Decoding EMCOR Group's Options Activity: What's the Big Picture?

Decoding EMCOR Group's Options Activity: What's the Big Picture?

Financial giants have made a conspicuous bearish move on EMCOR Group. Our analysis of options history for EMCOR Group (NYSE:EME) revealed 11 unusual trades.

金融巨頭在EMCOR Group上做了明顯的看淡舉動。我們分析了EMCOR Group(NYSE:EME)期權歷史,發現11次不同尋常的交易。

Delving into the details, we found 45% of traders were bullish, while 54% showed bearish tendencies. Out of all the trades we spotted, 3 were puts, with a value of $184,750, and 8 were calls, valued at $500,020.

深入挖掘細節,我們發現45%的交易者看好,54%的交易者表現出看淡趨勢。我們發現所有發現的交易中,有3次看跌交易,價值爲$ 184,750,8次看漲交易,價值爲$ 500,020。

Projected Price Targets

預計價格目標

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $310.0 to $380.0 for EMCOR Group over the last 3 months.

考慮到這些合同的成交量和未平倉合約數量,似乎鯨魚們在過去3個月裏一直在瞄準EMCOR Group的價格區間爲$ 310.0至$ 380.0。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

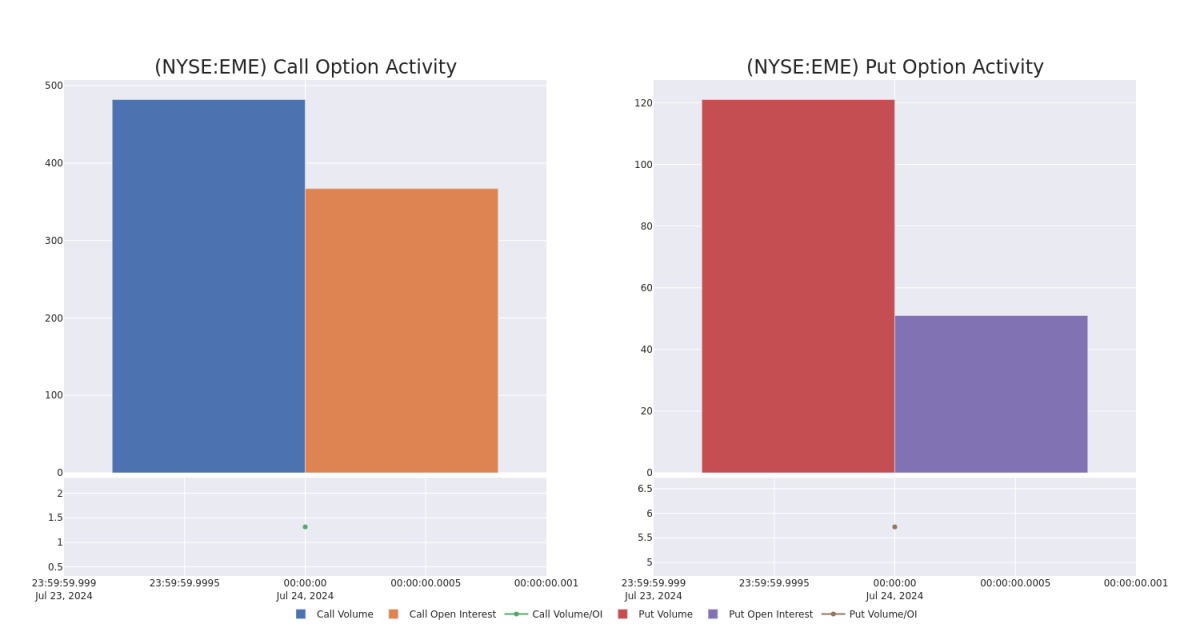

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in EMCOR Group's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to EMCOR Group's substantial trades, within a strike price spectrum from $310.0 to $380.0 over the preceding 30 days.

