Unpacking the Latest Options Trading Trends in Chipotle Mexican Grill

Unpacking the Latest Options Trading Trends in Chipotle Mexican Grill

Deep-pocketed investors have adopted a bullish approach towards Chipotle Mexican Grill (NYSE:CMG), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in CMG usually suggests something big is about to happen.

資金雄厚的投資者們對Chipotle Mexican Grill(紐交所:CMG)採取看好的態度,市場參與者不應該忽視這一點。我們在Benzinga追蹤公共期權記錄時發現了這一重大舉動。這些投資者的身份仍然未知,但CMG有如此大的動向通常意味着有大事即將發生。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 11 extraordinary options activities for Chipotle Mexican Grill. This level of activity is out of the ordinary.

今天,當Benzinga的期權掃描器突出顯示Chipotle Mexican Grill的11個非同尋常的期權活動時,我們從今天的觀察中獲得了這些信息。這種活躍程度是不同尋常的。

The general mood among these heavyweight investors is divided, with 45% leaning bullish and 18% bearish. Among these notable options, 5 are puts, totaling $177,710, and 6 are calls, amounting to $259,800.

這些重量級投資者中,45%的人看好,18%的人抱持悲觀態度。在這些顯著的期權中,有5個認購期權,總額爲177,710美元,6個認沽期權,總額達259,800美元。

Predicted Price Range

預測價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $30.8 to $60.0 for Chipotle Mexican Grill over the recent three months.

根據交易活動,看來一些重要投資者在最近三個月內對Chipotle Mexican Grill的價格區間有所瞄準,該區間價格從30.8美元到60.0美元。

Volume & Open Interest Development

成交量和持倉量的評估是期權交易中的一個關鍵步驟。這些指標揭示了阿里巴巴集團(Alibaba Gr Hldgs)特定執行價格期權的流動性和投資者興趣。下面的數據可視化了在過去30天內,阿里巴巴集團(Alibaba Gr Hldgs)在執行價格在74.0美元到120.0美元區間內的看漲看跌期權中,成交量和持倉量的波動情況。

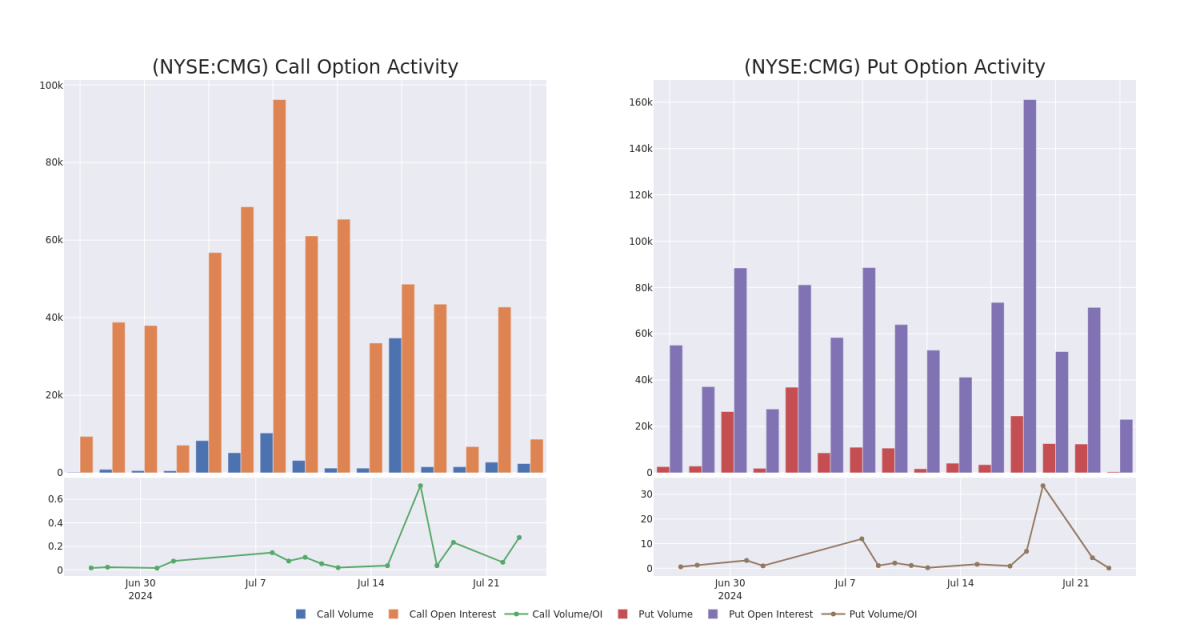

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Chipotle Mexican Grill's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Chipotle Mexican Grill's substantial trades, within a strike price spectrum from $30.8 to $60.0 over the preceding 30 days.

