Market Whales and Their Recent Bets on DHR Options

Market Whales and Their Recent Bets on DHR Options

Investors with a lot of money to spend have taken a bullish stance on Danaher (NYSE:DHR).

有很多錢可以投資的投資者對丹納赫(紐交所:DHR)持看漲態度。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄中發現,今天這些頭寸已經出現了。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with DHR, it often means somebody knows something is about to happen.

無論是機構還是富人,我們都不知道。但當丹納赫出現這種大事情時,通常意味着有人知道即將發生的事情。

Today, Benzinga's options scanner spotted 10 options trades for Danaher.

今天,Benzinga的期權掃描器發現了10個丹納赫的期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 80% bullish and 20%, bearish.

這些大手交易人的整體情緒在80%看漲和20%看跌間分化。

Out of all of the options we uncovered, there was 1 put, for a total amount of $150,334, and 9, calls, for a total amount of $532,503.

在我們發現的所有期權中,共有1個看跌期權,總金額爲$150,334,以及9個看漲期權,總金額爲$532,503。

Expected Price Movements

預期價格波動

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $230.0 to $260.0 for Danaher over the last 3 months.

考慮到這些合約的成交量和未平倉量,似乎鯨魚們在過去的三個月裏一直瞄準最終目標價格在$230.0至$260.0的區間。

Volume & Open Interest Trends

成交量和未平倉量趨勢

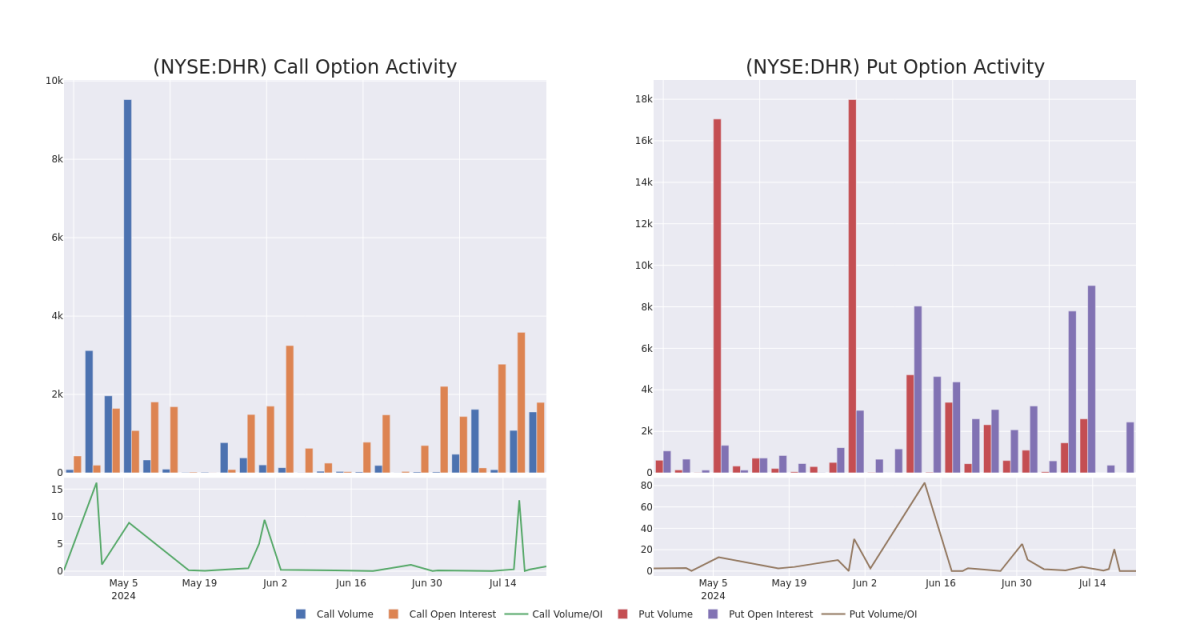

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Danaher's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Danaher's substantial trades, within a strike price spectrum from $230.0 to $260.0 over the preceding 30 days.

