This Is What Whales Are Betting On CrowdStrike Holdings

This Is What Whales Are Betting On CrowdStrike Holdings

Whales with a lot of money to spend have taken a noticeably bearish stance on CrowdStrike Holdings.

有大量資金可以花的鯨魚對CrowdStrike Holdings採取了明顯的看跌立場。

Looking at options history for CrowdStrike Holdings (NASDAQ:CRWD) we detected 19 trades.

查看CrowdStrike Holdings(納斯達克股票代碼:CRWD)的期權歷史記錄,我們發現了19筆交易。

If we consider the specifics of each trade, it is accurate to state that 31% of the investors opened trades with bullish expectations and 36% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,31%的投資者以看漲的預期開啓交易,36%的投資者持看跌預期。

From the overall spotted trades, 6 are puts, for a total amount of $820,726 and 13, calls, for a total amount of $654,600.

在已發現的全部交易中,有6筆是看跌期權,總額爲820,726美元,13筆是看漲期權,總額爲654,600美元。

Predicted Price Range

預測的價格區間

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $210.0 to $360.0 for CrowdStrike Holdings over the last 3 months.

考慮到這些合約的交易量和未平倉合約,在過去的3個月中,鯨魚似乎一直將CrowdStrike Holdings的價格定在210.0美元至360.0美元之間。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

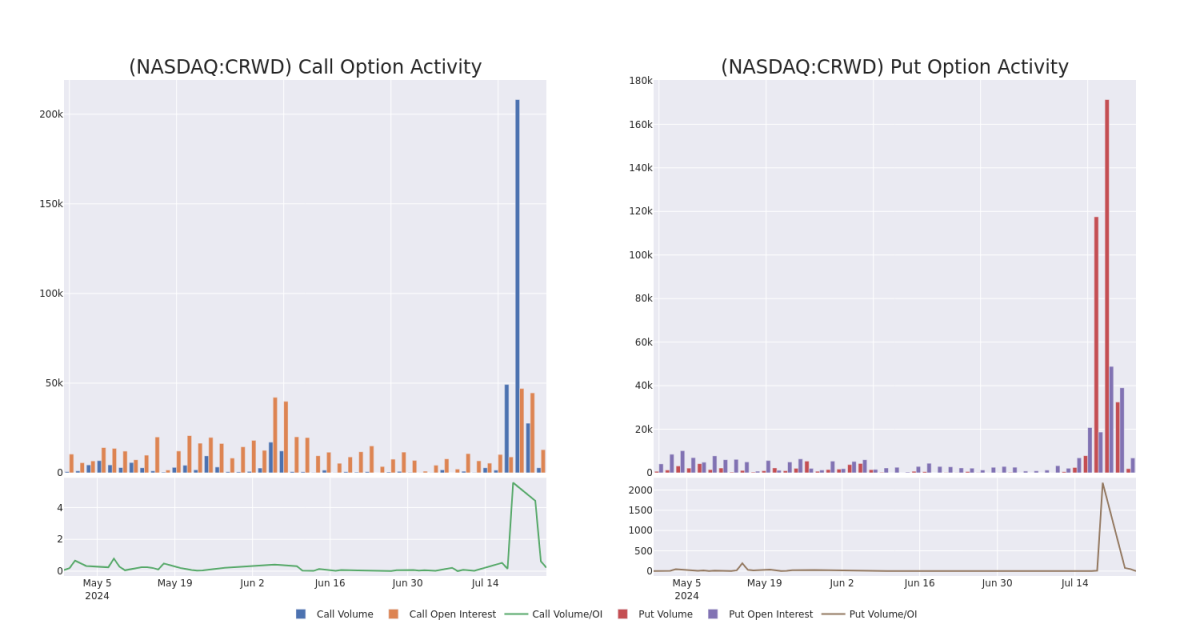

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

查看交易量和未平倉合約是一種對股票進行盡職調查的有見地的方法。

This data can help you track the liquidity and interest for CrowdStrike Holdings's options for a given strike price.

這些數據可以幫助您跟蹤給定行使價下CrowdStrike Holdings期權的流動性和利息。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of CrowdStrike Holdings's whale activity within a strike price range from $210.0 to $360.0 in the last 30 days.

下面,我們可以分別觀察CrowdStrike Holdings在過去30天行使價範圍內所有鯨魚活動的看漲和看跌期權交易量和未平倉合約的變化。

CrowdStrike Holdings Option Activity Analysis: Last 30 Days

CrowdStrike Holdings期權活動分析:過去30天

Biggest Options Spotted:

