Vistra Unusual Options Activity

Vistra Unusual Options Activity

Financial giants have made a conspicuous bullish move on Vistra. Our analysis of options history for Vistra (NYSE:VST) revealed 8 unusual trades.

金融巨頭在Vistra上做出了明顯的看漲動作。我們對Vistra(紐交所:VST)期權歷史的分析顯示了8個不尋常的交易。

Delving into the details, we found 50% of traders were bullish, while 25% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $60,260, and 6 were calls, valued at $598,581.

深入了解細節後,我們發現50%的交易者看漲,而25%的交易者呈現出看淡趨勢。在我們發現的所有交易中,兩筆交易的價值爲60,260美元,六筆交易的價值爲598,581美元。

Expected Price Movements

預期價格波動

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $75.0 to $100.0 for Vistra over the last 3 months.

考慮到這些合同的成交量和持倉量,過去3個月來,鯨魚一直在瞄準Vistra價格區間在75.0美元至100.0美元之間。

Volume & Open Interest Trends

成交量和未平倉量趨勢

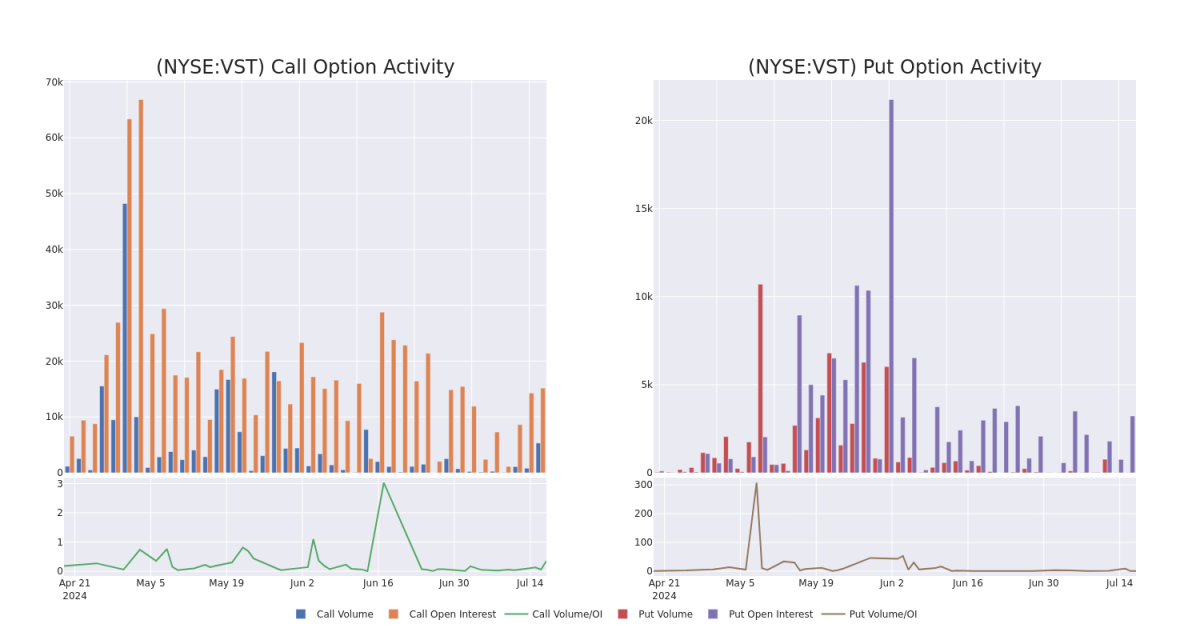

In today's trading context, the average open interest for options of Vistra stands at 3678.2, with a total volume reaching 5,345.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Vistra, situated within the strike price corridor from $75.0 to $100.0, throughout the last 30 days.

