FTAI Aviation's Options: A Look at What the Big Money Is Thinking

FTAI Aviation's Options: A Look at What the Big Money Is Thinking

High-rolling investors have positioned themselves bullish on FTAI Aviation (NASDAQ:FTAI), and it's important for retail traders to take note.\This activity came to our attention today through Benzinga's tracking of publicly available options data. The identities of these investors are uncertain, but such a significant move in FTAI often signals that someone has privileged information.

高富帥投資者看好FTAI Aviation(納斯達克: FTAI)的投資機會,而零售交易者應該注意。這一活動是通過Benzinga的公開期權數據跟蹤獲知的,這些投資者的身份不確定,但FTAI的這一重大變動通常意味着有人掌握了保密信息。

Today, Benzinga's options scanner spotted 11 options trades for FTAI Aviation. This is not a typical pattern.

今天,Benzinga的期權掃描器發現了11次FTAI Aviation的期權交易。這不是典型的交易模式。

The sentiment among these major traders is split, with 36% bullish and 36% bearish. Among all the options we identified, there was one put, amounting to $36,000, and 10 calls, totaling $727,486.

這些主要交易者的情緒分爲兩派,看好和看淡各佔36%。我們識別出的所有期權中,有一項看跌期權,金額爲36,000美元,共計10項看漲期權,總金額爲727,486美元。

Expected Price Movements

預期價格波動

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $72.5 and $105.0 for FTAI Aviation, spanning the last three months.

在評估交易量和未平倉合約後,顯而易見的是,主要市場運動者正專注於FTAI Aviation在價格範圍72.5美元到105.0美元之間的價格區間,該區間覆蓋過去三個月。

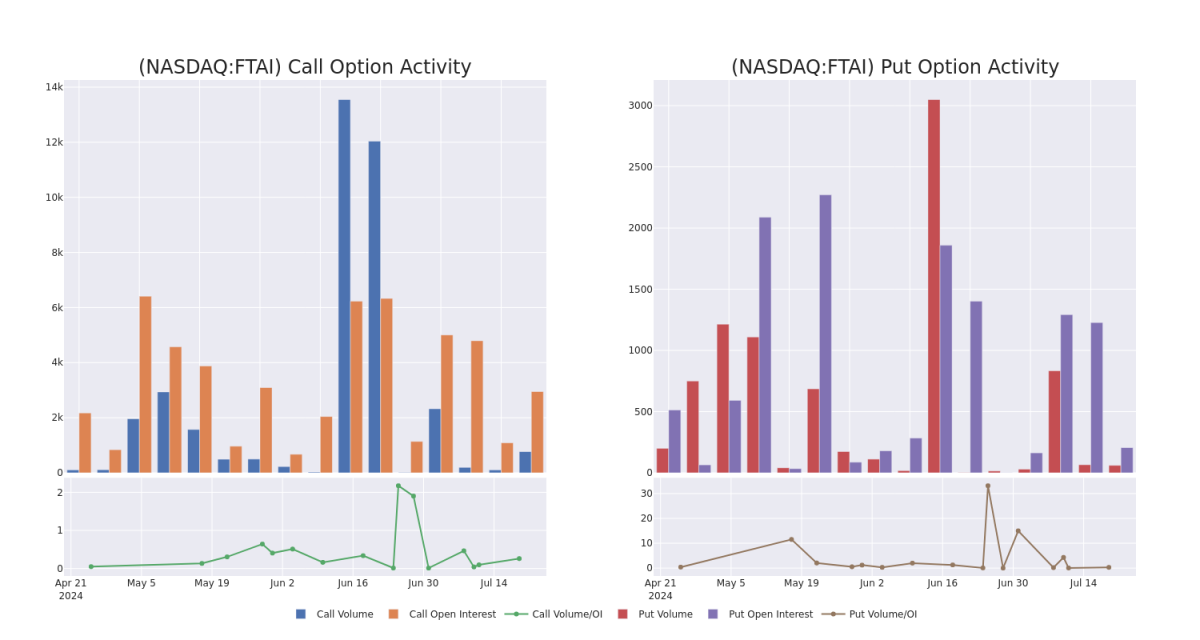

Volume & Open Interest Trends

成交量和未平倉量趨勢

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in FTAI Aviation's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to FTAI Aviation's substantial trades, within a strike price spectrum from $72.5 to $105.0 over the preceding 30 days.

