Market Mover | STMicroelectronics Shares Drop 10% After Q2 Earning Release

Market Mover | STMicroelectronics Shares Drop 10% After Q2 Earning Release

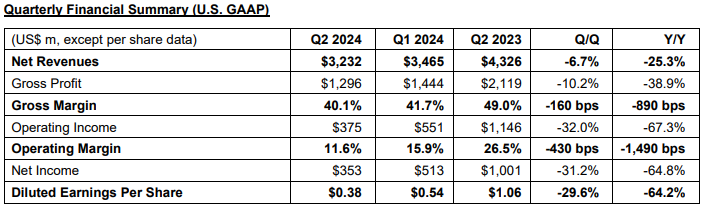

July 25, 2024 - $STMicroelectronics (STM.US)$shares dropped 10.22% to $35.50 in pre-market trading on Thursday. The company has reported U.S. GAAP financial results for the second quarter ended June 29, 2024.

2024年7月25日 - $意法半導體 (STM.US)$週四美股盤前,股價下跌10.22%至35.50美元。該公司已公佈了截至2024年6月29日的第二季度美國通用會計準則財務業績報告。

Jean-Marc Chery, ST President & CEO, commented:

St主席兼首席執行官Jean-Marc Chery評論道:

“Q2 net revenues were above the midpoint of our business outlook range driven by higher revenues in Personal Electronics, partially offset by lower than expected revenues in Automotive. Gross margin was in line with expectations.”

“First half net revenues decreased 21.9% year-over-year, mainly driven by a decrease in Microcontrollers and Power and Discrete segments. Operating margin was 13.8% and net income was $865 million.”

“During the quarter, contrary to our prior expectations, customer orders for Industrial did not improve and Automotive demand declined.”

“Our third quarter business outlook, at the mid-point, is for net revenues of $3.25 billion, decreasing year-overyear by 26.7% and increasing sequentially by 0.6%; gross margin is expected to be about 38%, impacted by about 350 basis points of unused capacity charges.”

“We will now drive the Company based on a plan for FY24 revenues in the range of $13.2 billion to $13.7 billion. Within this plan, we expect a gross margin of about 40%.”

“第二季度淨收入超過了業務展望範圍的中點,由個人電子的收入增長推動,部分抵消了在汽車業務中低於預期的收入。毛利率與預期相符。”

“上半年淨收入同比下降21.9%,主要由單片機和功率及分立器件業務的下降所致。營業利潤率爲13.8%,淨利潤爲$86500萬。”

“在本季度,與我們之前的預期相反,工業業務的客戶訂單沒有改善,汽車需求也下降了。”

“我們的第三季度業務展望,在中點爲淨收入32.5億美元,同比下降26.7%,環比增長0.6%;預計毛利率約爲38%,受未使用產能費用約350點子的影響。”

“我們將根據收入在132億至137億美元範圍內的2024財年規劃推動公司發展。在此計劃中,我們預計毛利率約爲40%。”

Business Outlook

業務展望

ST’s guidance, at the mid-point, for the 2024 third quarter is:

意法半導體2024財年第三季度的指引,中點如下:

Net revenues are expected to be $3.25 billion, an increase of 0.6% sequentially, plus or minus 350 basis points.

Gross margin of 38%, plus or minus 200 basis points.

This outlook is based on an assumed effective currency exchange rate of approximately $1.07 = €1.00 for the 2024 third quarter and includes the impact of existing hedging contracts.

The third quarter will close on September 28, 2024.

預計淨銷售額爲32.5億美元,環比增長0.6%,誤差範圍爲350個點子。

毛利率爲38%,誤差範圍爲200個點子。

這一展望基於2024年第三季度約1.07美元 = 1歐元的有效貨幣兌換率,幷包含現有對沖合約的影響。

2024年第三季度將於2024年9月28日結束。

Related Reading: Press Release

相關閱讀:新聞發佈