We Think Shareholders Will Probably Be Generous With Singapore Airlines Limited's (SGX:C6L) CEO Compensation

We Think Shareholders Will Probably Be Generous With Singapore Airlines Limited's (SGX:C6L) CEO Compensation

Key Insights

主要見解

- Singapore Airlines will host its Annual General Meeting on 29th of July

- CEO Choon Phong Goh's total compensation includes salary of S$1.44m

- Total compensation is similar to the industry average

- Singapore Airlines' EPS grew by 124% over the past three years while total shareholder return over the past three years was 54%

- 新加坡航空公司將於7月29日舉行其股東周年大會

- CEO吳俊風的總薪酬包括144萬新幣的薪金

- 總補償與行業平均水平相似

- 在過去三年裏,新加坡航空公司的每股收益增長了124%,而股東總回報率爲54%

The performance at Singapore Airlines Limited (SGX:C6L) has been quite strong recently and CEO Choon Phong Goh has played a role in it. The pleasing results would be something shareholders would keep in mind at the upcoming AGM on 29th of July. This would also be a chance for them to hear the board review the financial results, discuss future company strategy and vote on any resolutions such as executive remuneration. Here is our take on why we think CEO compensation is not extravagant.

新加坡航空有限公司(SGX:C6L)的業績近來非常強勁,CEO吳俊風對此發揮了一定作用。愉快的業績將是股東在7月29日即將舉行的股東周年大會上會記在心頭的事情。這也是讓他們聽取董事會審查財務業績,討論未來的公司策略和投票議案(如高管薪酬等)的機會。以下是我們對爲什麼認爲CEO薪酬並不奢侈的看法。

Comparing Singapore Airlines Limited's CEO Compensation With The Industry

將新加坡航空有限公司CEO薪酬與行業進行比較

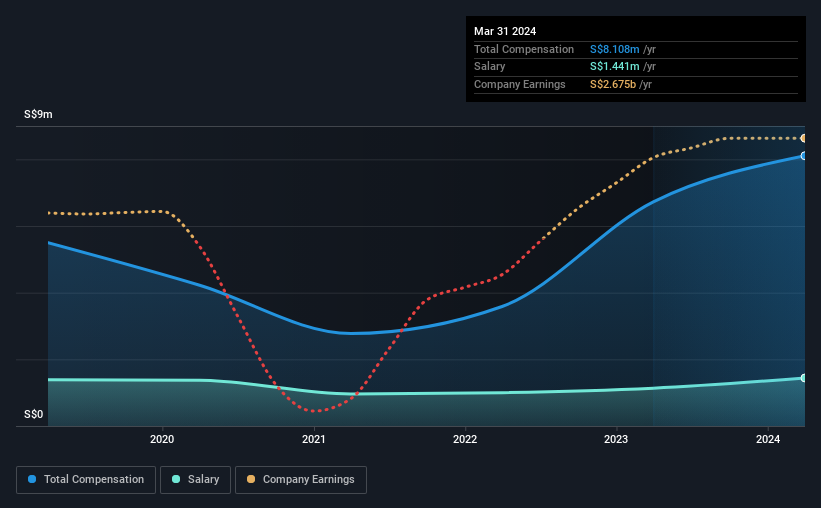

At the time of writing, our data shows that Singapore Airlines Limited has a market capitalization of S$25b, and reported total annual CEO compensation of S$8.1m for the year to March 2024. That's a notable increase of 21% on last year. We think total compensation is more important but our data shows that the CEO salary is lower, at S$1.4m.

截至撰寫本文時,我們的數據顯示,新加坡航空有限公司的市值爲250億新幣,截至2024年3月的年度總CEO薪酬爲810萬新幣。相比去年,這是一個顯著的增長21%。我們認爲總薪酬更加重要,但我們的數據顯示,CEO的薪水較低,僅爲140萬新幣。

On comparing similar companies in the Singapore Airlines industry with market capitalizations above S$11b, we found that the median total CEO compensation was S$10m. This suggests that Singapore Airlines remunerates its CEO largely in line with the industry average. Furthermore, Choon Phong Goh directly owns S$30m worth of shares in the company, implying that they are deeply invested in the company's success.

