Decoding the Earnings of TSMC, the World's Top Chipmaker

Decoding the Earnings of TSMC, the World's Top Chipmaker

[July.2024] Decoding the Earnings of TSMC, the World's Top Chipmaker

[2024年7月]解讀全球最大的芯片製造商台積電的業績

The semiconductor industry is often regarded as the crown jewel of modern technology. Among its key players is TSMC, or Taiwan Semiconductor Manufacturing Company, which boasts the most advanced chip foundries in the world. As such, the company's financial health mirrors the cyclical nature of the chip market, with considerable swings in its stock price over the past few years.

半導體行業板塊常被視爲現代科技的驕傲。台積電是其中的主要參與者之一,其擁有全球最先進的晶圓廠。因此,該公司的財務狀況反映出芯片市場的週期性特徵,在過去幾年中,其股價波動很大。

Since May, TSMC's stock has hit new highs, nearing a trillion-dollar market cap. This surge is partly fueled by Apple's price cuts boosting high-end smartphone chip demand and the ongoing strong demand from data centers.

自5月以來,台積電的股價一直創造新高,市值接近萬億美元市值這股漲勢在一定程度上受到了蘋果降價刺激高端智能手機芯片需求以及數據中心強勁需求的推動

Each time a company releases its financial report, it may present a potential trading or investment opportunity. But before diving in, investors need to understand how to interpret their financial statements.

每家公司發佈業績時,都可能會提供潛在的交易或投資機會。但在投資前,投資者需要了解如何解讀公司的財務報表。

How do we analyze TSMC's earnings reports, and how can we pinpoint its current phase in the business cycle? Key indicators to watch may include revenue growth and gross margin, the composition of its income, capital expenditures, and cash flow.

我們如何分析台積電的業績,如何確定其當前業務週期的階段?需要關注的主要因素可能包括營業收入增長、毛利率、收入構成、資本支出和現金流。

1. Revenue growth and gross margin

1.營業收入增長和毛利率

For cyclical industries, shifts in revenue growth and profit margins are key indicators of the cycle's direction. High growth in revenue and improving gross margins usually signal a peak in the cycle, while the opposite could suggest a downturn.

對於週期性產業,營業收入增長和利潤率的變化是週期走向的關鍵指標。營業收入高增長和毛利率的改善通常意味着週期達到峯值,而反之則可能意味着下降。

TSMC's revenue, after three-quarters of sequential declines, showed signs of recovery in the third quarter of 2023 with a 10.2% increase, followed by a 14.4% increase in the fourth quarter.

在連續三個季度下滑後,台積電的營業收入在2023年第三季度開始出現復甦跡象,增長了10.2%,隨後在第四季度增長了14.4%。

By Q1 2024, TSMC reported revenue of NT$592.64 billion, marking a 5.3% decline from the previous quarter, halting its rebound trend. However, compared to the same period last year, TSMC's revenue still saw a growth of approximately 16.5%.

到2024年第一季度,台積電的營業收入爲5926.4億新臺幣,較上一季度下降了5.3%,停止了反彈趨勢。然而,與去年同期相比,台積電的營收仍然增長了約16.5%。

TSMC's revenue is determined by the product of shipment volumes and prices, both of which saw a rise in Q4 2023, indicating a possible rebound in demand.

台積電的營業收入取決於出貨量和價格的乘積,兩者在2023年第四季度都有所上漲,表明需求有可能反彈。

TSMC calculates its revenue by multiplying product shipment volumes by their prices. In Q1 2024, the company's revenue declined quarter-over-quarter primarily due to a drop in product prices. This was largely driven by a significant decrease in Apple smartphone sales, which in turn reduced demand for TSMC's highest-priced 3nm chip manufacturing services, leading to an overall decline in prices.

