Stock Of The Day: Reversal For SFL Corp? Why Investors Are Concerned

Stock Of The Day: Reversal For SFL Corp? Why Investors Are Concerned

Shares of SFL Corporation Ltd. (NYSE:SFL) were crushed yesterday. The Hamilton, Bermuda-based company announced that it was offering $100 million of new shares.

昨天,SFL Corporation Ltd.(紐交所:SFL)的股票遭受了打擊。總部位於百慕大的該公司宣佈發行新股10000萬美元。

Some investors are concerned that this would dilute the value of their holdings so they sold aggressively.

一些投資者擔心這將稀釋他們的持股價值,因此他們積極賣出。

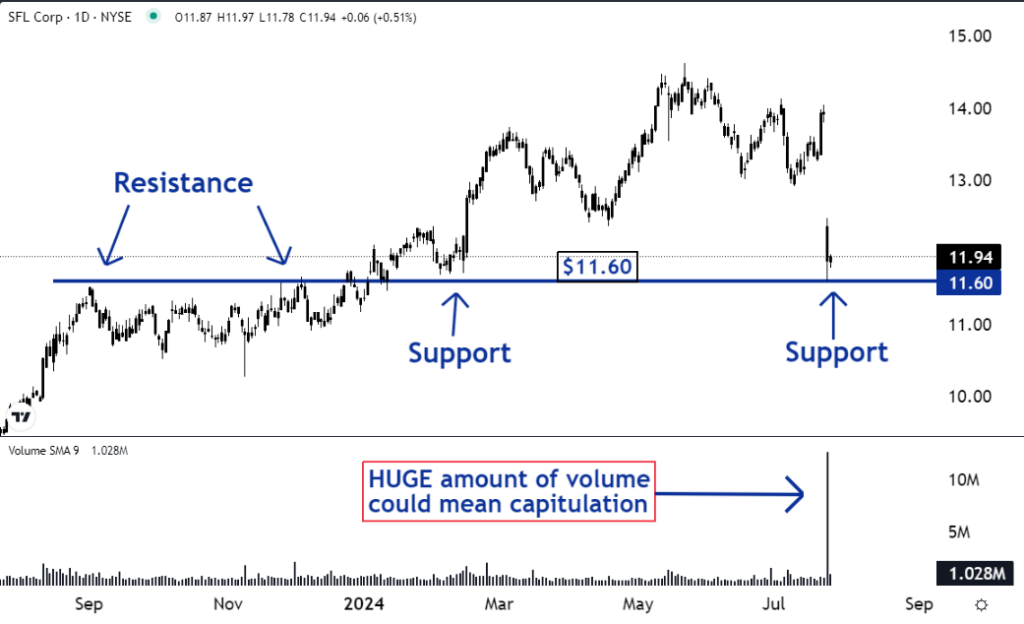

But the stock could be about to bounce back. There may have been a capitulation. They also have dropped to a price level that had previously been support. This is why our team of trading experts made it our 'Stock of the Day'.

但股票可能會反彈。可能已經出現了拋盤的情況。他們的價格也下降到先前的支撐位。這就是我們的交易專家團隊將其評選爲“每日股票”的原因。

A capitulation occurs when sellers throw in the towel and give up. They become sick and tired of watching their stocks move lower. Finally, they decide to sell their shares regardless of the price. As a result, huge amounts of volume trade.

拋盤發生在賣方認輸並放棄的時候。他們厭倦了看着自己的股票下跌。最後,他們決定無論價格如何都要出售自己的股份。因此,成交量巨大。

And this could be bullish for the stock.

這可能對股票產生看好的影響。

After a capitulation, some traders and investors may decide that the move lower was an overreaction, so they enter the market as buyers. But they have a hard time finding someone to buy shares from. The sellers have been cleaned out.

在拋盤之後,一些交易員和投資者可能認爲下跌是過度反應,因此以買方身份進入市場。但他們很難找到有人願意購買股票。原來的賣方已經拋出。

So, these buyers will have no choice but to increase the prices they are willing to pay to draw sellers back into the market. This could force the price higher.

因此,這些買家別無選擇,只能提高他們願意支付的價格來吸引賣方回到市場。這可能迫使股價上漲。

As you can see on the chart, SFL found support at the $11.60 level. This could also be a bullish dynamic.

正如圖表所示,SFL在11.60美元的位置找到了支撐位。這也可能是看好的動態。

Read Also: Benzinga's 'Stock Whisper' Index: 5 Stocks Investors Secretly Monitor But Don't Talk About Yet

閱讀更多:Benzinga's 'Stock Whisper' Index:5只投資者暗中關注但尚未談論的股票。

Support is a large group of traders and investors who are looking to buy shares at, or close to, the same price. In this case it's $11.60.

支撐位是一大批交易員和投資者,他們希望在相同的價格或接近該價格時購買股票。在這種情況下,支撐位是11.60美元。

Sometimes stocks rally after they drop to support. This happens when some of the potential buyers become concerned that they are going to miss the opportunity to acquire shares.

有時,股票在下跌到支撐位後會反彈。當一些潛在的買家擔心錯過收購股票的機會時就會發生這種情況。

They know that the sellers will go to whichever buyer is willing to pay the highest price. As a result, they increase their bid price. For example, instead of paying $11.60, they may increase their bid to $11.70.

他們知道,賣方將會去願意支付最高價格的買家那裏。因此,他們提高出價。例如,他們可能將出價從11.60美元提高到11.70美元。

Other concerned buyers may see this and decide to increase their bids as well. This could result in a snowball effect which pushes SFL higher.

其他擔心的買家可能會看到這一點,並決定提高出價。這可能導致雪球效應,推高SFL的股票價格。

Finding support after a capitulation can be a bullish setup for a stock. There is a good chance SFL recovers and a new uptrend forms.

在經歷拋盤後尋找支撐位是一個看好的股票走勢。有很大的機會,SFL會復甦並形成一個新的上升趨勢。

- Surprise Q2 GDP Growth, Inflation Eases — 'Economy Is Much Stronger Than People Realize': 7 ETFs On The Move

- 驚喜第二季度GDP創業板增長,通脹緩和——“經濟比人們意識到的要強大得多”: 7 etf動了起來

A capitulation occurs when sellers throw in the towel and give up. They become sick and tired of watching their stocks move lower. Finally, they decide to sell their shares regardless of the price. As a result, huge amounts of volume trade.

A capitulation occurs when sellers throw in the towel and give up. They become sick and tired of watching their stocks move lower. Finally, they decide to sell their shares regardless of the price. As a result, huge amounts of volume trade.