COSCO SHIPPING Specialized Carriers Co.,Ltd. (SHSE:600428) Goes Ex-Dividend Soon

COSCO SHIPPING Specialized Carriers Co.,Ltd. (SHSE:600428) Goes Ex-Dividend Soon

Some investors rely on dividends for growing their wealth, and if you're one of those dividend sleuths, you might be intrigued to know that COSCO SHIPPING Specialized Carriers Co.,Ltd. (SHSE:600428) is about to go ex-dividend in just 3 days. The ex-dividend date is usually set to be one business day before the record date which is the cut-off date on which you must be present on the company's books as a shareholder in order to receive the dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Therefore, if you purchase COSCO SHIPPING Specialized CarriersLtd's shares on or after the 22nd of July, you won't be eligible to receive the dividend, when it is paid on the 22nd of July.

一些投資者依賴分紅來增長財富,如果你是其中之一,可能會感興趣地知道,中遠海特(SHSE:600428)將在3天內分紅。分紅日通常設置爲股權登記日前1個工作日,股權登記日是你必須在公司股東名冊上出現的截止日期,以便獲得分紅。了解分紅日很重要,因爲任何對股票的交易都需要在股權登記日或之前結算。因此,如果你在7月22日或之後購買中遠海特的股票,則無法獲得分紅,當分紅於7月22日支付時。

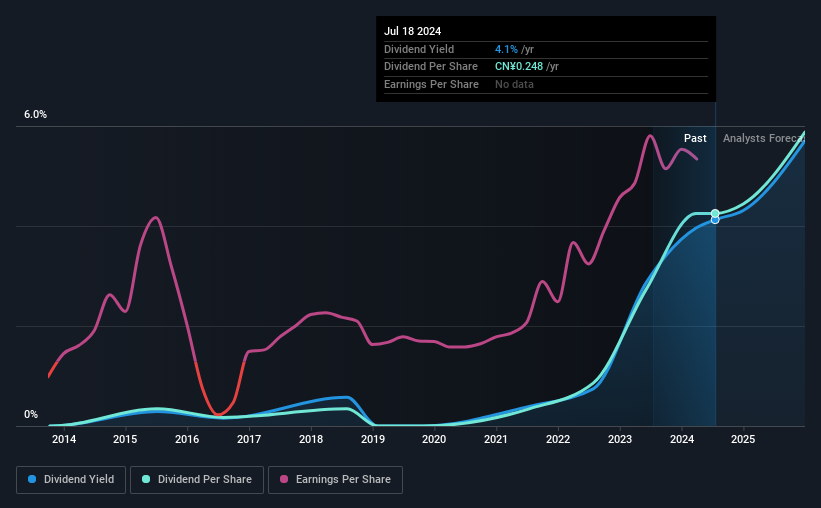

The company's upcoming dividend is CN¥0.248 a share, following on from the last 12 months, when the company distributed a total of CN¥0.25 per share to shareholders. Looking at the last 12 months of distributions, COSCO SHIPPING Specialized CarriersLtd has a trailing yield of approximately 4.1% on its current stock price of CN¥6.01. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. So we need to investigate whether COSCO SHIPPING Specialized CarriersLtd can afford its dividend, and if the dividend could grow.

該公司即將分紅每股CN¥0.248,而在過去的12個月中,該公司向股東發放了每股CN¥0.25。從過去12個月的派息看來,中遠海特的股息率約爲當前股價CN¥6.01的4.1%。分紅對許多股東來說是重要的收入來源,但企業的健康狀況對於維持這些分紅至關重要。因此,我們需要調查中遠海特是否能夠承擔其分紅以及分紅是否能夠增長。

Dividends are typically paid out of company income, so if a company pays out more than it earned, its dividend is usually at a higher risk of being cut. COSCO SHIPPING Specialized CarriersLtd is paying out an acceptable 52% of its profit, a common payout level among most companies. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Over the last year it paid out 58% of its free cash flow as dividends, within the usual range for most companies.