台積電通過乘以產品出貨量和價格來計算其營收。2024年第一季度,公司的營收環比下降主要是由於產品價格下降。這主要是由蘋果智能手機銷量大幅下降所引起的,這反過來減少了對臺積電最高價3nm芯片製造服務的需求,導致整體價格下降。

However, Apple's aggressive price cuts in the second quarter have sparked a strong rebound in its sales. Additionally, Apple's upcoming new models, which will feature integrated AI capabilities, have heightened market expectations for the new generation's sales. This may potentially raise TSMC's average selling prices, thereby boosting future revenue growth.

然而,蘋果在第二季度大力降價刺激了其銷售。此外,蘋果即將推出的新型號將具有集成的人工智能功能,這提高了市場對新一代產品銷售的預期。這可能會提高臺積電的平均銷售價格,從而促進未來的營業收入增長。

Regarding gross margin, TSMC reported approximately 53.1% in Q1 2024, still at a relatively low level, possibly due to the high costs of ramping up 3nm chip production.

關於毛利率,台積電在2024年第一季度報告的毛利率約爲53.1%,仍處於相對較低的水平,可能是由於大量投入3nm芯片生產的高成本。

Although TSMC's revenue has increased for two consecutive quarters—hinting at a warming industry demand—the gross margin has not yet shown a definitive recovery, likely because the demand surge isn't strong enough to boost profitability. Close monitoring of revenue and gross margin trends will be essential to gauge the cycle's rebound.

儘管台積電的營業收入已連續兩個季度增長,暗示行業需求正在增加,但毛利率尚未顯示出明確的復甦跡象,可能是因爲需求增長不足以推動盈利能力的提高。密切監測營業收入和毛利率趨勢將是評估週期反彈的關鍵。

Overall, TSMC's revenue growth has shown signs of improvement, suggesting a potential recovery in industry demand. However, the growth rate remains somewhat unstable. TSMC's gross profit margin is still relatively low, partly due to high depreciation costs, but more importantly because the demand surge has not been strong enough to boost profitability.

總體而言,台積電的營業收入增長已經顯示出改善的跡象,表明行業需求可能正在恢復。然而,增長率仍然相對不穩定。台積電的毛利潤率仍然相對較低,部分原因是由於高額折舊成本,但更重要的是需求增長不足以提高盈利能力。

Moving forward, we may continue to monitor TSMC's revenue and gross profit margin trends to better determine the stability and extent of its cyclical recovery.

未來,我們可以繼續關注台積電的營業收入和毛利率趨勢,以更好地確定其週期性復甦的穩定性和程度。

2. Revenue mix

2.營業收入構成

TSMC's revenue mix is primarily comprised of sales from the smartphone and high-performance computing sectors, which collectively make up about 80% of its total revenue.

台積電的營業收入構成主要由智能手機和高性能計算領域的銷售所組成,兩者共約佔其總營業收入的80%左右。

During the fourth quarter of 2023, the company witnessed a notable increase in smartphone-related revenue, which rose from a 33% share in the second quarter to 43% by Q4. This significant increase suggests a rebound in the global smartphone market demand.

在2023年第四季度,公司的智能手機相關收入顯著增長,從第二季度的33%上升到第四季度的43%。這一顯著增長意味着全球智能手機市場需求正在恢復。

However, in Q1 2024, the decline in Apple smartphone sales led to a decrease in TSMC's revenue share from the smartphone segment. Conversely, driven by strong demand from data centers and AI, TSMC's high-performance computing segment saw its revenue contribution to TSMC reach a new high in recent quarters.

然而,在2024年第一季度,蘋果智能手機銷售下降導致台積電在智能手機板塊的營收份額下降。相反,受到來自數據中心和人工智能的強勁需求推動,台積電的高性能計算板塊在近幾個季度貢獻的營收達到了新高。

Moving forward, we may continue to monitor the cyclical changes in smartphone market demand and the sustained robustness of data center demand. These factors will significantly impact TSMC's overall performance.

