Here's Why Baoding Technology (SZSE:002552) Has Caught The Eye Of Investors

Here's Why Baoding Technology (SZSE:002552) Has Caught The Eye Of Investors

For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But the reality is that when a company loses money each year, for long enough, its investors will usually take their share of those losses. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Baoding Technology (SZSE:002552). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Baoding Technology's Improving Profits

In business, profits are a key measure of success; and share prices tend to reflect earnings per share (EPS) performance. So for many budding investors, improving EPS is considered a good sign. Commendations have to be given in seeing that Baoding Technology grew its EPS from CN¥0.11 to CN¥0.70, in one short year. Even though that growth rate may not be repeated, that looks like a breakout improvement. This could point to the business hitting a point of inflection.

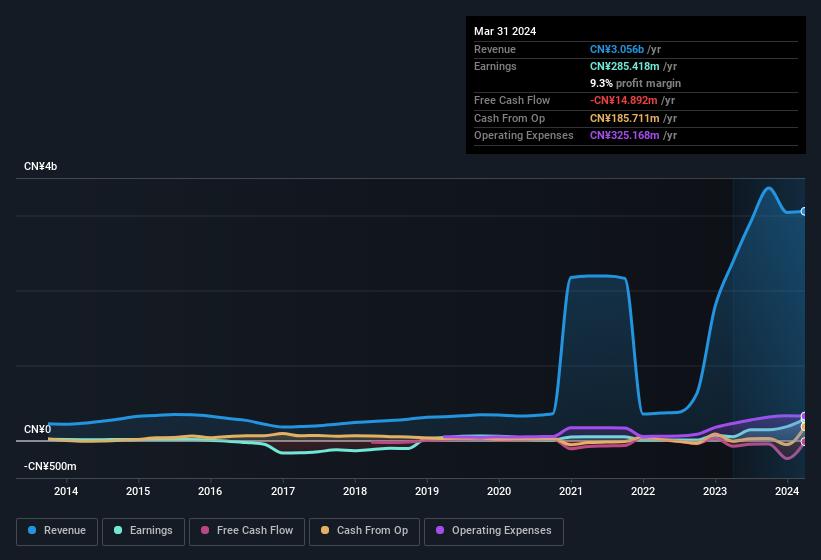

Careful consideration of revenue growth and earnings before interest and taxation (EBIT) margins can help inform a view on the sustainability of the recent profit growth. On the one hand, Baoding Technology's EBIT margins fell over the last year, but on the other hand, revenue grew. So it seems the future may hold further growth, especially if EBIT margins can remain steady.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

While it's always good to see growing profits, you should always remember that a weak balance sheet could come back to bite. So check Baoding Technology's balance sheet strength, before getting too excited.

Are Baoding Technology Insiders Aligned With All Shareholders?

It should give investors a sense of security owning shares in a company if insiders also own shares, creating a close alignment their interests. Baoding Technology followers will find comfort in knowing that insiders have a significant amount of capital that aligns their best interests with the wider shareholder group. Notably, they have an enviable stake in the company, worth CN¥1.6b. Coming in at 33% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Looking very optimistic for investors.

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. The median total compensation for CEOs of companies similar in size to Baoding Technology, with market caps between CN¥2.9b and CN¥12b, is around CN¥1.1m.

Baoding Technology offered total compensation worth CN¥900k to its CEO in the year to December 2023. That seems pretty reasonable, especially given it's below the median for similar sized companies. CEO compensation is hardly the most important aspect of a company to consider, but when it's reasonable, that gives a little more confidence that leadership are looking out for shareholder interests. Generally, arguments can be made that reasonable pay levels attest to good decision-making.

Is Baoding Technology Worth Keeping An Eye On?

Baoding Technology's earnings per share growth have been climbing higher at an appreciable rate. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The strong EPS improvement suggests the businesses is humming along. Big growth can make big winners, so the writing on the wall tells us that Baoding Technology is worth considering carefully. Before you take the next step you should know about the 2 warning signs for Baoding Technology (1 is a bit unpleasant!) that we have uncovered.

Although Baoding Technology certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of Chinese companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com