評估成交量和未平倉合約是期權交易的重要步驟。這些指標揭示了EMCOR Group期權的流動性和投資者對指定行權價的興趣。即將到來的數據可視化了EMCOR Group在$ 310.0至$ 380.0行權價區間內的看漲和看跌期權的成交量和未平倉合約的波動情況,這些期權交易與EMCOR Group的重大交易相關。 過去30天。

EMCOR Group Option Volume And Open Interest Over Last 30 Days

EMCOR Group過去30天的期權成交量和未平倉合約

Largest Options Trades Observed:

觀察到的最大期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EME | CALL | TRADE | BULLISH | 05/16/25 | $53.5 | $51.7 | $53.5 | $370.00 | $160.5K | 151 | 30 |

| EME | PUT | SWEEP | BULLISH | 08/16/24 | $14.6 | $12.2 | $13.7 | $360.00 | $130.1K | 45 | 100 |

| EME | CALL | TRADE | BULLISH | 05/16/25 | $52.0 | $50.4 | $52.0 | $370.00 | $104.0K | 151 | 50 |

| EME | CALL | SWEEP | BEARISH | 10/18/24 | $20.7 | $18.2 | $18.2 | $380.00 | $91.0K | 210 | 50 |

| EME | CALL | TRADE | BEARISH | 05/16/25 | $52.2 | $50.0 | $50.0 | $370.00 | $30.0K | 151 | 80 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| EME | 看漲 | 交易 | 看好 | 05/16/25 | $ 53.5 | $51.7 | $ 53.5 | $370.00 | $ 160.5K | 151 | 30 |

| EME | 看跌 | SWEEP | 看好 | 08/16/24 | 14.6美元 | $12.2 | $13.7 | $360.00 | $130.1K | 45 | 100 |

| EME | 看漲 | 交易 | 看好 | 05/16/25 | $52.0 | $ 50.4 | $52.0 | $370.00 | 104,000美元 | 151 | 50 |

| EME | 看漲 | SWEEP | 看淡 | 10/18/24 | $20.7美元 | $18.2 | $18.2 | $380.00 | 91000 美元 | 210 | 50 |

| EME | 看漲 | 交易 | 看淡 | 05/16/25 | $52.2 | $50.0 | $50.0 | $370.00 | $30.0K | 151 | 80 |

About EMCOR Group

關於EMCOR Group

EMCOR Group Inc is a specialty contractor in the United States and a provider of electrical and mechanical construction and facilities services, building services, and industrial services. Its services are provided to a broad range of commercial, technology, manufacturing, industrial, healthcare, utility, and institutional customers through approximately 100 operating subsidiaries. The company's operating subsidiaries are organized into reportable segments: United States electrical construction and facilities services, United States mechanical construction and facilities services, United States building services, United States industrial services, and United Kingdom building services. Geographically the majority of revenue is generated from the United States.

EMCOR Group Inc是美國的一家專業承包商,提供電氣和機械建築、設施服務、建築服務和工業服務。公司通過大約100個運營子公司向廣泛的商業、科技、製造業、工業、醫療、公共事業和機構客戶提供服務。該公司的運營子公司組織爲可報告的細分領域:美國電氣建築和設施服務、美國機械建築和設施服務、美國建築服務、美國工業服務和英國建築服務。從地理上看,大部分營業收入來自美國。

Having examined the options trading patterns of EMCOR Group, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在分析了EMCOR Group期權交易模式之後,我們現在將直接轉向該公司。這種轉變使我們能夠深入研究其現在的市場地位和表現。

EMCOR Group's Current Market Status

EMCOR Group當前的市場狀態

- With a volume of 602,665, the price of EME is down -5.93% at $356.73.

- RSI indicators hint that the underlying stock is currently neutral between overbought and oversold.

- Next earnings are expected to be released in 1 days.

- EME的成交量爲602,665,價格下跌-5.93%,爲$ 356.73。

- RSI指標暗示該標的股票目前處於超買和超賣的中立區間。

- 下次盈利預計將於1天內發佈。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。