Check Out What Whales Are Doing With JNJ

Check Out What Whales Are Doing With JNJ

Whales with a lot of money to spend have taken a noticeably bullish stance on Johnson & Johnson.

資金充裕的鯨魚明顯看好強生公司。

Looking at options history for Johnson & Johnson (NYSE:JNJ) we detected 9 trades.

查看強生(Johnson & Johnson)期權歷史記錄,我們檢測到9筆交易。

If we consider the specifics of each trade, it is accurate to state that 77% of the investors opened trades with bullish expectations and 22% with bearish.

若考慮每筆交易的具體情況,正確的表述是77%的投資者持多頭預期,22%持空頭預期。

From the overall spotted trades, 3 are puts, for a total amount of $130,505 and 6, calls, for a total amount of $278,695.

從總體上看,3種是看跌期權,總金額爲130505美元,而6種是看漲期權,總金額爲278695美元。

Expected Price Movements

預期價格波動

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $130.0 to $160.0 for Johnson & Johnson over the last 3 months.

考慮到這些合同的成交量和持倉量,過去3個月鯨魚一直把瞄準強生公司的價格範圍鎖定在130.0美元至160.0美元之間。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

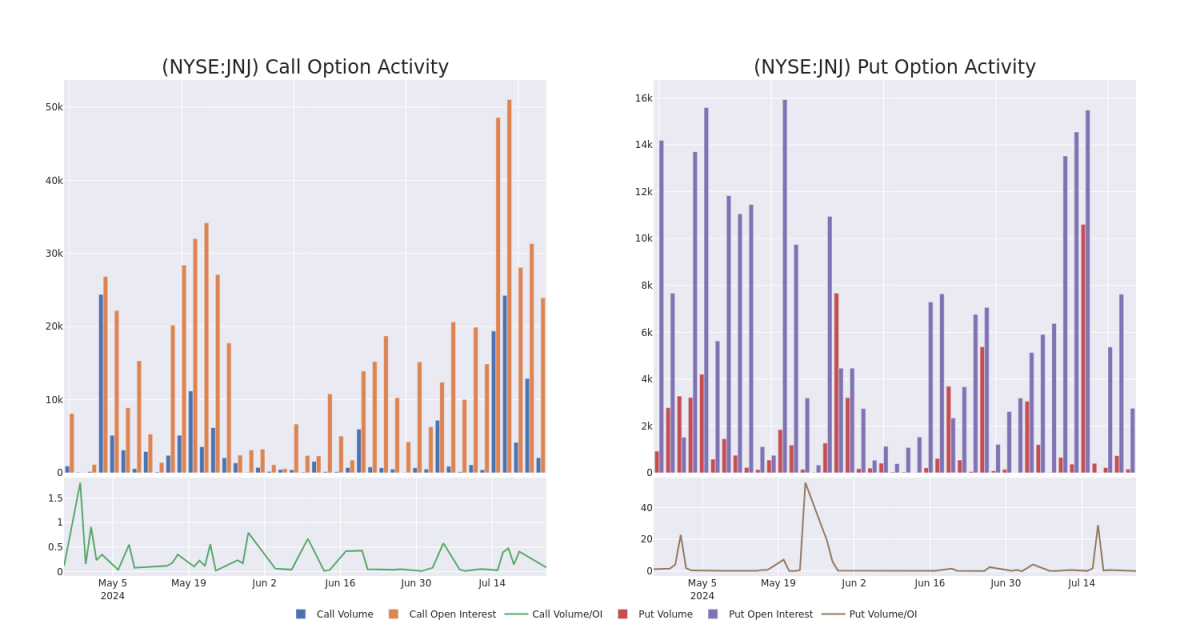

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Johnson & Johnson's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Johnson & Johnson's substantial trades, within a strike price spectrum from $130.0 to $160.0 over the preceding 30 days.

評估成交量和持倉量是期權交易的戰略步驟。這些衡量標準揭示了投資者對特定行權價格下強生公司期權的流動性和投資者興趣。即將公佈的數據展示了過去30天內強生公司在行權價範圍爲130.0美元至160.0美元的看漲期權和看跌期權的成交量和持倉量的波動情況,與強生公司的重大交易有關。

