Smart Money Is Betting Big In CAT Options

Smart Money Is Betting Big In CAT Options

Whales with a lot of money to spend have taken a noticeably bearish stance on Caterpillar.

有大量資金的鯨魚明顯看淡卡特彼勒。

Looking at options history for Caterpillar (NYSE:CAT) we detected 8 trades.

查看卡特彼勒(紐交所:CAT)的期權歷史,我們檢測到8次交易。

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 62% with bearish.

如果我們考慮每次交易的具體細節,可以準確地說,25%的投資者以看好的預期開倉,62%的投資者以看淡的預期開倉。

From the overall spotted trades, 3 are puts, for a total amount of $180,263 and 5, calls, for a total amount of $182,938.

從總的交易中發現,有3個看跌期權,總金額爲180,263美元,有5個看漲期權,總金額爲182,938美元。

Expected Price Movements

預期價格波動

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $350.0 to $400.0 for Caterpillar over the recent three months.

基於交易活動,重要投資者似乎瞄準近三個月內卡特彼勒的價格範圍從350.0美元到400.0美元。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

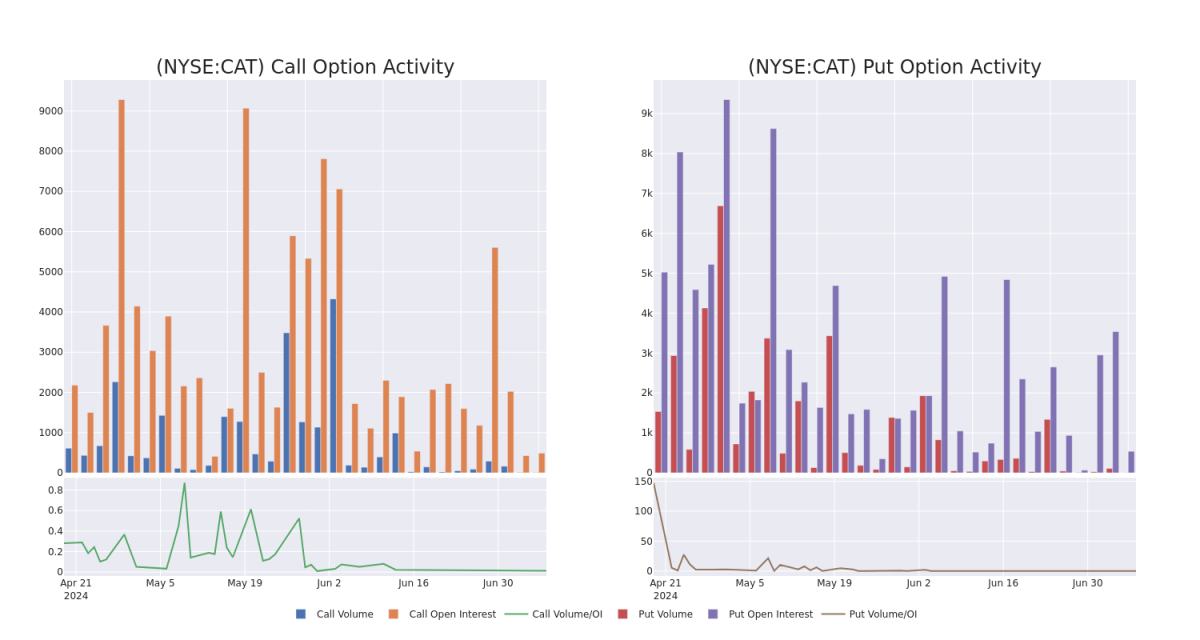

In today's trading context, the average open interest for options of Caterpillar stands at 810.33, with a total volume reaching 87.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Caterpillar, situated within the strike price corridor from $350.0 to $400.0, throughout the last 30 days.

