Shareholders in Tianjin Troila Information TechnologyLtd (SHSE:600225) Have Lost 73%, as Stock Drops 6.5% This Past Week

Shareholders in Tianjin Troila Information TechnologyLtd (SHSE:600225) Have Lost 73%, as Stock Drops 6.5% This Past Week

The art and science of stock market investing requires a tolerance for losing money on some of the shares you buy. But it's not unreasonable to try to avoid truly shocking capital losses. So we hope that those who held Tianjin Troila Information Technology Co.,Ltd. (SHSE:600225) during the last year don't lose the lesson, in addition to the 73% hit to the value of their shares. While some investors are willing to stomach this sort of loss, they are usually professionals who spread their bets thinly. We note that it has not been easy for shareholders over three years, either; the share price is down 50% in that time. Shareholders have had an even rougher run lately, with the share price down 39% in the last 90 days.

With the stock having lost 6.5% in the past week, it's worth taking a look at business performance and seeing if there's any red flags.

Tianjin Troila Information TechnologyLtd isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Shareholders of unprofitable companies usually desire strong revenue growth. Some companies are willing to postpone profitability to grow revenue faster, but in that case one would hope for good top-line growth to make up for the lack of earnings.

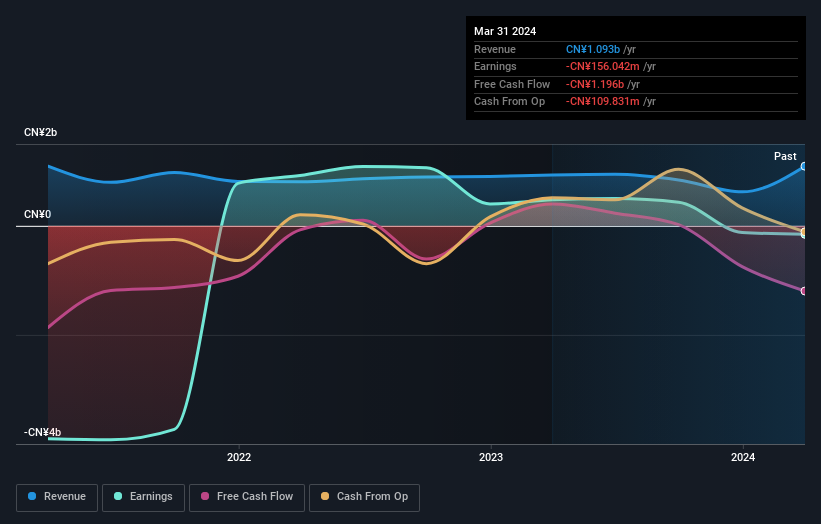

In the last year Tianjin Troila Information TechnologyLtd saw its revenue grow by 17%. That's definitely a respectable growth rate. However, it seems like the market wanted more, since the share price is down 73%. One fear might be that the company might be losing too much money and will need to raise more. It seems that the market has concerns about the future, because that share price action does not seem to reflect the revenue growth at all.

You can see below how earnings and revenue have changed over time (discover the exact values by clicking on the image).

Balance sheet strength is crucial. It might be well worthwhile taking a look at our free report on how its financial position has changed over time.

A Different Perspective

While the broader market lost about 17% in the twelve months, Tianjin Troila Information TechnologyLtd shareholders did even worse, losing 73%. Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, last year's performance may indicate unresolved challenges, given that it was worse than the annualised loss of 9% over the last half decade. We realise that Baron Rothschild has said investors should "buy when there is blood on the streets", but we caution that investors should first be sure they are buying a high quality business. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Even so, be aware that Tianjin Troila Information TechnologyLtd is showing 1 warning sign in our investment analysis , you should know about...

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies we expect will grow earnings.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Chinese exchanges.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com