在期權交易中評估成交量和未平倉合約是重要的策略步驟。這些指標揭示了Chipotle Mexican Grill在特定行使價格下的期權的流動性和投資者興趣。下表數據可視化了Chipotle Mexican Grill在30.8美元至60.0美元行使價格範圍內的認購和認沽期權的成交量和未平倉合約的波動,這些期權與該公司的大宗交易掛鉤。

Chipotle Mexican Grill 30-Day Option Volume & Interest Snapshot

Chipotle Mexican Grill 30天期權成交量及未平倉合約一覽表

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CMG | CALL | SWEEP | BULLISH | 07/26/24 | $2.05 | $2.0 | $2.0 | $55.00 | $86.4K | 3.3K | 994 |

| CMG | CALL | TRADE | NEUTRAL | 09/20/24 | $1.8 | $1.7 | $1.75 | $59.00 | $43.7K | 2.9K | 665 |

| CMG | PUT | SWEEP | BEARISH | 09/20/24 | $3.5 | $3.4 | $3.5 | $55.00 | $43.7K | 11.8K | 181 |

| CMG | PUT | TRADE | BEARISH | 09/20/24 | $2.9 | $2.85 | $2.9 | $54.00 | $43.5K | 8.4K | 140 |

| CMG | CALL | SWEEP | BULLISH | 09/20/24 | $1.65 | $1.6 | $1.65 | $59.00 | $41.2K | 2.9K | 368 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CMG | 看漲 | SWEEP | 看好 | 07/26/24 | $2.05 | $2.0 | $2.0 | $55.00 | $86.4K | 3.3K | 994 |

| CMG | 看漲 | 交易 | 中立 | 09/20/24 | $1.8 | $1.7 | $1.75 | $59.00 | $43.7千美元 | 2.9K | 665 |

| CMG | 看跌 | SWEEP | 看淡 | 09/20/24 | $3.5 | $3.4 | $3.5 | $55.00 | $43.7千美元 | 11.8千 | 181 |

| CMG | 看跌 | 交易 | 看淡 | 09/20/24 | $2.9 | $2.85 | $2.9 | 該公司的股票上週四收盤價爲42.69美元。 | $43.5千 | 8.4K | 140 |

| CMG | 看漲 | SWEEP | 看好 | 09/20/24 | $1.65 | $1.6 | $1.65 | $59.00 | $41.2K | 2.9K | 368 |

About Chipotle Mexican Grill

關於奇波雷墨西哥燒烤

Chipotle Mexican Grill is the largest fast-casual chain restaurant in the United States, with systemwide sales of $9.9 billion in 2023. The Mexican concept is predominately company-owned, although it recently inked a development agreement with Alshaya Group in the Middle East. It had a footprint of nearly 3,440 stores at the end of 2023, heavily indexed to the United States, although it maintains a small presence in Canada, the UK, France, and Germany. Chipotle sells burritos, burrito bowls, tacos, quesadillas, and beverages, with a selling proposition built around competitive prices, high-quality food sourcing, speed of service, and convenience. The company generates its revenue entirely from restaurant sales and delivery fees.

奇波雷墨西哥燒烤是美國最大的快餐連鎖餐廳,2023年全系統銷售額爲99億美元。這家墨西哥概念餐廳主要由公司擁有,儘管最近與阿爾沙亞集團簽署了一項發展協議,在中東有着接近3440家店鋪的佔比,更加支點在美國市場,儘管在加拿大、英國、法國和德國也有小規模的業務。Chipotle銷售捲餅、捲餅碗、塔可餅、奶酪玉米脆餅和飲料,其銷售日益增長的主張是基於競爭價格、高質量食品來源、快速服務和便利性。該公司的收入完全來自餐廳銷售和配送費。

Having examined the options trading patterns of Chipotle Mexican Grill, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了奇波雷墨西哥燒烤的期權交易模式後,我們的注意力現在直接轉向公司。這個轉變使我們能夠深入探討該公司目前的市場地位和業績。

Chipotle Mexican Grill's Current Market Status

Chipotle Mexican Grill的當前市場狀況

- With a volume of 2,150,303, the price of CMG is up 1.81% at $54.53.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 1 days.

- 成交量爲2,150,303股,CMG股價上漲1.81%,報54.53美元。

- RSI指標表明該基礎股票可能被超賣。

- 下次盈利預計將於1天內發佈。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Chipotle Mexican Grill options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在回報。敏銳的交易者通過不斷地學習、適應自己的策略、監控多個指標並密切關注市場動向來管理這些風險。通過Benzinga Pro的實時警報保持最新的Chipotle Mexican Grill期權交易信息。

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $30.8 to $60.0 for Chipotle Mexican Grill over the recent three months.

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $30.8 to $60.0 for Chipotle Mexican Grill over the recent three months.