通常,分紅是從公司的利潤中支付的,因此,如果公司支付的金額超過了其賺取的金額,其股息通常面臨更高的風險被削減。中遠海特支付了其盈利的可接受部分,即52%的股息,這是大多數公司的常見支付水平。然而,現金流比利潤對於評估分紅可持續性更爲重要,因此,我們應該始終檢查公司是否產生了足夠的現金來支付其分紅。在過去一年中,中遠海特支付了其自由現金流的58%以支付股息,這是大多數公司的通常範圍內。

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

看到股息既有盈利也有現金流的覆蓋是令人鼓舞的。這通常表明股息是可持續的,只要收益沒有急劇下降。

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

點擊此處查看公司的支付比率以及未來分紅的分析師預期。

Have Earnings And Dividends Been Growing?

收益和股息一直在增長嗎?

Stocks in companies that generate sustainable earnings growth often make the best dividend prospects, as it is easier to lift the dividend when earnings are rising. If earnings decline and the company is forced to cut its dividend, investors could watch the value of their investment go up in smoke. That's why it's comforting to see COSCO SHIPPING Specialized CarriersLtd's earnings have been skyrocketing, up 64% per annum for the past five years. Management appears to be striking a nice balance between reinvesting for growth and paying dividends to shareholders. Earnings per share have been growing quickly and in combination with some reinvestment and a middling payout ratio, the stock may have decent dividend prospects going forwards.

具有可持續盈利增長的公司股票通常是最好的分紅前景,因爲在收益增長時更容易提高股息。如果收益下降,公司被迫削減其股息,則投資者可能看到其投資價值煙消雲散。這就是爲什麼能看到中遠海特的收益過去五年每年飆升64%非常令人欣慰。管理層似乎在維持增長的同時向股東支付股息達到了良好的平衡。每股收益正在快速增長,並且以某些再投資和適度的支付比率爲輔助,該股票可能具有良好的分紅前景。

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. In the last nine years, COSCO SHIPPING Specialized CarriersLtd has lifted its dividend by approximately 32% a year on average. It's great to see earnings per share growing rapidly over several years, and dividends per share growing right along with it.

衡量公司分紅前景的另一個關鍵方法是通過衡量其歷史股息增長率。在過去的九年中,中遠海特的平均每年股息增長率約爲32%。看到每股收益在幾年內快速增長,並且每股股息也隨之增長真是太好了。

Final Takeaway

最後的結論

Has COSCO SHIPPING Specialized CarriersLtd got what it takes to maintain its dividend payments? Higher earnings per share generally lead to higher dividends from dividend-paying stocks over the long run. That's why we're glad to see COSCO SHIPPING Specialized CarriersLtd's earnings per share growing, although as we saw, the company is paying out more than half of its earnings and cashflow - 52% and 58% respectively. It might be worth researching if the company is reinvesting in growth projects that could grow earnings and dividends in the future, but for now we're not all that optimistic on its dividend prospects.

中遠海特是否有能力維持其股息支付?較高的每股收益通常會使分紅支付的股票長期來看更具吸引力。這就是爲什麼我們很高興看到中遠海特的每股收益在增長,雖然正如我們所看到的,該公司支付的股息和現金流佔其收益的比例均超過了一半,即52%和58%。它可能值得研究該公司是否正在投資於未來的增長項目,這些項目可能會增加收益和股息,但目前對其分紅前景並不太樂觀。

While it's tempting to invest in COSCO SHIPPING Specialized CarriersLtd for the dividends alone, you should always be mindful of the risks involved. Case in point: We've spotted 3 warning signs for COSCO SHIPPING Specialized CarriersLtd you should be aware of.

雖然僅僅由於分紅而投資於中遠海特可能很誘人,但你應該時刻注意涉及的風險。例如:我們發現中遠海特有三個警示信號需要注意。

Generally, we wouldn't recommend just buying the first dividend stock you see. Here's a curated list of interesting stocks that are strong dividend payers.

一般來說,我們不建議僅僅購買第一個股息股票。下面是一個經過策劃的有趣的、股息表現良好的股票清單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.