評估成交量和未平倉合約是進行期權交易的戰略步驟。這些指標揭示了FTAI Aviation在特定執行價格的期權流動性和投資者興趣。接下來的數據可視化了在過去30天中,FTAI Aviation的看漲和看跌期權的成交量和未平倉合約波動,涉及執行價格區間72.5美元到105.0美元的大量交易。

FTAI Aviation Option Activity Analysis: Last 30 Days

FTAI Aviation期權活動分析:最近30天

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| FTAI | CALL | SWEEP | BEARISH | 08/16/24 | $16.4 | $15.6 | $15.6 | $90.00 | $134.2K | 1.0K | 151 |

| FTAI | CALL | SWEEP | BULLISH | 08/16/24 | $15.9 | $15.6 | $15.9 | $90.00 | $103.3K | 1.0K | 0 |

| FTAI | CALL | SWEEP | BULLISH | 08/16/24 | $15.2 | $15.1 | $15.2 | $90.00 | $94.2K | 1.0K | 251 |

| FTAI | CALL | SWEEP | BEARISH | 08/16/24 | $15.7 | $15.6 | $15.7 | $90.00 | $87.7K | 1.0K | 0 |

| FTAI | CALL | TRADE | NEUTRAL | 08/16/24 | $16.0 | $14.4 | $15.3 | $90.00 | $76.5K | 1.0K | 351 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ftai | 看漲 | SWEEP | 看淡 | 08/16/24 | $16.4 | $15.6 | $15.6 | $90.00 | 134,200美元 | 1.0K | 151 |

| ftai | 看漲 | SWEEP | 看好 | 08/16/24 | $15.9 | $15.6 | $15.9 | $90.00 | $103.3K | 1.0K | 0 |

| ftai | 看漲 | SWEEP | 看好 | 08/16/24 | $15.2 | $15.1 | $15.2 | $90.00 | $94.2K | 1.0K | 251 |

| ftai | 看漲 | SWEEP | 看淡 | 08/16/24 | 15.7 | $15.6 | 15.7 | $90.00 | $87.7K | 1.0K | 0 |

| ftai | 看漲 | 交易 | 中立 | 08/16/24 | $16.0 | 14.4美元 | $15.3 | $90.00 | $76.5K | 1.0K | 351 |

About FTAI Aviation

關於FTAI Aviation

FTAI Aviation Ltd is a aerospace company .It owns and maintains commercial jet engines with a focus on CFM56 engines. FTAI owns and leases jet aircraft which often facilitates the acquisition of engines at attractive prices. It invests in aviation assets and aerospace products that generate strong and stable cash flows with the potential for earnings growth and asset appreciation.

FTAI Aviation股份有限公司是一家航空航天公司。該公司專注於擁有和維護商業噴氣發動機,尤其是CFM56發動機。FTAI擁有和租賃噴氣式飛機,這通常有助於以優惠的價格收購發動機。該公司投資於產生穩定和強大現金流的航空資產和航空產品,並具有潛力實現收益增長和資產增值。

Having examined the options trading patterns of FTAI Aviation, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了FTAI Aviation的期權交易模式後,我們現在直接關注該公司。這個轉變使我們能夠深入探討它當前的市場地位和業績。

Where Is FTAI Aviation Standing Right Now?

FTAI Aviation現在處於何種地位?

- Trading volume stands at 503,256, with FTAI's price up by 0.98%, positioned at $104.0.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 4 days.

- 交易量爲503,256,FTAI的價格上漲0.98%,位於104.0美元。

- RSI指標顯示該股票可能接近超買。

- 預計4天內公佈業績。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for FTAI Aviation with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供更高的利潤潛力。精明的交易者通過持續的教育、策略性的交易調整、利用各種指標並關注市場動態來降低這些風險。通過Benzinga Pro的實時提醒,了解FTAI Aviation的最新期權交易。