Spotlight on Lockheed Martin: Analyzing the Surge in Options Activity

Spotlight on Lockheed Martin: Analyzing the Surge in Options Activity

Benzinga's options scanner has just identified more than 12 option transactions on Lockheed Martin (NYSE:LMT), with a cumulative value of $733,005. Concurrently, our algorithms picked up 6 puts, worth a total of 400,235.

Benzinga的期權掃描器剛剛確定了超過12個洛克希德馬丁(紐交所:LMT)的期權交易,累計價值$ 733,005。同時,我們的算法捕捉到6個看跌期權,總價值爲400,235。

Expected Price Movements

預期價格波動

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $470.0 to $515.0 for Lockheed Martin over the recent three months.

根據交易活動,重要投資者似乎瞄準了洛克希德·馬丁的價格區間,最近三個月該區間的價格區間從$ 470.0到$ 515.0。

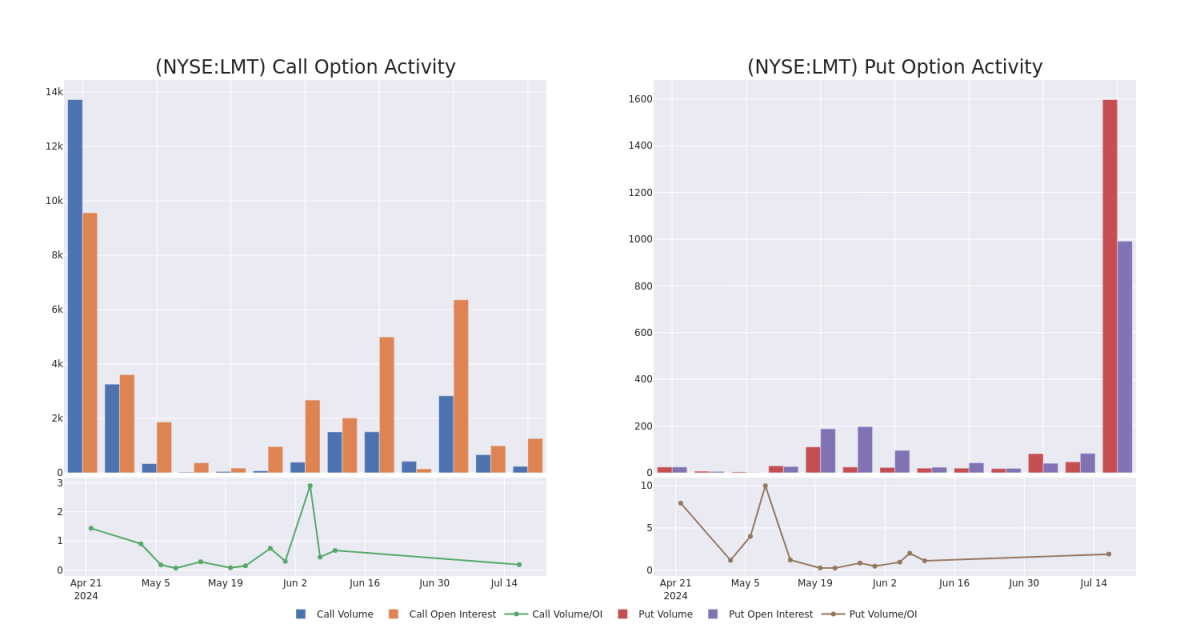

Volume & Open Interest Trends

成交量和未平倉量趨勢

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Lockheed Martin's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Lockheed Martin's significant trades, within a strike price range of $470.0 to $515.0, over the past month.

檢查成交量和未平倉合約對股票研究提供了關鍵見解。此信息對於測量洛克希德·馬丁某些行使價格的期權的流動性和利益水平至關重要。以下是我們爲洛克希德馬丁顯着交易所涉及的認購和認沽期權的成交量和未平倉合約趨勢的快照,此區間的行使價格範圍爲$ 470.0至$ 515.0,在過去一個月內。

Lockheed Martin Option Activity Analysis: Last 30 Days

洛克希德馬丁期權活動分析:近30日

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LMT | CALL | SWEEP | BULLISH | 09/20/24 | $2.0 | $1.95 | $1.95 | $515.00 | $94.3K | 61 | 0 |

| LMT | CALL | SWEEP | BULLISH | 08/16/24 | $9.2 | $9.1 | $9.19 | $480.00 | $93.5K | 1.1K | 62 |

| LMT | CALL | SWEEP | BULLISH | 08/16/24 | $9.2 | $8.8 | $9.16 | $480.00 | $91.8K | 1.1K | 62 |

| LMT | PUT | TRADE | BULLISH | 08/16/24 | $8.0 | $7.7 | $7.8 | $470.00 | $78.0K | 842 | 101 |

| LMT | PUT | TRADE | BULLISH | 08/16/24 | $8.0 | $7.8 | $7.8 | $470.00 | $78.0K | 842 | 0 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LMT | 看漲 | SWEEP | 看好 | 09/20/24 | $2.0 | $1.95 | $1.95 | $515.00 | $94.3K | 61 | 0 |

| LMT | 看漲 | SWEEP | 看好 | 08/16/24 | $9.2 | $9.1 | $9.19 | 該公司的股票上週五收於$74.31。 | $93.5K | 1.1千 | 62 |

| LMT | 看漲 | SWEEP | 看好 | 08/16/24 | $9.2 | $ 8.8 | $9.16 | 該公司的股票上週五收於$74.31。 | $91.8K | 1.1千 | 62 |

| LMT | 看跌 | 交易 | 看好 | 08/16/24 | $8.0 | $7.7 | $7.8 | $470.00 | $78.0K | 842 | 101 |

| LMT | 看跌 | 交易 | 看好 | 08/16/24 | $8.0 | $7.8 | $7.8 | $470.00 | $78.0K | 842 | 0 |

About Lockheed Martin

關於洛克希德馬丁

Lockheed Martin is the world's largest defense contractor and has dominated the Western market for high-end fighter aircraft since it won the F-35 Joint Strike Fighter program in 2001. Lockheed's largest segment is aeronautics, which derives upward of two-thirds of its revenue from the F-35. Lockheed's remaining segments are rotary and mission systems, mainly encompassing the Sikorsky helicopter business; missiles and fire control, which creates missiles and missile defense systems; and space systems, which produces satellites and receives equity income from the United Launch Alliance joint venture.

洛克希德馬丁是全球最大的國防承包商,並自2001年贏得F-35聯合攻擊戰鬥機項目以來一直主導高端戰鬥機市場。洛克希德的主要業務爲航空航天,其兩個三分之一的收入來自F-35。洛克希德的其餘業務包括旋翼和任務系統,主要涵蓋Sikorsky直升機業務,導彈和火控,創建導彈和導彈防禦系統;太空系統,生產衛星並從United Launch Alliance合資企業獲得權益收入。

Current Position of Lockheed Martin

洛克希德馬丁的當前位置

- With a volume of 530,883, the price of LMT is up 1.47% at $475.45.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 6 days.

- LMt的成交量爲530,883,價格爲475.45美元,上漲了1.47%。

- RSI指標暗示該股票可能要超買了。

- 下一輪業績將在6天后發佈。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Lockheed Martin with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高的利潤潛力。精明的交易者通過持續的教育,戰略性的交易調整,利用各種因子,以及關注市場動態來減輕這些風險。使用Benzinga Pro及時獲取洛克希德馬丁的最新期權交易。