Servyou Software Group Co., Ltd. (SHSE:603171) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

Servyou Software Group Co., Ltd. (SHSE:603171) Stock Rockets 26% As Investors Are Less Pessimistic Than Expected

Servyou Software Group Co., Ltd. (SHSE:603171) shareholders have had their patience rewarded with a 26% share price jump in the last month. Not all shareholders will be feeling jubilant, since the share price is still down a very disappointing 25% in the last twelve months.

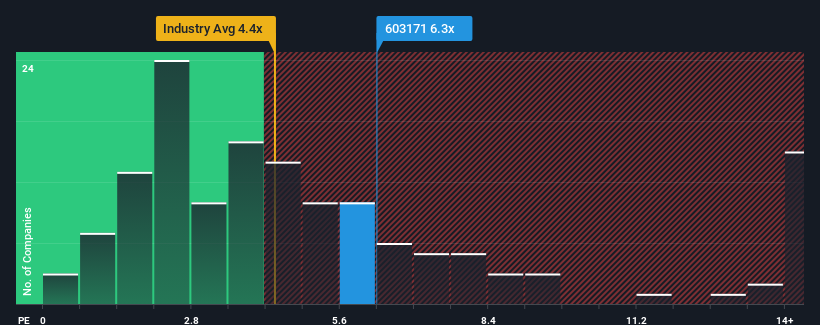

After such a large jump in price, Servyou Software Group may be sending sell signals at present with a price-to-sales (or "P/S") ratio of 6.3x, when you consider almost half of the companies in the Software industry in China have P/S ratios under 4.4x and even P/S lower than 2x aren't out of the ordinary. Nonetheless, we'd need to dig a little deeper to determine if there is a rational basis for the elevated P/S.

How Servyou Software Group Has Been Performing

Recent times have been advantageous for Servyou Software Group as its revenues have been rising faster than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. However, if this isn't the case, investors might get caught out paying too much for the stock.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Servyou Software Group.What Are Revenue Growth Metrics Telling Us About The High P/S?

In order to justify its P/S ratio, Servyou Software Group would need to produce impressive growth in excess of the industry.

Retrospectively, the last year delivered a decent 7.6% gain to the company's revenues. Revenue has also lifted 20% in aggregate from three years ago, partly thanks to the last 12 months of growth. Accordingly, shareholders would have probably been satisfied with the medium-term rates of revenue growth.

Turning to the outlook, the next year should generate growth of 24% as estimated by the five analysts watching the company. That's shaping up to be materially lower than the 28% growth forecast for the broader industry.

With this information, we find it concerning that Servyou Software Group is trading at a P/S higher than the industry. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

The Final Word

Servyou Software Group shares have taken a big step in a northerly direction, but its P/S is elevated as a result. We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

We've concluded that Servyou Software Group currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. Right now we aren't comfortable with the high P/S as the predicted future revenues aren't likely to support such positive sentiment for long. This places shareholders' investments at significant risk and potential investors in danger of paying an excessive premium.

Before you take the next step, you should know about the 2 warning signs for Servyou Software Group (1 makes us a bit uncomfortable!) that we have uncovered.

Of course, profitable companies with a history of great earnings growth are generally safer bets. So you may wish to see this free collection of other companies that have reasonable P/E ratios and have grown earnings strongly.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com