Johnson & Johnson Call and Put Volume: 30-Day Overview

強生(Johnson & Johnson)看漲、看跌期權成交量:30天總覽

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JNJ | CALL | SWEEP | BEARISH | 09/20/24 | $3.8 | $3.65 | $3.69 | $155.00 | $92.3K | 7.1K | 85 |

| JNJ | PUT | TRADE | BEARISH | 12/18/26 | $6.9 | $4.1 | $6.9 | $130.00 | $69.0K | 6 | 0 |

| JNJ | CALL | SWEEP | BULLISH | 08/16/24 | $0.57 | $0.55 | $0.57 | $160.00 | $45.5K | 14.9K | 1.1K |

| JNJ | CALL | TRADE | BULLISH | 01/16/26 | $13.6 | $12.15 | $13.6 | $155.00 | $43.5K | 284 | 32 |

| JNJ | CALL | TRADE | BULLISH | 07/26/24 | $2.19 | $2.02 | $2.14 | $152.50 | $42.8K | 679 | 348 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| JNJ24C | 看漲 | SWEEP | 看淡 | 09/20/24 | $3.8 | $3.65 | $3.69 | $155.00 | $92.3K | 7.1K | 85 |

| JNJ24C | 看跌 | 交易 | 看淡 | 12/18/26 | $6.9 | $4.1 | $6.9 | $130.00 | $69.0K | 6 | 0 |

| JNJ24C | 看漲 | SWEEP | 看好 | 08/16/24 | $0.57 | $0.55 | $0.57 | $160.00 | $45.5K | 14.9K | 1.1千 |

| JNJ24C | 看漲 | 交易 | 看好 | 01/16/26 | 13.6美元 | $12.15 | 13.6美元 | $155.00 | $43.5千 | 284 | 32 |

| JNJ24C | 看漲 | 交易 | 看好 | 07/26/24 | $2.19 | $2.02 | $2.14 | $152.50 | $42.8千 | 679 | 348 |

About Johnson & Johnson

關於Johnson & Johnson

Johnson & Johnson is the world's largest and most diverse healthcare firm. It has two divisions: pharmaceutical and medical devices. These now represent all of the company's sales following the divestment of the consumer business, Kenvue, in 2023. The drug division focuses on the following therapeutic areas: immunology, oncology, neurology, pulmonary, cardiology, and metabolic diseases. Geographically, just over half of total revenue is generated in the United States.

強生(Johnson & Johnson)是全球最大、最多元化的醫療保健公司,業務包括藥品和醫療設備兩個部門。在2023年的消費業務Kenvue剝離後,這兩個部門現在代表公司的全部銷售額。藥品部門專注於以下治療領域:免疫學、腫瘤學、神經學、肺、心臟病和代謝性疾病。地理上,總收入中略超過一半是在美國產生的。

Following our analysis of the options activities associated with Johnson & Johnson, we pivot to a closer look at the company's own performance.

在分析與強生公司相關的期權活動後,我們轉而更近距離地觀察該公司的表現。

Current Position of Johnson & Johnson

強生公司的當前持倉

- With a volume of 1,964,188, the price of JNJ is up 1.88% at $155.21.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 83 days.

- 強生公司成交量爲1,964,188股,價格上漲1.88%,爲155.21美元。

- RSI指標暗示該股票可能要超買了。

- 下次盈利預計在83天后發佈。

What The Experts Say On Johnson & Johnson

有關強生公司的專家意見

5 market experts have recently issued ratings for this stock, with a consensus target price of $182.0.

5位市場專家最近對這隻股票發佈了評級,共識目標價爲$182.0。

- In a cautious move, an analyst from Cantor Fitzgerald downgraded its rating to Overweight, setting a price target of $215.

- Maintaining their stance, an analyst from Goldman Sachs continues to hold a Neutral rating for Johnson & Johnson, targeting a price of $155.

- Reflecting concerns, an analyst from Cantor Fitzgerald lowers its rating to Overweight with a new price target of $215.

- An analyst from Daiwa Capital downgraded its action to Neutral with a price target of $150.

- An analyst from RBC Capital downgraded its action to Outperform with a price target of $175.

- 作爲預防措施,Cantor Fitzgerald的一位分析師將其評級下調爲超重,將價格目標設定爲215美元。

- 高盛的分析師維持強生公司的中立評級,目標價爲155美元。

- 反映擔憂,Cantor Fitzgerald的分析師將其評級降至增持,並給出新的價格目標爲215美元。

- Daiwa Capital的分析師把其評級下調至中立,並給出150美元的價格目標。

- RBC Capital的分析師將其評級降至跑贏大市,並給出175美元的價格目標。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Johnson & Johnson options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在回報。精明的交易者通過不斷學習、調整其策略、監控多種因子以及密切關注市場動向來管理這些風險。通過Benzinga Pro的實時警報,了解最新的強生(Johnson & Johnson)期權交易。