Assessing Visa's Performance Against Competitors In Financial Services Industry

Assessing Visa's Performance Against Competitors In Financial Services Industry

In the dynamic and fiercely competitive business environment, conducting a thorough analysis of companies is crucial for investors and industry enthusiasts. In this article, we will perform an extensive industry comparison, evaluating Visa (NYSE:V) in relation to its major competitors in the Financial Services industry. By closely examining crucial financial metrics, market position, and growth prospects, we aim to offer valuable insights for investors and shed light on company's performance within the industry.

在充滿活力和激烈競爭的商業環境中,對公司進行透徹的分析對投資者和行業愛好者至關重要。在本文中,我們將進行廣泛的行業比較,評估Visa(紐約證券交易所代碼:V)與其在金融服務行業的主要競爭對手的關係。通過仔細研究關鍵財務指標、市場地位和增長前景,我們的目標是爲投資者提供寶貴的見解,並闡明公司在行業內的表現。

Visa Background

簽證背景

Visa is the largest payment processor in the world. In fiscal 2023, it processed almost $15 trillion in total volume. Visa operates in over 200 countries and processes transactions in over 160 currencies. Its systems are capable of processing over 65,000 transactions per second.

Visa是世界上最大的支付處理商。在2023財年,它處理了近15萬億美元的總交易量。Visa在200多個國家開展業務,處理超過160種貨幣的交易。它的系統每秒能夠處理超過65,000筆交易。

| Company | P/E | P/B | P/S | ROE | EBITDA (in billions) | Gross Profit (in billions) | Revenue Growth |

|---|---|---|---|---|---|---|---|

| Visa Inc | 27.21 | 12.91 | 14.88 | 12.62% | $6.45 | $7.13 | 1.42% |

| Mastercard Inc | 34.38 | 55.50 | 15.83 | 42.49% | $3.92 | $4.83 | 10.44% |

| Fiserv Inc | 28.03 | 3.35 | 4.87 | 2.51% | $1.96 | $2.88 | 7.39% |

| PayPal Holdings Inc | 14.63 | 2.94 | 2.08 | 4.25% | $1.56 | $3.46 | 9.36% |

| Fidelity National Information Services Inc | 104.62 | 2.33 | 4.47 | 3.9% | $0.8 | $0.92 | 2.92% |

| Block Inc | 102.85 | 2.01 | 1.67 | 2.51% | $0.51 | $2.09 | 19.38% |

| Global Payments Inc | 19.56 | 1.13 | 2.62 | 1.39% | $0.95 | $1.5 | 5.57% |

| Corpay Inc | 21.28 | 6.17 | 5.59 | 7.03% | $0.48 | $0.73 | 3.76% |

| Jack Henry & Associates Inc | 32.36 | 6.88 | 5.60 | 4.97% | $0.17 | $0.21 | 5.9% |

| WEX Inc | 29.07 | 4.21 | 2.97 | 3.66% | $0.23 | $0.39 | 6.65% |

| Euronet Worldwide Inc | 17.36 | 3.71 | 1.32 | 6.76% | $0.18 | $0.41 | 15.08% |

| PagSeguro Digital Ltd | 13.49 | 1.71 | 2.58 | 3.57% | $1.77 | $0.2 | 10.15% |

| Shift4 Payments Inc | 44.20 | 6.26 | 1.50 | 3.1% | $0.1 | $0.19 | 29.32% |

| The Western Union Co | 7.33 | 10.54 | 1.03 | 32.55% | $0.24 | $0.41 | 1.18% |

| StoneCo Ltd | 14.06 | 1.52 | 1.98 | 2.52% | $0.9 | $2.14 | 15.45% |

| Paymentus Holdings Inc | 86.70 | 5.64 | 3.85 | 1.66% | $0.02 | $0.05 | 24.64% |