發現的最大選擇:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| CRWD | PUT | TRADE | BULLISH | 08/16/24 | $102.1 | $99.55 | $99.55 | $360.00 | $567.4K | 197 | 11 |

| CRWD | CALL | SWEEP | NEUTRAL | 07/26/24 | $3.2 | $3.1 | $3.1 | $265.00 | $160.0K | 2.7K | 1.2K |

| CRWD | CALL | SWEEP | BULLISH | 01/17/25 | $68.7 | $67.7 | $68.7 | $210.00 | $109.6K | 1.0K | 1 |

| CRWD | PUT | SWEEP | BULLISH | 07/26/24 | $2.34 | $1.95 | $1.9 | $255.00 | $94.9K | 3.4K | 1.3K |

| CRWD | CALL | SWEEP | NEUTRAL | 01/17/25 | $54.5 | $53.6 | $54.5 | $230.00 | $81.5K | 326 | 12 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 人群 | 放 | 貿易 | 看漲 | 08/16/24 | 102.1 美元 | 99.55 美元 | 99.55 美元 | 360.00 美元 | 567.4 萬美元 | 197 | 11 |

| 人群 | 打電話 | 掃 | 中立 | 07/26/24 | 3.2 美元 | 3.1 美元 | 3.1 美元 | 265.00 美元 | 160.0K | 2.7K | 1.2K |

| 人群 | 打電話 | 掃 | 看漲 | 01/17/25 | 68.7 美元 | 67.7 美元 | 68.7 美元 | 210.00 美元 | 109.6 萬美元 | 1.0K | 1 |

| 人群 | 放 | 掃 | 看漲 | 07/26/24 | 2.34 美元 | 1.95 美元 | 1.9 美元 | 255.00 美元 | 94.9 萬美元 | 3.4K | 1.3K |

| 人群 | 打電話 | 掃 | 中立 | 01/17/25 | 54.5 美元 | 53.6 美元 | 54.5 美元 | 230.00 美元 | 81.5 萬美元 | 326 | 12 |

About CrowdStrike Holdings

關於 CrowdStrike

CrowdStrike is a cloud-based cybersecurity company specializing in next-generation security verticals such as endpoint, cloud workload, identity, and security operations. CrowdStrike's primary offering is its Falcon platform that offers a proverbial single pane of glass for an enterprise to detect and respond to security threats attacking its IT infrastructure. The Texas-based firm was founded in 2011 and went public in 2019.

CrowdStrike是一家基於雲的網絡安全公司,專門從事下一代安全垂直領域,例如端點、雲工作負載、身份和安全運營。CrowdStrike的主要產品是其Falcon平台,該平台爲企業提供了衆所周知的單一管理面板,以檢測和應對攻擊其IT基礎設施的安全威脅。這家總部位於德克薩斯州的公司成立於2011年,並於2019年上市。

In light of the recent options history for CrowdStrike Holdings, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於CrowdStrike Holdings最近的期權歷史,現在應該專注於公司本身。我們的目標是探索其目前的表現。

Present Market Standing of CrowdStrike Holdings

CrowdStrike Holdings 目前的

- With a volume of 714,932, the price of CRWD is up 0.05% at $258.26.

- RSI indicators hint that the underlying stock may be oversold.

- Next earnings are expected to be released in 34 days.

- CRWD的交易量爲714,932美元,上漲0.05%,至258.26美元。

- RSI 指標暗示標的股票可能被超賣。

- 下一份業績預計將在34天后公佈。

What Analysts Are Saying About CrowdStrike Holdings

分析師對於 CrowdStrike Holdings

5 market experts have recently issued ratings for this stock, with a consensus target price of $357.4.

5位市場專家最近發佈了該股的評級,共識目標價爲357.4美元。

- Consistent in their evaluation, an analyst from Evercore ISI Group keeps a Outperform rating on CrowdStrike Holdings with a target price of $350.

- Consistent in their evaluation, an analyst from Canaccord Genuity keeps a Buy rating on CrowdStrike Holdings with a target price of $405.

- Consistent in their evaluation, an analyst from RBC Capital keeps a Outperform rating on CrowdStrike Holdings with a target price of $380.

- Maintaining their stance, an analyst from Rosenblatt continues to hold a Buy rating for CrowdStrike Holdings, targeting a price of $350.

- Reflecting concerns, an analyst from HSBC lowers its rating to Hold with a new price target of $302.

- 根據他們的評估,Evercore ISI集團的一位分析師維持CrowdStrike Holdings的跑贏大盤評級,目標價爲350美元。

- Canaccord Genuity的一位分析師在評估中保持了對CrowdStrike Holdings的買入評級,目標價爲405美元。

- 加拿大皇家銀行資本的一位分析師在評估中保持了CrowdStrike Holdings的跑贏大盤評級,目標價爲380美元。

- 羅森布拉特的一位分析師保持立場,繼續維持CrowdStrike Holdings的買入評級,目標價格爲350美元。

- 匯豐銀行的一位分析師將其評級下調至持有,新的目標股價爲302美元,這反映了人們的擔憂。

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for CrowdStrike Holdings with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了獲得更高利潤的可能性。精明的交易者通過持續的教育、戰略交易調整、利用各種指標以及隨時關注市場動態來降低這些風險。使用Benzinga Pro了解CrowdStrike Holdings的最新期權交易,獲取實時提醒。