評估成交量和未平倉量是進行期權交易的一種戰略性步驟。這些指標揭示出了特定行權價的丹納赫期權的流動性和投資者興趣。下面的數據可視化了過去30天內$230.0至$260.0行權價範圍內,與丹納赫的大手交易所關聯的看漲和看跌期權的成交量和未平倉量的波動。

Danaher 30-Day Option Volume & Interest Snapshot

丹納赫30天期權成交量和持倉量快照

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| DHR | CALL | SWEEP | BULLISH | 10/18/24 | $7.3 | $7.2 | $7.3 | $260.00 | $171.5K | 56 | 0 |

| DHR | PUT | SWEEP | BULLISH | 09/20/24 | $6.6 | $6.5 | $6.5 | $240.00 | $150.3K | 2.4K | 1 |

| DHR | CALL | SWEEP | BULLISH | 10/18/24 | $7.4 | $7.2 | $7.3 | $260.00 | $80.3K | 56 | 242 |

| DHR | CALL | SWEEP | BULLISH | 07/26/24 | $1.7 | $1.6 | $1.65 | $260.00 | $78.0K | 264 | 145 |

| DHR | CALL | SWEEP | BULLISH | 01/16/26 | $38.6 | $37.8 | $37.8 | $250.00 | $52.9K | 72 | 30 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 丹納赫 | 看漲 | SWEEP | 看好 | 10/18/24 | $7.3 | $7.2 | $7.3 | $260.00 | $171.5K | 56 | 0 |

| 丹納赫 | 看跌 | SWEEP | 看好 | 09/20/24 | 6.6 | $6.5 | $6.5 | $240.00 | $150.3K | 2.4K | 1 |

| 丹納赫 | 看漲 | SWEEP | 看好 | 10/18/24 | $7.4 | $7.2 | $7.3 | $260.00 | 80.3K美元 | 56 | 242 |

| 丹納赫 | 看漲 | SWEEP | 看好 | 07/26/24 | $1.7 | $1.6 | $1.65 | $260.00 | $78.0K | 264 | 145 |

| 丹納赫 | 看漲 | SWEEP | 看好 | 01/16/26 | $38.6 | 37.8美元 | 37.8美元 | $250.00 | $52.9K | 72 | 30 |

About Danaher

關於丹納赫

In 1984, Danaher's founders transformed a real estate organization into an industrial-focused manufacturing company. Through a series of mergers, acquisitions, and divestitures, Danaher now focuses primarily on manufacturing scientific instruments and consumables in the life science and diagnostic industries after the late 2023 divesititure of its environmental and applied solutions group, Veralto.

1984年,丹納赫的創始人將一個房地產組織轉變成了一家以製造業爲重點的製造公司。通過一系列的併購和剝離,丹納赫現在主要專注於在生命科學和診斷行業製造科學儀器和消耗品,其環保和應用解決方案集團Veralto在2023年末進行了分拆。

Danaher's Current Market Status

丹納赫當下的市場狀況

- Trading volume stands at 1,129,939, with DHR's price up by 0.82%, positioned at $245.54.

- RSI indicators show the stock to be is currently neutral between overbought and oversold.

- Earnings announcement expected in 1 days.

- 交易量爲1,129,939,DHR的價格上漲了0.82%,爲$245.54。

- RSI指標顯示該股票目前處於超買和超賣之間的中立狀態。

- 預計1天內發佈盈利聲明。

Expert Opinions on Danaher

關於丹納赫的專家意見

In the last month, 1 experts released ratings on this stock with an average target price of $260.0.

在過去一個月中,有1位專家對該股票發表了評級,平均目標價爲$260.0。

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on Danaher with a target price of $260.

- Evercore ISI集團的一位分析師持續給丹納赫的股票擁有者提供買入評級,目標價爲$260。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Danaher options trades with real-time alerts from Benzinga Pro.

期權交易帶來更高的風險和潛在的回報。精明的交易員通過不斷地學習、調整策略、監測多個因子、密切關注市場走勢來管理這些風險。通過Benzinga Pro的實時警報及時了解最新的丹納赫期權交易動態。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with DHR, it often means somebody knows something is about to happen.

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with DHR, it often means somebody knows something is about to happen.