未來,我們可能會繼續監控智能手機市場需求和數據中心需求持續強勁的週期性變化。這些因素將極大地影響台積電的整體表現。

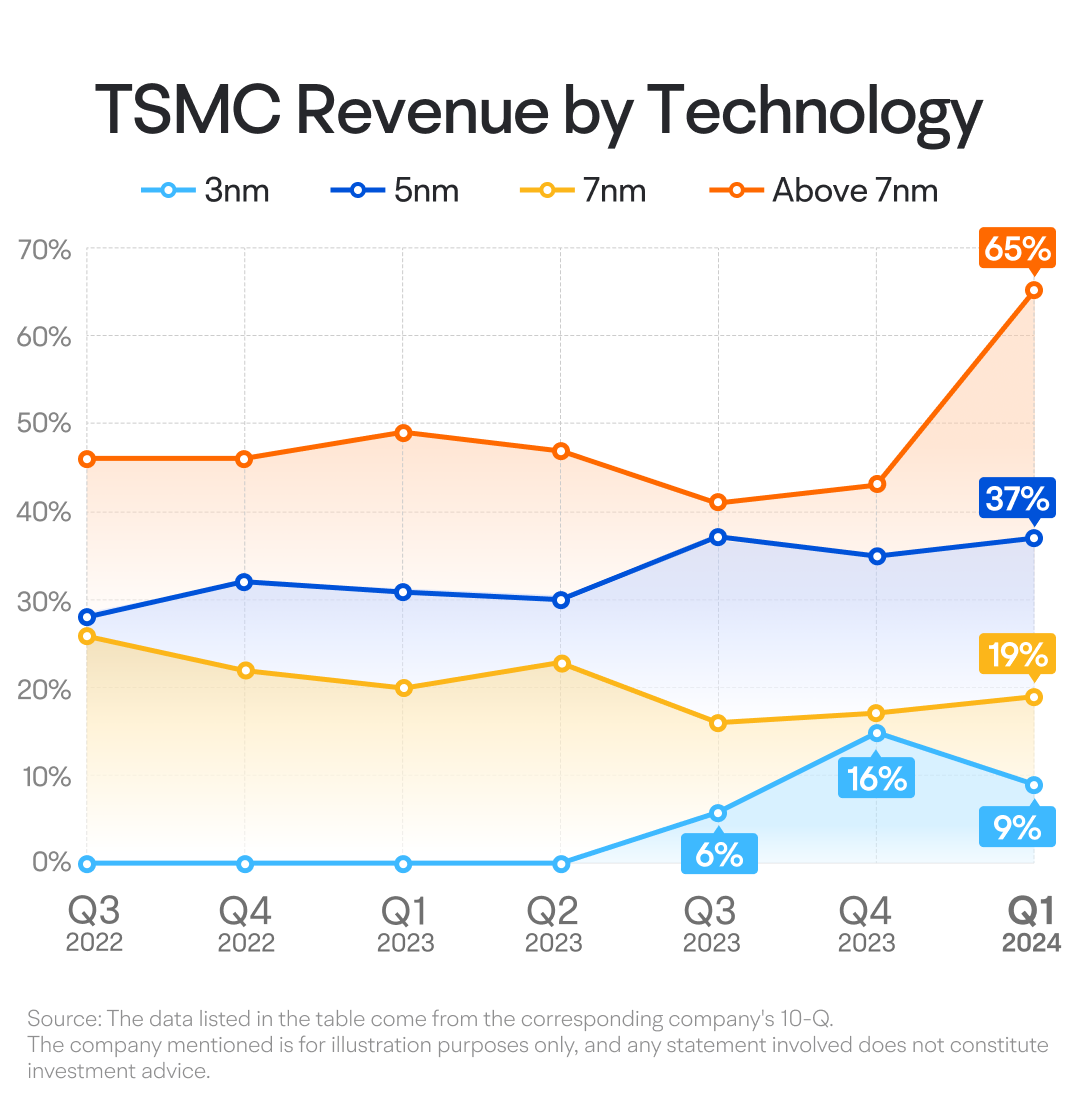

In terms of chip manufacturing technology, TSMC categorizes its revenue into two segments: advanced sub-7nm processes and the less advanced 7nm-and-above processes. The sub-7nm category, which includes the latest and more sophisticated technology, is where TSMC earns the majority of its income.