| Evertec Inc | 34.45 | 4.33 | 3.04 | 2.9% | $0.07 | $0.1 | 28.47% |

| DLocal Ltd | 16.91 | 4.51 | 3.23 | 3.8% | $0.05 | $0.06 | 34.34% |

| Payoneer Global Inc | 17.90 | 3.03 | 2.42 | 4.37% | $0.05 | $0.19 | 18.84% |

| Average | 35.51 | 6.99 | 3.7 | 7.44% | $0.78 | $1.15 | 13.82% |

| 公司 | P/E | P/B | 市銷率 | 羅伊 | 息稅折舊攤銷前利潤(單位:十億) | 毛利(單位:十億) | 收入增長 |

|---|---|---|---|---|---|---|---|

| Visa Inc | 27.21 | 12.91 | 14.88 | 12.62% | 6.45 美元 | 7.13 美元 | 1.42% |

| 萬事達卡公司 | 34.38 | 55.50 | 15.83 | 42.49% | 3.92 美元 | 4.83 美元 | 10.44% |

| Fiserv Inc. | 28.03 | 3.35 | 4.87 | 2.51% | 1.96 美元 | 2.88 美元 | 7.39% |

| 貝寶控股公司 | 14.63 | 2.94 | 2.08 | 4.25% | 1.56 | 3.46 美元 | 9.36% |

| 富達國家信息服務公司 | 104.62 | 2.33 | 4.47 | 3.9% | 0.8 美元 | 0.92 美元 | 2.92% |

| Block Inc | 102.85 | 2.01 | 1.67 | 2.51% | 0.51 美元 | 2.09 美元 | 19.38% |

| 全球支付公司 | 19.56 | 1.13 | 2.62 | 1.39% | 0.95 美元 | 1.5 美元 | 5.57% |

| Corpay Inc | 21.28 | 6.17 | 5.59 | 7.03% | 0.48 美元 | 0.73 美元 | 3.76% |

| 傑克·亨利律師事務所 | 32.36 | 6.88 | 5.60 | 4.97% | 0.17 美元 | 0.21 美元 | 5.9% |

| WEX Inc | 29.07 | 4.21 | 2.97 | 3.66% | 0.23 美元 | 0.39 美元 | 6.65% |

| Euronet 全球公司 | 17.36 | 3.71 | 1.32 | 6.76% | 0.18 美元 | 0.41 美元 | 15.08% |

| PagSeguro 數字有限公司 | 13.49 | 1.71 | 2.58 | 3.57% | 1.77 | 0.2 美元 | 10.15% |

| Shift4 Payments | 44.20 | 6.26 | 1.50 | 3.1% | 0.1 美元 | 0.19 美元 | 29.32% |

| 西聯匯款公司 | 7.33 | 10.54 | 1.03 | 32.55% | 0.24 美元 | 0.41 美元 | 1.18% |

| Stoneco Ltd | 14.06 | 1.52 | 1.98 | 2.52% | 0.9 美元 | 2.14 美元 | 15.45% |

| Paymentus 控股公司 | 86.70 | 5.64 | 3.85 | 1.66% | 0.02 | 0.05 美元 | 24.64% |

| 埃弗泰克公司 | 34.45 | 4.33 | 3.04 | 2.9% | 0.07 美元 | 0.1 美元 | 28.47% |

| dLocal 有限公司 | 16.91 | 4.51 | 3.23 | 3.8% | 0.05 美元 | 0.06 美元 | 34.34% |

| Payoneer Global Inc | 17.90 | 3.03 | 2.42 | 4.37% | 0.05 美元 | 0.19 美元 | 18.84% |

| 平均值 | 35.51 | 6.99 | 3.7 | 7.44% | 0.78 美元 | 1.15 美元 | 13.82% |

By thoroughly analyzing Visa, we can discern the following trends:

通過對Visa的深入分析,我們可以辨別出以下趨勢:

At 27.21, the stock's Price to Earnings ratio is 0.77x less than the industry average, suggesting favorable growth potential.

It could be trading at a premium in relation to its book value, as indicated by its Price to Book ratio of 12.91 which exceeds the industry average by 1.85x.

The Price to Sales ratio of 14.88, which is 4.02x the industry average, suggests the stock could potentially be overvalued in relation to its sales performance compared to its peers.

With a Return on Equity (ROE) of 12.62% that is 5.18% above the industry average, it appears that the company exhibits efficient use of equity to generate profits.

