How TFSAs Help Regular Canadians Outperform the Rich

How TFSAs Help Regular Canadians Outperform the Rich

Did you know that the tax-free savings account (TFSA) is one of the few aspects of the Canadian tax system that gives regular Canadians an advantage over the rich? It's not widely known, but it's true. With tax-deferred accounts, wealthier Canadians typically get more contribution room than working class Canadians. An effect of this is that the rich are able to put more money in such accounts than regular Canadians are. So, these accounts just end up being another way for the rich to get richer.

你知道嗎,免稅儲蓄賬戶(TFSA)是加拿大稅收制度中爲數不多的讓普通加拿大人比富人更具優勢的方面之一?它並不廣爲人知,但確實如此。有了延稅帳戶,較富裕的加拿大人通常比工人階級的加拿大人獲得更大的繳款空間。這樣做的影響是,富人能夠比普通加拿大人更多的錢存入此類帳戶。因此,這些帳戶最終成爲富人致富的另一種方式。

It's not so with the TFSA. The TFSA's new contribution limit is the same for everyone each year, and relatively small. As a result, the TFSA allows regular Canadians to shelter a larger percentage of their wealth than rich Canadians. So, a working class Canadian who invests in a TFSA can slowly catch up with one of their rich peers over time.

免稅儲蓄賬戶並非如此。免稅儲蓄賬戶每年的新供款限額對每個人都相同,而且相對較小。因此,TFSA允許普通加拿大人比富裕的加拿大人更大比例地保護其財富。因此,隨着時間的推移,投資免稅儲蓄賬戶的加拿大工人階級可以慢慢趕上富有的同行。

How the TFSA helps regular Canadians

免稅儲蓄賬戶如何幫助普通加拿大人

At first glance, you might think that the annual TFSA contribution room is the same for Canadians over the age of 17. It's the same for everyone, so the end result is the same, right?

乍一看,你可能會認爲17歲以上的加拿大人的年度免稅儲蓄賬戶供款額度是相同的。每個人都一樣,所以最終結果是一樣的,對吧?

No. You see, working class Canadians often have total savings that can fit inside of a maxed out TFSA. Rich Canadians can only put a portion of their savings into a TFSA. So the working class Canadian can have a fully tax-sheltered portfolio. For a rich Canadian, that's not possible â barring fleeing to a foreign country.

不。你看,加拿大工人階級的儲蓄總額通常可以存入已用完的免稅儲蓄賬戶。富有的加拿大人只能將部分儲蓄存入免稅儲蓄賬戶。因此,加拿大工人階級可以擁有完全免稅的投資組合。對於一個富有的加拿大人來說,除非逃往國外,這是不可能的。

TFSA math

免稅儲蓄賬戶數學

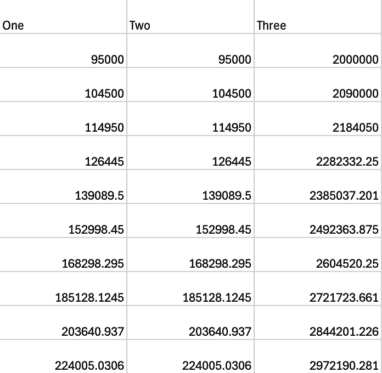

To illustrate how a poorer Canadian gets more of a benefit from the TFSA than a richer Canadian, I built a table with three columns. Column one is a $95,000 TFSA balance that represents an entire working class Canadian's lifetime savings. Column two is a $95,000 TFSA belonging to the rich person. Column three is $2 million, which represents the rich person's taxable savings. Each of these columns sees a 10% return each year, but each year the rich person sells enough stock to pay a 5% capital gain tax on the entire portfolio.

爲了說明較窮的加拿大人如何比富裕的加拿大人從免稅儲蓄賬戶中獲得更多的好處,我創建了一張包含三列的表格。第一欄是95,000美元的免稅儲蓄賬戶餘額,代表了整個加拿大工人階級的終身儲蓄。第二欄是屬於富人的9.5萬美元免稅儲蓄賬戶。第三欄爲200萬美元,代表富人的應納稅儲蓄。這些專欄每年的回報率均爲10%,但富人每年出售的股票足以爲整個投資組合繳納5%的資本利得稅。

As you can see, the working class Canadian ends up with $224,005, while the rich Canadian ends up with $224,005 from the TFSA plus $2.97 million from the taxable account, or $3.19 million in total.

如你所見,加拿大工人階級最終獲得224,005美元,而富有的加拿大人最終從免稅儲蓄賬戶中獲得224,005美元,外加應納稅帳戶中的297萬美元,合計319萬加元。

At the start of the 10 years, the working class Canadian has 4.5% of the rich Canadian's wealth. By the end, he/she has 7% of the rich Canadian's wealth. That's the advantage of having a smaller starting amount. You can put more of it in a TFSA!

在十年之初,加拿大工人階級擁有加拿大富人財富的4.5%。最後,他/她擁有加拿大富人財富的7%。這就是起始金額較小的優點。你可以把更多的錢存入免稅儲蓄賬戶!

A suggestion

一個建議

If you want to build wealth at a rate similar to that of the working class Canadian earned above, you might want to invest in dividend stocks. They offer a lot of compounding power.

如果你想以與上述加拿大工人階級相似的速度積累財富,你可能需要投資股息股票。它們提供了很大的複合力。

Take the Canadian National Railway (TSX:CNR) for example. It's a Canadian railroad company that has a 2% dividend yield at today's prices. The dividend might seem small at first glance, but it has grown at 10.5% per year over the last decade. More importantly, CNR has delivered total returns above 10% per year, which makes the math above work.

以加拿大國家鐵路(TSX: CNR)爲例。這是一家加拿大鐵路公司,按今天的價格計算,其股息收益率爲2%。乍一看,股息可能看起來很小,但在過去十年中以每年10.5%的速度增長。更重要的是,CNR的年總回報率超過10%,這使得上述數學行之有效。

Can CN Railway keep this going? Potentially, yes. It still has all the advantages it had at the start of its rise. It has only one competitor. It has a 35% profit margin. It has an enviable rail network that touches three coasts. Rail is far cheaper per unit of weight than trucks. So CN Railway may indeed keep the compounding going into future. If it does, then a $95,000 TFSA invested in it could go a long way.

CN Railway 能繼續這樣下去嗎?有可能,是的。它仍然具有崛起之初的所有優勢。它只有一個競爭對手。它的利潤率爲35%。它擁有令人羨慕的鐵路網絡,覆蓋三個海岸。鐵路單位重量比卡車便宜得多。因此,CN Railway確實可能會將複合結構延續到未來。如果是這樣,那麼向其投資的9.5萬美元免稅儲蓄賬戶可能會大有幫助。

The post How TFSAs Help Regular Canadians Outperform the Rich appeared first on The Motley Fool Canada.

《加拿大免稅儲蓄賬戶如何幫助普通加拿大人跑贏富人》一文首次出現在《加拿大Motley Fool》上。