Snap's Options Frenzy: What You Need to Know

Snap's Options Frenzy: What You Need to Know

Investors with significant funds have taken a bearish position in Snap (NYSE:SNAP), a development that retail traders should be aware of.

擁有大量資金的投資者對Snap(紐約證券交易所代碼:SNAP)持看跌立場,零售交易者應該注意這一事態發展。

This was brought to our attention today through our monitoring of publicly accessible options data at Benzinga. The exact nature of these investors remains a mystery, but such a major move in SNAP usually indicates foreknowledge of upcoming events.

今天,通過對本辛加可公開訪問的期權數據的監控,這引起了我們的注意。這些投資者的確切性質仍然是個謎,但是SNAP的如此重大舉動通常表明對即將發生的事件的預感。

Today, Benzinga's options scanner identified 9 options transactions for Snap. This is an unusual occurrence. The sentiment among these large-scale traders is mixed, with 33% being bullish and 55% bearish. Of all the options we discovered, 8 are puts, valued at $341,814, and there was a single call, worth $173,810.

今天,Benzinga的期權掃描儀爲Snap確定了9筆期權交易。這是一種不尋常的事件。這些大型交易者的情緒喜憂參半,33%的人看漲,55%的人看跌。在我們發現的所有期權中,有8個是看跌期權,價值341,814美元,還有一個看漲期權,價值173,810美元。

Predicted Price Range

預測的價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $15.0 and $15.5 for Snap, spanning the last three months.

在評估了交易量和未平倉合約之後,很明顯,主要市場推動者將注意力集中在Snap在過去三個月的15.0美元至15.5美元之間的價格區間上。

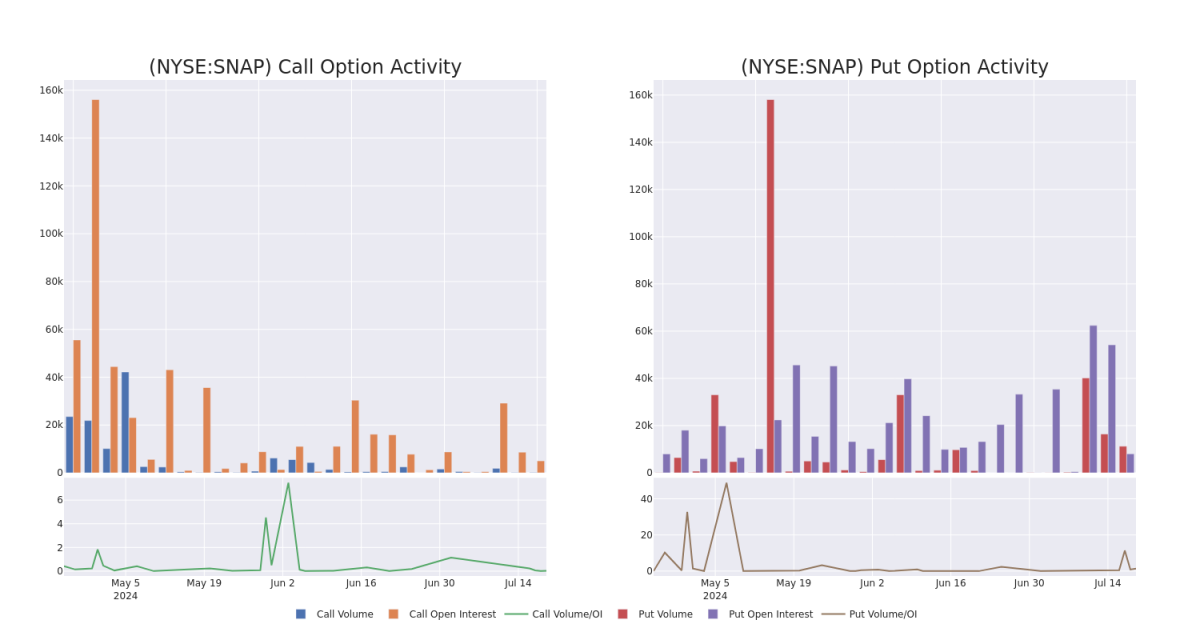

Volume & Open Interest Trends

交易量和未平倉合約趨勢

Examining the volume and open interest provides crucial insights into stock research. This information is key in gauging liquidity and interest levels for Snap's options at certain strike prices. Below, we present a snapshot of the trends in volume and open interest for calls and puts across Snap's significant trades, within a strike price range of $15.0 to $15.5, over the past month.