在對新加坡航空行業中市值超過110億新幣的類似公司進行比較時,我們發現中位數的總CEO薪酬爲1000萬新幣。這表明新加坡航空公司的CEO薪酬與行業平均水平基本相符。此外,吳俊風在公司中直接持有3000萬新幣的股份,這意味着他們對公司的成功深感投入。

| Component | 2024 | 2023 | Proportion (2024) |

| Salary | S$1.4m | S$1.1m | 18% |

| Other | S$6.7m | S$5.6m | 82% |

| Total Compensation | S$8.1m | S$6.7m | 100% |

| 組成部分 | 2024 | 2023 | 比例(2024年) |

| 薪資 | 1.4百萬新加坡元 | 110萬新元 | 18% |

| 其他 | 6.7百萬新元 | 5.6百萬新元 | 82% |

| 總補償 | 810萬新幣 | 6.7百萬新元 | 100% |

On an industry level, roughly 44% of total compensation represents salary and 56% is other remuneration. Singapore Airlines pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

從行業層面來看,約44%的總薪酬代表薪水,56%爲其他薪酬。與整個行業相比,新加坡航空公司通過薪水支付適度的薪酬比例較低。需要注意的是,傾向於非薪酬性薪酬表明總工資與公司業績有關。

Singapore Airlines Limited's Growth

新加坡航空有限公司的成長

Singapore Airlines Limited has seen its earnings per share (EPS) increase by 124% a year over the past three years. Its revenue is up 7.0% over the last year.

新加坡航空有限公司過去三年每年的每股收益增長了124%。其營業收入過去一年增長7.0%。

Shareholders would be glad to know that the company has improved itself over the last few years. It's nice to see revenue heading northwards, as this is consistent with healthy business conditions. Historical performance can sometimes be a good indicator on what's coming up next but if you want to peer into the company's future you might be interested in this free visualization of analyst forecasts.

股東將會高興地知道,公司過去幾年已經取得了改善。收入增長是良好業務條件的體現,這是令人欣慰的。歷史表現有時可以成爲下一步發展的良好指標,但是如果您想了解公司的未來,您可能會對此感興趣。分析師預測的免費可視化。

Has Singapore Airlines Limited Been A Good Investment?

新加坡航空有限公司是否是一個不錯的投資?

Boasting a total shareholder return of 54% over three years, Singapore Airlines Limited has done well by shareholders. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

新加坡航空有限公司在過去三年裏股東總回報率達到54%,表現良好。因此,一些人可能認爲CEO的薪酬應該比同等規模的公司更高。

In Summary...

總之……

Seeing that the company has put in a relatively good performance, the CEO remuneration policy may not be the focus at the AGM. However, investors will get the chance to engage on key strategic initiatives and future growth opportunities for the company and set their longer-term expectations.

考慮到公司表現相對良好,CEO的報酬政策並不是股東大會的焦點。但是,投資者將有機會參與公司的關鍵戰略計劃和未來增長機會,並確定它們的長期期望。

It is always advisable to analyse CEO pay, along with performing a thorough analysis of the company's key performance areas. In our study, we found 2 warning signs for Singapore Airlines you should be aware of, and 1 of them is potentially serious.

分析CEO薪酬是必要的,同時要對公司的關鍵績效領域進行徹底分析。在我們的研究中,我們發現新加坡航空有2個警告信號需要注意,其中1個是潛在的嚴重問題。

Important note: Singapore Airlines is an exciting stock, but we understand investors may be looking for an unencumbered balance sheet and blockbuster returns. You might find something better in this list of interesting companies with high ROE and low debt.

重要提示:新加坡航空公司是一隻令人振奮的股票,但我們了解到投資者可能正在尋找一個沒有負擔的資產負債表和巨額回報的股票。您可能會在這個具有高roe和低負債的有趣公司名單中找到更好的投資選擇。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有反饋?對內容感到擔憂?請直接與我們聯繫。或者,發送電子郵件至editorial-team (at) simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

對本文有反饋?對內容感到擔憂?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

On an industry level, roughly 44% of total compensation represents salary and 56% is other remuneration. Singapore Airlines pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.

On an industry level, roughly 44% of total compensation represents salary and 56% is other remuneration. Singapore Airlines pays a modest slice of remuneration through salary, as compared to the broader industry. It's important to note that a slant towards non-salary compensation suggests that total pay is tied to the company's performance.