Compared to its industry, the company has higher Earnings Before Interest, Taxes, Depreciation, and Amortization (EBITDA) of $6.45 Billion, which is 8.27x above the industry average, indicating stronger profitability and robust cash flow generation.

The gross profit of $7.13 Billion is 6.2x above that of its industry, highlighting stronger profitability and higher earnings from its core operations.

The company's revenue growth of 1.42% is significantly below the industry average of 13.82%. This suggests a potential struggle in generating increased sales volume.

該股的市盈率爲27.21,比行業平均水平低0.77倍,表明良好的增長潛力。

它的賬面市價比率爲12.91,比行業平均水平高出1.85倍,其交易價格可能高於賬面價值。

14.88的市售比率是行業平均水平的4.02倍,這表明與同行相比,該股的銷售業績可能會被高估。

該公司的股本回報率(ROE)爲12.62%,比行業平均水平高出5.18%,看來該公司表現出有效利用股權來創造利潤。

與同行業相比,該公司的利息、稅項、折舊和攤銷前收益(EBITDA)更高,達到64.5億美元,比行業平均水平高出8.27倍,表明盈利能力更強,現金流產生強勁。

71.3億美元的毛利是該行業的6.2倍,凸顯了其更強的盈利能力和更高的核心業務收益。

該公司的收入增長1.42%,大大低於行業平均水平的13.82%。這表明在增加銷量方面可能存在困難。

Debt To Equity Ratio

負債權益比率

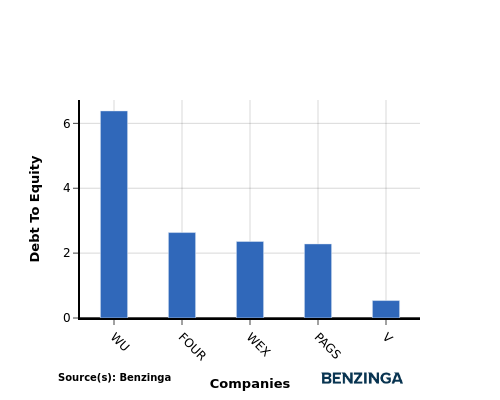

The debt-to-equity (D/E) ratio provides insights into the proportion of debt a company has in relation to its equity and asset value.

債務與權益(D/E)比率提供了對公司債務佔其權益和資產價值的比例的見解。

Considering the debt-to-equity ratio in industry comparisons allows for a concise evaluation of a company's financial health and risk profile, aiding in informed decision-making.

在行業比較中考慮債務與權益比率可以對公司的財務狀況和風險狀況進行簡明的評估,從而有助於做出明智的決策。

In light of the Debt-to-Equity ratio, a comparison between Visa and its top 4 peers reveals the following information:

鑑於債務與權益比率,Visa與其前四大同行之間的比較顯示了以下信息:

Visa is in a relatively stronger financial position compared to its top 4 peers, as evidenced by its lower debt-to-equity ratio of 0.54.

This implies that the company relies less on debt financing and has a more favorable balance between debt and equity.

與排名前四的同行相比,Visa的財務狀況相對較強,其較低的債務與權益比率爲0.54。

這意味着該公司減少了對債務融資的依賴,在債務和股權之間取得了更有利的平衡。

Key Takeaways

關鍵要點

For Visa, the PE ratio is low compared to peers, indicating potential undervaluation. The high PB and PS ratios suggest strong market sentiment and revenue multiples. In terms of ROE, EBITDA, and gross profit, Visa demonstrates high profitability and operational efficiency. However, the low revenue growth may raise concerns about future performance compared to industry peers in the Financial Services sector.

對於Visa而言,與同行相比,市盈率較低,這表明估值可能被低估。較高的市盈率和市盈率表明強勁的市場情緒和收入倍數。在投資回報率、息稅折舊攤銷前利潤和毛利方面,Visa表現出很高的盈利能力和運營效率。但是,與金融服務行業的同行相比,低收入增長可能會引起人們對未來表現的擔憂。

This article was generated by Benzinga's automated content engine and reviewed by an editor.

本文由Benzinga的自動內容引擎生成,並由編輯審閱。