Tesla, Apple Chip Supplier STMicroelectronics Q2 Earnings Hit by Weakness in Industrial and Automotive Sectors, Stock Plunges

Tesla, Apple Chip Supplier STMicroelectronics Q2 Earnings Hit by Weakness in Industrial and Automotive Sectors, Stock Plunges

STMicroelectronics NV (NYSE: STM) reported a fiscal second-quarter 2024 revenue decline of 25.3% year-on-year to $3.23 billion, beating the analyst consensus estimate of $3.20 billion.

意法半導體 (紐交所: STM) 報告財務季度第二季度2024年營業收入同比下降25.3%至32.3億美元,超過分析師一致預期的32億美元。

The Tesla Inc (NASDAQ:TSLA) and Apple Inc (NASDAQ:AAPL) supplier's EPS of $0.38 beat the analyst consensus estimate of $0.36.

特斯拉 (納斯達克: TSLA) 和蘋果 (納斯達克: AAPL) 的供應商每股收益爲0.38美元,超過分析師一致預期的0.36美元。

Sales to OEMs decreased by 14.9% Y/Y, and Distribution sales fell by 43.7% Y/Y.

銷往原始設備製造商的銷售同比下降14.9%,分銷銷售同比下降43.7%。

Analog products, MEMS, and Sensors (AM&S) segment revenue declined 10.0% Y/Y to $1.17 billion, mainly due to a decrease in Imaging.

模擬產品、微電子機械系統及傳感器 (AM&S) 部門的營收同比下降10.0%至11.7億美元,主要因圖像部門銷售下降所致。

Power and Discrete products (P&D) segment revenue decreased 24.4% Y/Y to $747 million.

電源和離散產品 (P&D) 部門的營收同比下降24.4%至74700萬美元。

The microcontrollers (MCU) segment revenue decreased 46.0% year over year to $800 million, mainly due to a decrease in GP MCU.

微控制器 (MCU) 部門的營收同比下降46.0%至80000萬美元,主要因通用乘用車微控制器的銷量下降所致。

Digital ICs and RF products (D&RF) segment revenue decreased 7.6% Y/Y to $516 million due to a decrease in ADAS.

數字集成電路和射頻器件 (D&RF) 部門的營收同比下降7.6%至51600萬美元,主要由於高級輔助駕駛系統的銷量下降。

Margins: The gross margin declined by 890 bps to 40.1%, mainly due to the combination of the sales price, product mix, and unused capacity charges. The operating margin decreased by 1,490 bps to 11.6%.

利潤率:毛利率下降890個點子至40.1%,主要由於銷售價格、產品組合和閒置能力費用的綜合影響。營業利潤率下降1490個點子至11.6%。

STMicroelectronics generated $159 million in free cash flow and held $6.3 billion in cash and equivalents as of June 29, 2024. It generated an operating cash flow of $702 million.

意法半導體自由現金流達1.59億美元,截至2024年6月29日,現金及等價物爲63億美元。該公司的經營現金流爲7.02億美元。

Jean-Marc Chery, ST President & CEO, commented: "Q2 net revenues were above the midpoint of our business outlook range driven by higher revenues in Personal Electronics, partially offset by lower than expected revenues in Automotive. Gross margin was in line with expectations."

意法半導體總裁兼首席執行官Jean-Marc Chery表示: "第二季度淨營收超出了我們業務展望區間的中點,主要由個人電子業務收入增長支撐,部分抵消了汽車銷售收入低於預期的影響。毛利率與預期持平。"

"During the quarter, contrary to our prior expectations, customer orders for Industrial did not improve and Automotive demand declined."

"本季度,與我們此前的預期相反,工業客戶訂單未改善,汽車需求下降。"

Outlook: STMicroelectronics expects fiscal third-quarter 2024 revenue of $3.25 billion, a decrease of about 0.6% sequentially, plus or minus 350 bps (consensus $3.58 billion). The company expects a gross margin of 38.0%, plus or minus 200 bps.

展望:意法半導體預計2024年第三財季營收爲32.5億美元,環比下降約0.6%,加減350個點子(市場預期在35.8億美元)。公司預計毛利率爲38.0%,加減200個點子。

It now expects fiscal 2024 revenue of $13.2 billion – $13.7 billion (prior $14 billion – $15 billion) versus consensus of $14.34 billion and a gross margin of 40% (prior in the low 40%).

現在,公司預計2024年營收爲132億至137億美元,押低了先前爲140億至150億美元的預期,市場預期爲143.4億美元,毛利率爲40%(先前爲低於40%)。

During the first-quarter print, the company maintained a net Capex outlook of $2.5 billion for fiscal 2024.

在第一季度公佈的業績中,公司維持了2024財年淨資本支出預期爲25億美元的展望。

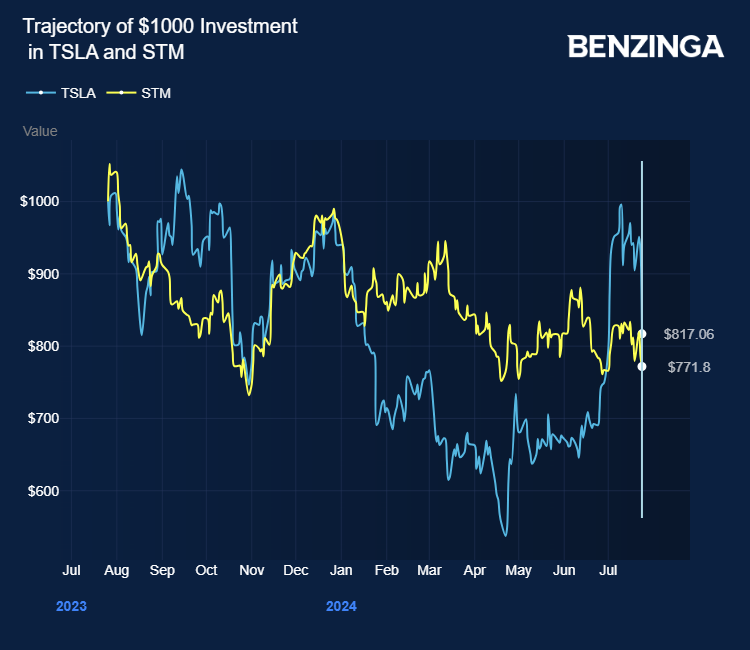

STMicroelectronics stock plunged 23.4% in the last 12 months.

意法半導體的股票在過去12個月中下跌了23.4%。

Price Action: STM shares traded lower by 13.01% at $34.41 premarket at the last check on Thursday.

由Michael Vi(許可)通過Shutterstock發佈的照片。

Photo by Michael Vi via Shutterstock

shutterstock