在芯片製造技術方面,台積電將其營收分爲兩個板塊:7納米以下的先進工藝和7納米及以上的較不先進工藝。先進的7納米以下分類別包括最新和更復雜的技術,是台積電賺取大部分收入的地方。

Historically, TSMC's sub-7nm revenues were dominated by 5nm and 7nm process chips, but there has been a shift towards the even more advanced 5nm process. In the third quarter of 2023, TSMC began mass-producing chips using the 3nm process technology, contributing approximately 6% to the overall revenue, with this figure climbing to 15% in the fourth quarter. However, in Q1 2024, Apple's sales declined, reducing TSMC's revenue share from the smartphone segment to 9%.

歷史上,台積電的7納米以下收入主要來自5納米和7納米工藝芯片,但現在已經向更先進的5納米工藝轉變。2023年第三季度,台積電開始使用3納米工藝技術大規模生產芯片,這爲其整體營收貢獻了約6%,這個數字在第四季度上升到了15%。然而,在2024年第一季度,蘋果的銷售下降,導致台積電在智能手機板塊的營收份額下降至9%。

In the coming quarters, the anticipated sales growth from Apple's price cuts and strong expectations for new models, along with the launch of the latest high-end Android devices, may potentially boost TSMC's revenue from its 3nm technology segment. This increase in demand may drive overall revenue growth for the company.

在未來幾個季度中,蘋果的降價和對新型號的強烈期望以及最新高端安卓設備的推出可能會推動台積電從其3納米技術板塊獲得更多營收。這種需求增長可能推動公司整體營收增長。

As we look to the future, the success of TSMC's 3nm technology is expected to grow further, especially with the anticipated launches of new Apple devices and the latest high-end Android smartphones. These product releases are likely to drive an increase in TSMC's 3nm process revenue, further boosting the company's growth.

展望未來,台積電的3納米技術的成功預計將進一步增長,特別是隨着新的蘋果設備和最新高端安卓智能手機的推出。這些產品發佈可能會推動台積電的3納米工藝營收增加,進一步推動公司的增長。

3. Capital expenditure and cash flow

3.資本支出和現金流

As the leading semiconductor foundry and second only to NVIDIA in market value within the chip industry, TSMC occupies a prestigious but challenging position. The company must continuously innovate to stay ahead, as the industry relentlessly pushes for more advanced technologies, spurred by Moore's Law. If TSMC were to fall behind, competitors like Samsung Electronics could quickly surpass it.

作爲領先的半導體代工廠,僅次於英偉達在芯片行業的市值,台積電處於崇高而具有挑戰性的地位。公司必須不斷創新,以保持領先地位,因爲行業不斷向着更先進的技術不斷髮力,受摩爾定律的推動。如果台積電落後,像三星電子這樣的競爭對手可能會很快超過它。