在今天的交易背景下,Vistra期權的平均持倉量爲3678.2,總成交量達到5345.00。附帶的圖表描述了在過去30天中,定於Vistra高值交易的看漲期權和看跌期權成交量和持倉量的進展,這些交易位於75.0美元至100.0美元的執行價格走廊內。

Vistra Option Volume And Open Interest Over Last 30 Days

Vistra過去30天的期權成交量和未平倉量

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VST | CALL | SWEEP | NEUTRAL | 08/16/24 | $2.05 | $1.65 | $1.87 | $95.00 | $177.4K | 4.2K | 14 |

| VST | CALL | SWEEP | BULLISH | 08/16/24 | $1.15 | $1.05 | $1.15 | $100.00 | $162.7K | 10.9K | 714 |

| VST | CALL | SWEEP | BULLISH | 08/16/24 | $1.25 | $1.1 | $1.25 | $100.00 | $97.5K | 10.9K | 2.3K |

| VST | CALL | SWEEP | NEUTRAL | 08/30/24 | $7.3 | $6.9 | $7.3 | $81.00 | $73.0K | 1 | 0 |

| VST | CALL | SWEEP | BULLISH | 08/16/24 | $1.1 | $1.0 | $1.05 | $100.00 | $61.5K | 10.9K | 128 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| VST | 看漲 | SWEEP | 中立 | 08/16/24 | $2.05 | $1.65 | $1.87 | $ 95.00 | $177.4K | 4.2千 | 14 |

| VST | 看漲 | SWEEP | 看好 | 08/16/24 | $1.15 | $1.05 | $1.15 | $100.00。 | $162.7K | 10.9K | 714 |

| VST | 看漲 | SWEEP | 看好 | 08/16/24 | $1.25 | $1.1 | $1.25 | $100.00。 | $97.5K | 10.9K | 2.3K |

| VST | 看漲 | SWEEP | 中立 | 08/30/2024 | $7.3 | $6.9 | $7.3 | 81.00美元 | $73.0K | 1 | 0 |

| VST | 看漲 | SWEEP | 看好 | 08/16/24 | $1.1 | $1.0 | $1.05 | $100.00。 | $61.5K | 10.9K | 128 |

About Vistra

關於Vistra

Vistra Energy is one of the largest power producers and retail energy providers in the us Following the 2024 Energy Harbor acquisition, Vistra owns 41 gigawatts of nuclear, coal, natural gas, and solar power generation along with one of the largest utility-scale battery projects in the world. Its retail electricity business serves 5 million customers in 20 states, including almost a third of all Texas electricity consumers. Vistra emerged from the Energy Future Holdings bankruptcy as a stand-alone entity in 2016. It acquired Dynegy in 2018.

Vistra Energy是美國最大的發電和零售能源提供商之一。在2024年能源港收購之後,Vistra擁有41吉瓦核、煤、天然氣和太陽能發電以及世界上最大的公用事業規模電池項目之一。其零售電力業務爲20個州的500萬客戶提供服務,包括幾乎所有德克薩斯電力消費者的三分之一。Vistra於2016年從能源未來控股破產中作爲獨立實體出現。2018年收購了Dynegy。

Having examined the options trading patterns of Vistra, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

經過對Vistra期權交易模式的研究,我們現在的注意力直接轉向了該公司。這種轉變使我們可以深入研究其當前的市場地位和業績。

Current Position of Vistra

Vistra的當前位置

- With a trading volume of 52,028, the price of VST is down by -3.59%, reaching $82.79.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 22 days from now.

- VSt的交易量爲52,028,價格下跌-3.59%,達到82.79美元。

- 目前的RSI值表明該股票目前處於超買和超賣之間的中立狀態。

- 下一個業績將於22天后發佈。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

In today's trading context, the average open interest for options of Vistra stands at 3678.2, with a total volume reaching 5,345.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Vistra, situated within the strike price corridor from $75.0 to $100.0, throughout the last 30 days.

In today's trading context, the average open interest for options of Vistra stands at 3678.2, with a total volume reaching 5,345.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Vistra, situated within the strike price corridor from $75.0 to $100.0, throughout the last 30 days.