July 22, 2024 - $Ryanair (RYAAY.US)$shares slumped 11.46% to $101.22 in pre-market trading on Monday. Ryanair Holdings has reported its FY2025 first quarter results today.

Q1 Highlights include:

Traffic grew 10% to 55.5m, despite multiple Boeing delivery delays.

Rev. per pax fell 10% (ave. fare down 15% & ancil. rev. flat).

156x B737 “Gamechangers” in 594 fleet at 30 June (20 less than budget).

156x B737 “Gamechangers” in 594 fleet at 30 June (20 less than budget).

Record Summer schedule launched (5 new bases, over 200 new S.24 routes).

Multiple “Approved OTA” partnerships signed to protect consumers.

Fuel hedges extended: 75% FY25 at under $80bbl saves over €450m & c.45% FY26 at $78bbl.

Over 50% of €700m share buyback completed.

Q1 FY25 BUSINESS REVIEW:

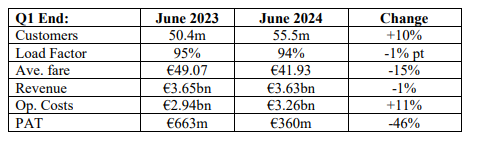

Q1 scheduled revenue fell 6% to €2.33bn. While traffic grew 10% to 55.5m, our customers enjoyed substantial savings thanks to 15% lower fares due, in part, to the absence of the first half of Easter which fell into March, and more price stimulation than we had previously expected. Ancillary sales rose 10% to €1.30bn (c.€23.40 per passenger). As a result, total revenue declined 1% to €3.63bn. Operating costs increased 11% to €3.26bn, marginally ahead of traffic growth, as fuel hedge savings offset higher staff and other costs which was in part due to Boeing delivery delays.

SHAREHOLDER RETURNS:

A €700m share buyback commenced in May. To date we have completed over 50% of the programme. When complete, Ryanair will have returned over €7.8bn to shareholders since 2008. A final dividend of €0.178 per share is due to be paid in Sept.

OUTLOOK:

FY25 traffic is expected to grow 8% (198m to 200m passengers), subject to no worsening Boeing delivery delays. As previously guided, we expect unit costs to rise modestly this year as ex-fuel costs (incl. pay & productivity increases, higher handling & ATC fees and the impact of multiple B737 delivery delays) are substantially offset by our fuel hedge savings, and rising net interest income, which widen Ryanair’s cost advantage over its competitors. While Q2 demand is strong, pricing remains softer than we expected, and we now expect Q2 fares to be materially lower than last summer (previously expected to be flat to modestly up). The final H1 outcome is, however, totally dependent on close-in bookings and yields in Aug. and Sept. As is normal at this time of year, we have almost zero Q3 and Q4 visibility, although Q4 will not benefit from last year’s early Easter. It is too early to provide meaningful FY25 PAT guidance, although we hope to be able to do so at our H1 results in Nov. The final FY25 outcome remains subject to avoiding adverse developments during FY25 (especially given continuing conflicts in Ukraine and the Middle East, repeated ATC shortstaffing and capacity restrictions, or further Boeing delivery delays).”

2024年7月22日 - $Ryanair (RYAAY.US)$Ryanair(瑞安航空)控股股份有限公司股票在週一的美股盤前交易中暴跌11.46%,至101.22美元。 Ryanair Holdings今天公佈了其FY2025第一季度業績報告。

第一季度亮點包括:

儘管波音交付情況多次延遲,但運輸量增長了10%,達到了5550萬人次。

每位旅客的收入下降了10%(平均票價下降了15%和輔助收入持平)。

截至6月30日,594架波音737“遊戲改變者”中有156架(比預算減少20架)。

截至6月30日,594架波音737“遊戲改變者”中有156架(比預算減少20架)。

推出了記錄的夏季航班計劃(5個新基地,超過200個新的S.24航線)。

簽署了多個“已批准OTA”合作伙伴關係以保護消費者。

燃油對沖擴大:75%的FY25低於每桶80美元,可節省超過45000萬歐元,以及約45%的FY26每桶78美元。

超過70,000,000歐元的股票回購計劃已完成50%以上。

Q1 FY25業務回顧:

Q1計劃收入下降了6%,至23.3億歐元。儘管交通量增長了10%,達到了5550萬,但由於復活節上半年落入三月份而部分原因,我們的客戶享受了15%的低票價,以及比預期更多的價格刺激。輔助銷售額增長10%,達到13億歐元(每位乘客約23.40歐元)。因此,總收入下降了1%,至36.3億歐元。運營成本增加了11%,至32.6億歐元,略高於交通量增長,因爲燃油對沖節省抵消了更高的員工和其他成本,部分原因是由於波音交付延遲。

股東回報:

7000萬歐元的股票回購計劃於5月份開始。到目前爲止,我們已完成該計劃的50%以上。屆時,Ryanair自2008年以來將向股東返還超過78億歐元。每股最終股息將於9月支付0.178歐元。

展望:

預計FY25的客運量將增長8%(從19800萬到20000萬乘客),如果沒有波音交付延誤的惡化。如先前指定,我們預計本年度單位成本將略微上升,因爲除燃油成本外(包括支付和生產力增長,更高的處理費和ATC費用以及多個B737交付延誤的影響),我們的燃油對沖節省將大大抵消成本,以及不斷上升的淨利息。Ryanair集團的成本優勢擴大。雖然Q2的需求強勁,但價格仍低於我們的預期,我們現在預計Q2的票價將比去年夏季低很多(先前預計票價將持平或略有上漲)。然而,上半年的最終結果完全取決於8月和9月的靠近預訂和收益。正常的時間沒提供有意義的FY25 PAt指導,儘管我們希望能夠在11月的半年度業績發佈會上提供。最終FY25業績仍取決於FY25期間避免不利發展(特別是在烏克蘭和中東的持續衝突,ATC短缺和容量限制或進一步的波音交付延遲情況下)。

截至6月30日,594架波音737“遊戲改變者”中有156架(比預算減少20架)。

截至6月30日,594架波音737“遊戲改變者”中有156架(比預算減少20架)。

156x B737 “Gamechangers” in 594 fleet at 30 June (20 less than budget).

156x B737 “Gamechangers” in 594 fleet at 30 June (20 less than budget).