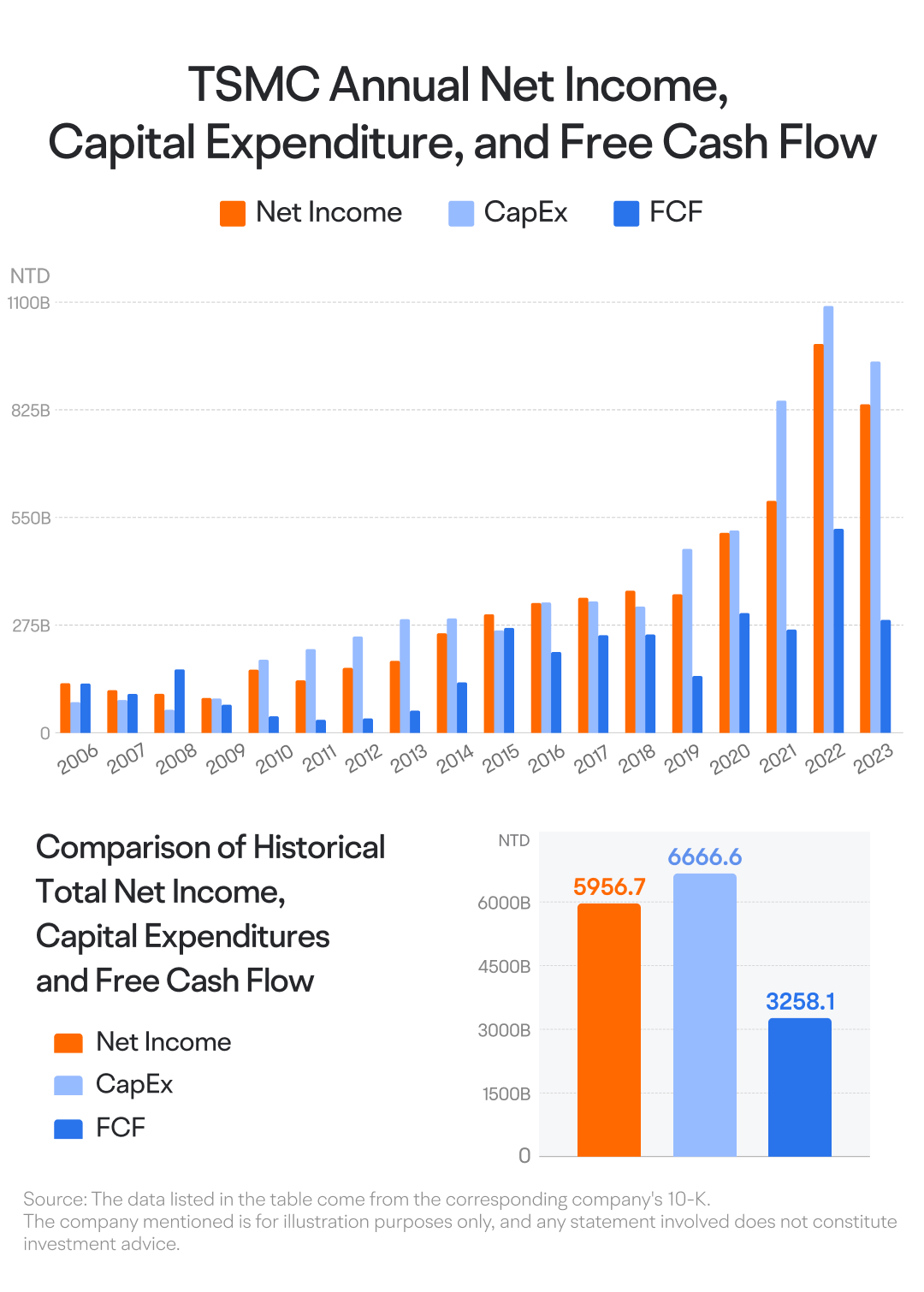

TSMC's commitment to innovation has led to high capital expenditures. From 2006 to 2023, its cumulative capital spending totaled 6.7 trillion New Taiwan Dollars, even exceeding its net income of 6 trillion during that period. This investment strategy resulted in a cumulative free cash flow of approximately 3.3 trillion, just 60% of its net income.

台積電致力於創新,高資本支出是其創新的結果。從2006年到2023年,其累計資本支出總計達到了6.7萬億新臺幣,甚至超過了在此期間的淨利潤6萬億。這種投資策略導致了大約3.3萬億元的累計自由現金流,僅相當於其淨利潤的60%。

Since free cash flow is a key valuation indicator, this discrepancy could negatively affect TSMC's valuation and long-term stock price.

由於自由現金流是一種重要的估值指標,這種差異可能會對臺積電的估值和長期股價產生負面影響。

In the short term, TSMC's capital expenditure reflects its outlook on industry cycles. Typically, if a company predicts a downturn, it may cut back on capital spending, whereas a sustained upturn might lead to increased expenditures. Recent quarters have seen TSMC reduce its capital spending. However, in Q1 2024, TSMC's capital expenditure saw a rebound, and it will be important to monitor these expenditures moving forward.

