Lantheus Holdings, Inc.'s (NASDAQ:LNTH) P/S Is Still On The Mark Following 48% Share Price Bounce

Lantheus Holdings, Inc.'s (NASDAQ:LNTH) P/S Is Still On The Mark Following 48% Share Price Bounce

Despite an already strong run, Lantheus Holdings, Inc. (NASDAQ:LNTH) shares have been powering on, with a gain of 48% in the last thirty days. Looking back a bit further, it's encouraging to see the stock is up 33% in the last year.

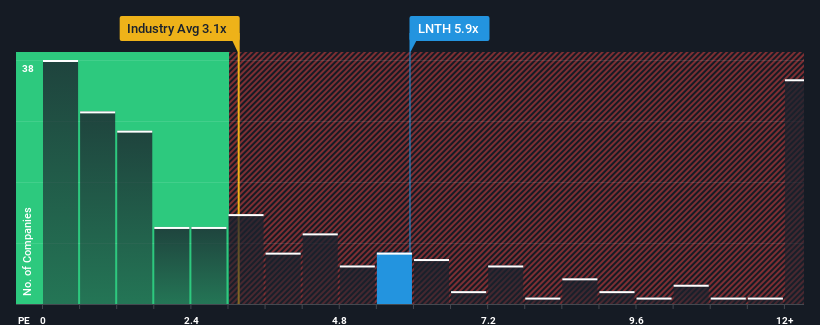

Following the firm bounce in price, when almost half of the companies in the United States' Medical Equipment industry have price-to-sales ratios (or "P/S") below 3.1x, you may consider Lantheus Holdings as a stock not worth researching with its 5.9x P/S ratio. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

What Does Lantheus Holdings' Recent Performance Look Like?

With revenue growth that's superior to most other companies of late, Lantheus Holdings has been doing relatively well. It seems that many are expecting the strong revenue performance to persist, which has raised the P/S. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Lantheus Holdings will help you uncover what's on the horizon.Is There Enough Revenue Growth Forecasted For Lantheus Holdings?

In order to justify its P/S ratio, Lantheus Holdings would need to produce outstanding growth that's well in excess of the industry.

Retrospectively, the last year delivered an exceptional 33% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. So we can start by confirming that the company has done a tremendous job of growing revenue over that time.

Turning to the outlook, the next three years should generate growth of 14% per year as estimated by the eleven analysts watching the company. That's shaping up to be materially higher than the 10% each year growth forecast for the broader industry.

With this information, we can see why Lantheus Holdings is trading at such a high P/S compared to the industry. It seems most investors are expecting this strong future growth and are willing to pay more for the stock.

What We Can Learn From Lantheus Holdings' P/S?

The strong share price surge has lead to Lantheus Holdings' P/S soaring as well. Typically, we'd caution against reading too much into price-to-sales ratios when settling on investment decisions, though it can reveal plenty about what other market participants think about the company.

As we suspected, our examination of Lantheus Holdings' analyst forecasts revealed that its superior revenue outlook is contributing to its high P/S. At this stage investors feel the potential for a deterioration in revenues is quite remote, justifying the elevated P/S ratio. It's hard to see the share price falling strongly in the near future under these circumstances.

Having said that, be aware Lantheus Holdings is showing 2 warning signs in our investment analysis, and 1 of those is significant.

If you're unsure about the strength of Lantheus Holdings' business, why not explore our interactive list of stocks with solid business fundamentals for some other companies you may have missed.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com