD17, followed by HKD18.50.

如果它保持在突破點上方,則該反彈將跌向下一個阻力位 HKD17,然後是18.50港元。

On the downside, falling below the HKD14 support would open the door for correction.

不利的一面是,跌破 HKD14 支撐位將爲修正打開大門。