檢查交易量和未平倉合約爲股票研究提供了至關重要的見解。這些信息是衡量Snap期權在特定行使價下的流動性和利息水平的關鍵。下面,我們簡要介紹了過去一個月Snap在15.0美元至15.5美元行使價區間內的重要交易的看漲期權和未平倉合約的交易量和未平倉合約的趨勢。

Snap Option Volume And Open Interest Over Last 30 Days

過去 30 天的 Snap Option 交易量和未平倉合約

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| SNAP | CALL | SWEEP | BEARISH | 07/26/24 | $0.36 | $0.34 | $0.35 | $15.00 | $173.8K | 5.0K | 155 |

| SNAP | PUT | SWEEP | BEARISH | 07/19/24 | $0.94 | $0.85 | $0.85 | $15.50 | $66.9K | 8.0K | 3.7K |

| SNAP | PUT | SWEEP | BULLISH | 07/19/24 | $0.95 | $0.85 | $0.85 | $15.50 | $62.7K | 8.0K | 1.5K |

| SNAP | PUT | SWEEP | BULLISH | 07/19/24 | $1.1 | $0.72 | $0.8 | $15.50 | $51.1K | 8.0K | 3.0K |

| SNAP | PUT | SWEEP | BEARISH | 07/19/24 | $0.89 | $0.88 | $0.89 | $15.50 | $36.3K | 8.0K | 751 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 拍下 | 打電話 | 掃 | 粗魯的 | 07/26/24 | 0.36 美元 | 0.34 美元 | 0.35 美元 | 15.00 美元 | 173.8 萬美元 | 5.0K | 155 |

| 拍下 | 放 | 掃 | 粗魯的 | 07/19/24 | 0.94 美元 | 0.85 美元 | 0.85 美元 | 15.50 美元 | 66.9 萬美元 | 8.0K | 3.7K |

| 拍下 | 放 | 掃 | 看漲 | 07/19/24 | 0.95 美元 | 0.85 美元 | 0.85 美元 | 15.50 美元 | 62.7 萬美元 | 8.0K | 1.5K |

| 拍下 | 放 | 掃 | 看漲 | 07/19/24 | 1.1 美元 | 0.72 美元 | 0.8 美元 | 15.50 美元 | 51.1 萬美元 | 8.0K | 3.0K |

| 拍下 | 放 | 掃 | 粗魯的 | 07/19/24 | 0.89 美元 | 0.88 美元 | 0.89 美元 | 15.50 美元 | 36.3 萬美元 | 8.0K | 751 |

About Snap

關於 Snap

Snap owns one of the most popular social networking apps, Snapchat, claiming more than 400 million daily active users as of the end of 2023. Snap generates nearly all its revenue from advertising. While only about one quarter of users are in North America, the region accounts for about 65% of sales.

Snap擁有最受歡迎的社交網絡應用程序之一Snapchat,截至2023年底,其每日活躍用戶超過4億。Snap 幾乎所有的收入都來自廣告。雖然只有大約四分之一的用戶在北美,但該地區約佔銷售額的65%。

After a thorough review of the options trading surrounding Snap, we move to examine the company in more detail. This includes an assessment of its current market status and performance.

在對圍繞Snap的期權交易進行了全面審查之後,我們將對該公司進行更詳細的審查。這包括評估其當前的市場狀況和表現。

Where Is Snap Standing Right Now?

Snap 現在站在哪裏?

- With a volume of 54,463, the price of SNAP is down 0.0% at $14.57.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 13 days.

- SNAP的交易量爲54,463美元,價格下跌0.0%,至14.57美元。

- RSI 指標暗示,標的股票目前在超買和超賣之間保持中立。

- 下一份業績預計將在13天后公佈。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

與僅交易股票相比,期權是一種風險更高的資產,但它們具有更高的獲利潛力。嚴肅的期權交易者通過每天自我教育、擴大交易規模、關注多個指標以及密切關注市場來管理這種風險。