從短期來看,台積電的資本支出反映了其對行業週期的前景看法。通常,如果一家公司預計經濟下行,它可能會削減資本支出,而持續上升可能會導致支出增加。最近幾個季度,台積電減少了資本支出。然而,在2024年第一季度,台積電的資本支出出現反彈,未來需要密切關注這些支出。

In the long run, however, TSMC's expenditure trends may align with the technological trends in wafer manufacturing. If Moore's Law eventually becomes obsolete and chip process technology reaches a plateau, TSMC's growth in capital expenditures may also slow down. At that point, with competitors possibly catching up and increasing competitive pressure, TSMC might improve its cash flow but face potential declines in gross margins, which could present a new set of competitive and valuation challenges.

從長遠來看,台積電的支出趨勢可能與晶圓製造技術的技術趨勢保持一致。如果摩爾定律最終變得過時,芯片工藝技術達到了一個高峰,台積電的資本支出增長也可能放緩。此時,競爭對手可能會趕上並增加競爭壓力,台積電可能會改善其現金流,但面臨可能導致新的競爭和估值挑戰的毛利率下降。

Having read this far, you may now have a deeper understanding of how to interpret TSMC's financial reports. It's noteworthy that the release of earnings reports from prominent companies may present unique trading opportunities for different types of investors.

如果你已經看到這裏了,你可能現在已經更深入地理解如何解讀台積電的財務報告了。值得注意的是,來自知名公司的業績發佈可能會爲不同類型的投資者提供獨特的交易機會。

For instance, if an investor, after analyzing past reports and considering recent developments, believes a company's latest earnings will send positive signals and boost the short-term stock price, they might consider taking a long position. This could involve buying the underlying stock or purchasing call options.

例如,如果投資者在分析過去的報告並考慮最近的發展後,認爲公司的最新收益將發出積極信號並提高短期股價,他們可能考慮建立看漲頭寸。這可能涉及到購買相關股票或者購買期權.

Conversely, if the investor expects the earnings to be unfavorable and potentially pressure the stock price, they might consider taking a short position, either through short selling or buying put options.

相反,如果投資者預計收益不利,可能會對空頭頭寸採取考慮,可以通過空頭賣出或購買看跌期權.

If the report's outcome is unclear but volatility is expected, they might use a straddle strategy, buying both calls and puts.

如果報告的結果不確定,但是預計存在波動性,則可使用過渡策略,購買看漲期權和看跌期權.

However, investors should carefully assess their risk tolerance, particularly when considering high-risk trades like short selling or options, before making any trading decisions.

但是,在做出任何交易決策之前,投資者應仔細評估其風險承受能力,特別是在考慮像空頭賣出或期權等高風險交易時。

In summary

總結一下

TSMC has seen a sequential rebound in revenue for two consecutive quarters, while their gross margin continued a downward trend. Signs of a cyclical recovery warrant further observation.

台積電營收連續兩個季度環比反彈,但毛利率持續下降。週期性復甦的跡象需要進一步觀察。

Regarding revenue composition, a warming smartphone market could positively influence TSMC's sales. Additionally, the mass production of TSMC's 3nm technology may further drive revenue growth.

關於主營構成,市場回暖的智能手機可能對臺積電銷售產生積極影響。此外,台積電的3nm技術的大規模生產可能進一步推動營收增長。

TSMC's significant capital expenditures have a substantial impact on its free cash flow and, consequently, its valuation. Capital expenditures should be monitored from both short-term and long-term perspectives.

台積電巨額的資本支出對其自由現金流和估值產生重大影響。從短期和長期的角度監控資本支出。

Disclaimer: This content is for informational and educational purposes only and does not constitute a recommendation or endorsement of any specific investment or investment strategy.

免責聲明:本內容僅供信息和教育目的,並不構成對任何特定投資或投資策略的推薦或認可。