AT&T Q2 Earnings: Strong Wireless Net Adds, Higher Free Cash Flow, Stable Annual Outlook

AT&T Q2 Earnings: Strong Wireless Net Adds, Higher Free Cash Flow, Stable Annual Outlook

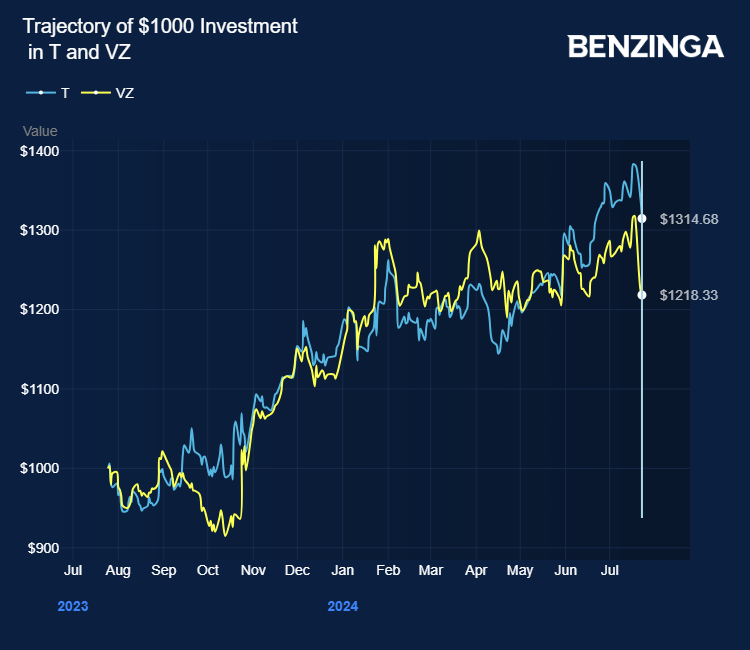

AT&T Inc (NYSE:T) reported fiscal second-quarter 2024 operating revenues of $29.8 billion, down 0.4% year over year and missing the analyst consensus estimate of $29.9 billion.

美國電話電報公司(紐約證券交易所代碼:T)公佈的2024財年第二季度營業收入爲298億美元,同比下降0.4%,未達到分析師共識估計的299億美元。

Adjusted EPS of $0.57 is in line with the analyst consensus estimate. The stock price gained after the print.

調整後的每股收益爲0.57美元,符合分析師的共識預期。印刷後股價上漲。

Also Read: AT&T and Snowflake Hit by Cyberattack, Millions of Customers Affected

另請閱讀:At&t和Snowflake受到網絡攻擊數以萬計的客戶受到影響

In the Mobility segment, AT&T clocked 997 thousand wireless net adds, including 419 thousand postpaid phone net adds, beating analyst estimates of 279 thousand, Bloomberg reports.

彭博社報道,在移動領域,AT&T的無線網絡新增量爲99.7萬個,其中包括41.9萬個後付費電話淨增量,超過了分析師估計的27.9萬個。

Verizon Communications Inc (NYSE:VZ) reported postpaid phone net additions of 148 thousand, surpassing forecasts of 118 thousand for the quarter.

威瑞森通訊公司(紐約證券交易所代碼:VZ)報告稱,後付費電話淨增14.8萬,超過了本季度預期的11.8萬部。

AT&T has attracted budget-conscious customers with its lower-priced unlimited plans, standing out amid fierce competition, CNBC reports.

據CNBC報道,At&t憑藉其價格較低的無限套餐吸引了精打細算的客戶,在激烈的競爭中脫穎而出。

AT&T's mobility segment saw a postpaid churn of 0.85% versus 0.95% a year ago. The Consumer Wireline segment had 239 thousand AT&T Fiber net adds, implying fiber broadband net additions lagging behind analyst estimates of 253 thousand. Verizon reported 391 thousand total broadband net additions.

AT&T的出行板塊的後付費流失率爲0.85%,而去年同期爲0.95%。消費有線板塊的AT&T光纖淨增量爲23.9萬個,這意味着光纖寬帶的淨增量落後於分析師估計的25.3萬。威瑞森報告稱,寬帶淨增總量爲39.1萬個。

The company reported 139 thousand AT&T Internet Air net adds.

該公司在At&T互聯網航空網中報告了13.9萬份。

AT&T's adjusted EBITDA of $11.3 billion was up from $11.1 billion a year ago. It spent $4.4 billion on Capex.

AT&T調整後的息稅折舊攤銷前利潤爲113億美元,高於去年同期的111億美元。它在資本支出上花費了44億美元。

The company generated $9.1 billion in operating cash flow (down from $9.9 billion in the year-ago quarter) and $4.6 billion in free cash flow (up from $4.2 billion last year).

該公司創造了91億美元的運營現金流(低於去年同期的99億美元)和46億美元的自由現金流(高於去年的42億美元)。

Currently, AT&T's dividend yield stands at 6.10%. Higher free cash flows allow the company to raise shareholder returns through higher stock buybacks and dividends.

目前,AT&T的股息收益率爲6.10%。更高的自由現金流使公司能夠通過更高的股票回購和分紅來提高股東回報。

Prepaid churn was 2.57% compared to 2.50% in the year-ago quarter. Postpaid phone-only ARPU was $56.42, up 1.4% compared to the year-ago quarter.

預付費流失率爲2.57%,而去年同期爲2.50%。僅限後付費電話的ARPU爲56.42美元,與去年同期相比增長了1.4%。

Operating Income: Operating income was $5.8 billion versus $6.4 billion a year ago.

營業收入:營業收入爲58億美元,去年同期爲64億美元。

Mobility segment operating income was up 1.6% year over year to $6.72 billion, with a margin of 32.8% compared to 32.6% in the year-ago quarter.

出行板塊的營業收入同比增長1.6%,達到67.2億美元,利潤率爲32.8%,而去年同期爲32.6%。

The Business Wireline segment operating margin was 2.1% compared to 7.5% in the year-ago quarter. The Consumer Wireline segment operating margin was 5.5% compared to 5.2% in the year-ago quarter.

商業有線板塊的營業利潤率爲2.1%,而去年同期爲7.5%。消費者有線板塊的營業利潤率爲5.5%,而去年同期爲5.2%。

FY24 Outlook: AT&T reiterated Wireless service revenue growth in the 3% range, Broadband revenue growth of 7%+, and adjusted EPS of $2.15 – $2.25 versus the $2.22 consensus.

24財年展望:At&t重申無線服務收入增長在3%之間,寬帶收入增長7%以上,調整後的每股收益爲2.15美元至2.25美元,而市場普遍預期爲2.22美元。

It maintained full-year adjusted EBITDA growth in the 3% range and a full-year free cash flow of $17 billion-$18 billion.

該公司將全年調整後的息稅折舊攤銷前利潤增長維持在3%之間,全年自由現金流爲170億至180億美元。

For 2025, the company affirmed the adjusted EPS growth guidance.

對於2025年,該公司確認了調整後的每股收益增長指導。

Price Action: T shares traded higher by 2.86% at $18.74 in the premarket at the last check on Wednesday.

價格走勢:在週三的最後一次盤前交易中,t股上漲2.86%,至18.74美元。

Also Read:

另請閱讀:

- Comcast'sComcast's Q2 Earnings: Studios And Theme Parks Pull Revenue Lower, Broadband And Video Subs Fall

- 康卡斯特的康卡斯特第二季度收益:工作室和主題公園降低收入,寬帶和視頻訂閱量下降

Photo by 2p2play via Shutterstock

照片由 2p2play 通過 Shutterstock 拍攝