Further Upside For Butterfly Network, Inc. (NYSE:BFLY) Shares Could Introduce Price Risks After 32% Bounce

Further Upside For Butterfly Network, Inc. (NYSE:BFLY) Shares Could Introduce Price Risks After 32% Bounce

Despite an already strong run, Butterfly Network, Inc. (NYSE:BFLY) shares have been powering on, with a gain of 32% in the last thirty days. But the last month did very little to improve the 54% share price decline over the last year.

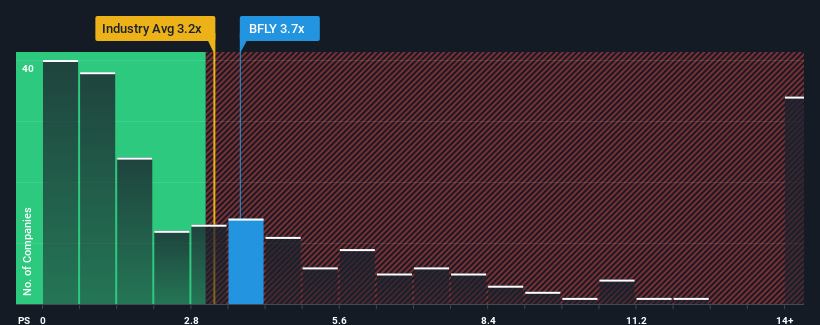

In spite of the firm bounce in price, you could still be forgiven for feeling indifferent about Butterfly Network's P/S ratio of 3.7x, since the median price-to-sales (or "P/S") ratio for the Medical Equipment industry in the United States is also close to 3.2x. Although, it's not wise to simply ignore the P/S without explanation as investors may be disregarding a distinct opportunity or a costly mistake.

What Does Butterfly Network's Recent Performance Look Like?

Butterfly Network hasn't been tracking well recently as its declining revenue compares poorly to other companies, which have seen some growth in their revenues on average. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. However, if this isn't the case, investors might get caught out paying too much for the stock.

Keen to find out how analysts think Butterfly Network's future stacks up against the industry? In that case, our free report is a great place to start.How Is Butterfly Network's Revenue Growth Trending?

The only time you'd be comfortable seeing a P/S like Butterfly Network's is when the company's growth is tracking the industry closely.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 7.1%. Even so, admirably revenue has lifted 36% in aggregate from three years ago, notwithstanding the last 12 months. So we can start by confirming that the company has generally done a very good job of growing revenue over that time, even though it had some hiccups along the way.

Turning to the outlook, the next year should generate growth of 17% as estimated by the dual analysts watching the company. With the industry only predicted to deliver 9.5%, the company is positioned for a stronger revenue result.

In light of this, it's curious that Butterfly Network's P/S sits in line with the majority of other companies. It may be that most investors aren't convinced the company can achieve future growth expectations.

The Final Word

Butterfly Network appears to be back in favour with a solid price jump bringing its P/S back in line with other companies in the industry While the price-to-sales ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of revenue expectations.

Despite enticing revenue growth figures that outpace the industry, Butterfly Network's P/S isn't quite what we'd expect. There could be some risks that the market is pricing in, which is preventing the P/S ratio from matching the positive outlook. At least the risk of a price drop looks to be subdued, but investors seem to think future revenue could see some volatility.

You should always think about risks. Case in point, we've spotted 4 warning signs for Butterfly Network you should be aware of.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com