在今天的交易環境中,卡特彼勒期權的平均持倉量爲810.33,總成交量達到87.00。下圖描述了位於從350.0美元到400.0美元的行權價走廊內,卡特彼勒高價值交易的看跌和看漲期權成交量和持倉量的進展情況,時間跨度爲30天。

Caterpillar Call and Put Volume: 30-Day Overview

卡特彼勒看漲和看跌期權成交量:30天概覽

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CAT | PUT | SWEEP | BEARISH | 07/26/24 | $5.65 | $4.75 | $5.65 | $355.00 | $93.2K | 326 | 2 |

| CAT | CALL | TRADE | BEARISH | 08/16/24 | $5.6 | $5.2 | $5.2 | $380.00 | $44.7K | 1.8K | 0 |

| CAT | PUT | SWEEP | NEUTRAL | 08/16/24 | $45.15 | $43.5 | $44.32 | $400.00 | $44.3K | 0 | 0 |

| CAT | PUT | TRADE | BEARISH | 08/16/24 | $43.3 | $41.85 | $42.73 | $400.00 | $42.7K | 0 | 10 |

| CAT | CALL | TRADE | BEARISH | 08/16/24 | $14.95 | $14.0 | $14.0 | $360.00 | $42.0K | 1.7K | 67 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 卡特彼勒 | 看跌 | SWEEP | 看淡 | 07/26/24 | $5.65 | $4.75 | $5.65 | $355.00 | $93.2K | 326 | 2 |

| 卡特彼勒 | 看漲 | 交易 | 看淡 | 08/16/24 | $5.6 | $5.2 | $5.2 | $380.00 | $44.7K | 1.8K | 0 |

| 卡特彼勒 | 看跌 | SWEEP | 中立 | 08/16/24 | $45.15 | $43.5 | $44.32 | $400.00 | $44.3K | 0 | 0 |

| 卡特彼勒 | 看跌 | 交易 | 看淡 | 08/16/24 | $43.3 | $41.85 | $42.73 | $400.00 | $42.7千 | 0 | 10 |

| 卡特彼勒 | 看漲 | 交易 | 看淡 | 08/16/24 | $14.95 | $14.0 | $14.0 | $360.00 | $42.0千 | 1.7K | 67 |

About Caterpillar

關於卡特彼勒

Caterpillar is the top manufacturer of heavy equipment, power solutions, and locomotives. It is currently the world's largest manufacturer of heavy equipment. The company is divided into four reportable segments: construction industries, resource industries, energy and transportation, and Cat Financial. Its products are available through a dealer network that covers the globe with about 2,700 branches maintained by 160 dealers. Cat Financial provides retail financing for machinery and engines to its customers, in addition to wholesale financing for dealers, which increases the likelihood of Caterpillar product sales.

卡特彼勒是重型機械、動力解決方案和機車製造商。它目前是世界上最大的重型設備製造商。該公司分爲四個可報告業務部門:建築產業、資源產業、能源和運輸、卡特金融。其產品可以通過全球約2,700個分支機構的160個經銷商網絡獲得。卡特金融爲其客戶提供機械和發動機的零售融資,此外還爲經銷商提供批發融資,增加了卡特彼勒產品銷售的可能性。

Having examined the options trading patterns of Caterpillar, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

經過對卡特彼勒的期權交易模式進行了審查,我們現在的注意力直接轉向公司。這種轉變使我們能夠深入探討其現在的市場位置和表現。

Present Market Standing of Caterpillar

卡特彼勒的當前市場地位

- Currently trading with a volume of 75,844, the CAT's price is down by -0.5%, now at $358.77.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 13 days.

- 當前交易量爲75,844,CAT的價格下跌了-0.5%,現在爲358.77美元。

- RSI讀數表明股票目前可能超買。

- 預計將在13天內發佈收益報告。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Caterpillar options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在回報。精明的交易者通過持續教育自己、調整策略、監控多個因子並密切關注市場動態來管理這些風險。通過Benzinga Pro的實時警報了解最新的卡特彼勒期權交易。