Goldman Sachs: Time To Hedge? Goldman's Flow-Of-Funds Guru Scott Rubner Suggests Hedging. Here Are Inexpensive Ways To Do So Ahead Of Mag 7 Earnings Next Week

Goldman Sachs: Time To Hedge? Goldman's Flow-Of-Funds Guru Scott Rubner Suggests Hedging. Here Are Inexpensive Ways To Do So Ahead Of Mag 7 Earnings Next Week

"Hedging Is Gaining Traction"

“套期保值越來越受歡迎”

That's what Goldman Sachs's flow of funds guru Scott Rubner said in his note earlier today ("I Am Not Buying This Dip").

這就是高盛的資金流大師斯科特·魯布納在今天早些時候的報告中所說的話(“我不是在逢低買入”)。

He also pointed out that four of the Magnificent Seven mega caps are reporting earnings next week: Microsoft Corporation (NASDAQ:MSFT), Meta Platforms, Inc. (NASDAQ:META), Apple, Inc. (NASDAQ:AAPL), and Amazon.com, Inc. (NASDAQ:AMZN), and that if their results and guidance are not "great", those stocks will likely get punished in this market environment.

他還指出,宏偉七大巨頭中有四家將在下週公佈業績:微軟公司(納斯達克股票代碼:MSFT)、Meta Platforms, Inc.(納斯達克股票代碼:META)、蘋果公司(納斯達克股票代碼:AAPL)和亞馬遜公司(納斯達克股票代碼:AMZN),如果他們的業績和指導不是 “好”,這些股票很可能會在這個市場上受到懲罰環境。

In the video below, I show inexpensive ways of hedging Microsoft and Meta ahead of their earnings next week.

在下面的視頻中,我展示了在微軟和Meta下週業績之前對沖微軟和Meta的廉價方法。

I mention a couple of times there that there's a link to download the newly updated Portfolio Armor iPhone app in the description of the video. Unfortunately, I found out after recording that that YouTube is not allowing me to post clickable links in the description, apparently because I uploaded a newsworthy clip of the late head of Wagner PMC recruiting prisoners for the Ukraine War last year (they have Wagner listed as a criminal organization, even though it's basically the Russian version of America's Blackwater).

我曾多次提到,視頻描述中有一個下載最新更新的 Portfolio Armor iPhone 應用程序的鏈接。不幸的是,我在錄製後發現YouTube不允許我在描述中發佈可點擊的鏈接,這顯然是因爲我上傳了一段具有新聞價值的片段,講述了去年瓦格納PMC的已故負責人爲烏克蘭戰爭招募囚犯(他們將瓦格納列爲犯罪組織,儘管它基本上是俄語版的美國黑水)。

But you can download the app here.

但是你可以在這裏下載應用程序。

Hedging META Ahead Of Earnings

在盈利之前對沖META

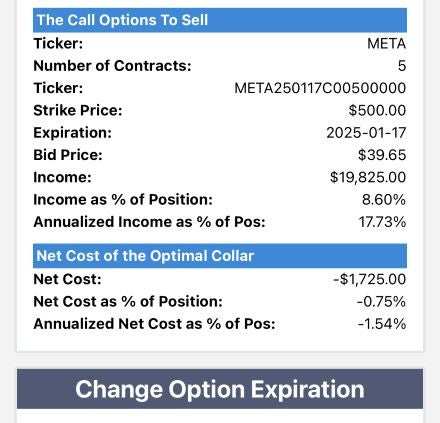

This is one of the hedges I present in the video, an optimal collar, as of Wednesday's close, to hedge 500 shares of META against a >5% decline by next Friday, without capping your possible upside at less than 8% on the week.

這是我在視頻中介紹的套期保值之一,是截至週三收盤時對沖500股META股票以應對下週五跌幅度超過5%的最佳選擇,而不會將本週可能的上漲幅度限制在8%以下。

As you can see, the net cost there was negative, meaning you'd collect a net credit of $1,725 when hedging META this way.

如您所見,那裏的淨成本爲負數,這意味着以這種方式對沖META時,您將獲得1,725美元的淨積分。

Something to consider if you're long Mag 7 stocks heading into earnings next week.

如果你看多下週即將進入業績的科技七巨頭股票,需要考慮一些問題。

Using The Correction To Look For Buying Opportunities

使用修正來尋找買入機會

In the Portfolio Armor trading Substack, we'll be using any further correction to look for buying opportunities. If you'd like a heads up when we place our next trade their, feel free to subscribe below.

在投資組合裝甲交易子堆棧中,我們將使用任何進一步的修正來尋找買入機會。如果您想提醒我們下次交易他們的時間,請隨時在下面訂閱。

If you'd like to stay in touch

如果你想保持聯繫

You can scan for optimal hedges for individual securities, find our current top ten names, and create hedged portfolios on our website. You can also follow Portfolio Armor on X here, or become a free subscriber to our trading Substack using the link below (we're using that for our occasional emails now).

您可以掃描個別證券的最佳套期保值,找到我們目前排名前十的股票,並在我們的網站上創建對沖投資組合。你也可以在此處的X上關注Portfolio Armor,或者使用下面的鏈接成爲我們的交易Substack的免費訂閱者(我們現在偶爾會用它來發送電子郵件)。

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

本文來自一位未付費的外部撰稿人。它不代表 Benzinga 的舉報,也未就內容或準確性進行過編輯。

I mention a couple of times there that there's a link to download the newly updated Portfolio Armor iPhone app in the description of the video. Unfortunately, I found out after recording that that YouTube is not allowing me to post clickable links in the description, apparently because I uploaded a newsworthy clip of the late head of Wagner PMC recruiting prisoners for the Ukraine War last year (they have Wagner listed as a criminal organization, even though it's basically the Russian version of America's Blackwater).

I mention a couple of times there that there's a link to download the newly updated Portfolio Armor iPhone app in the description of the video. Unfortunately, I found out after recording that that YouTube is not allowing me to post clickable links in the description, apparently because I uploaded a newsworthy clip of the late head of Wagner PMC recruiting prisoners for the Ukraine War last year (they have Wagner listed as a criminal organization, even though it's basically the Russian version of America's Blackwater).