Behind the Scenes of Linde's Latest Options Trends

Behind the Scenes of Linde's Latest Options Trends

Financial giants have made a conspicuous bearish move on Linde. Our analysis of options history for Linde (NASDAQ:LIN) revealed 10 unusual trades.

金融巨頭對林德採取了明顯的看跌舉動。我們對林德(納斯達克股票代碼:LIN)期權歷史的分析顯示了10筆不尋常的交易。

Delving into the details, we found 20% of traders were bullish, while 60% showed bearish tendencies. Out of all the trades we spotted, 2 were puts, with a value of $65,580, and 8 were calls, valued at $466,188.

深入研究細節,我們發現20%的交易者看漲,而60%的交易者表現出看跌的趨勢。在我們發現的所有交易中,有2筆是看跌期權,價值爲65,580美元,8筆是看漲期權,價值466,188美元。

Expected Price Movements

預期的價格走勢

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $400.0 to $455.0 for Linde over the last 3 months.

考慮到這些合約的交易量和未平倉合約,在過去的3個月中,鯨魚似乎一直將林德的價格定在400.0美元至455.0美元之間。

Insights into Volume & Open Interest

對交易量和未平倉合約的見解

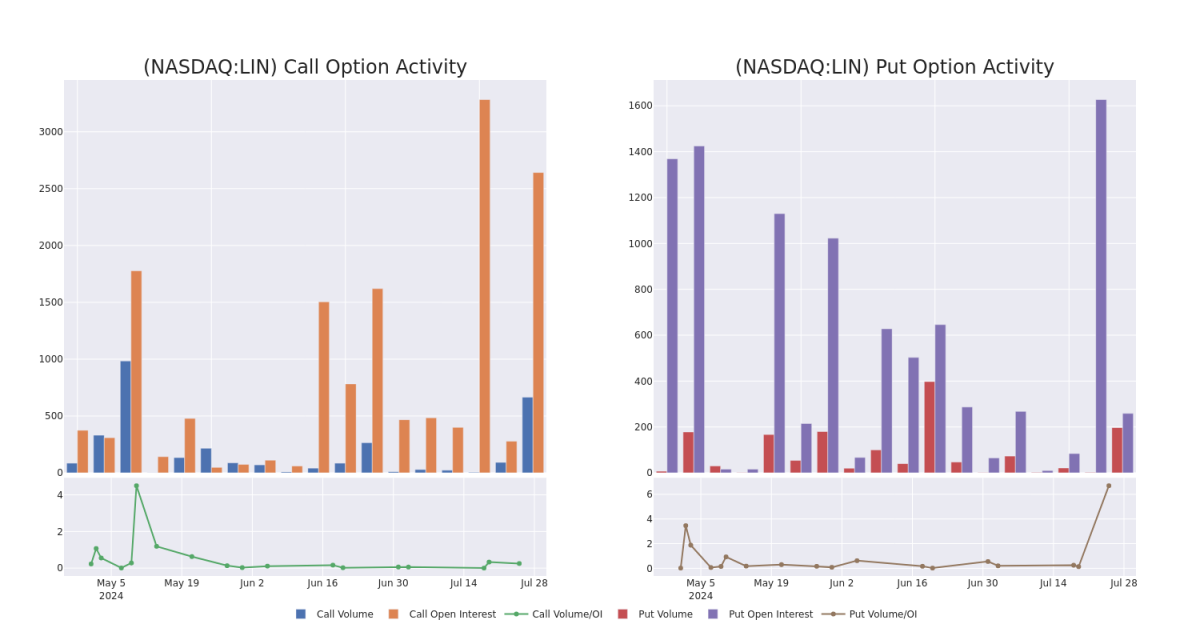

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Linde's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Linde's substantial trades, within a strike price spectrum from $400.0 to $455.0 over the preceding 30 days.

評估交易量和未平倉合約是期權交易的戰略步驟。這些指標揭示了林德期權在指定行使價下的流動性和投資者對林德期權的興趣。即將發佈的數據可視化了與林德的大量交易相關的看漲期權和看跌期權的交易量和未平倉合約的波動,在過去30天內,行使價範圍從400.0美元到455.0美元不等。

Linde Call and Put Volume: 30-Day Overview

林德看漲和看跌交易量:30天概述

Significant Options Trades Detected:

檢測到的重要期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| LIN | CALL | SWEEP | BEARISH | 01/17/25 | $27.4 | $26.7 | $26.7 | $450.00 | $95.9K | 2.6K | 35 |

| LIN | CALL | SWEEP | NEUTRAL | 01/17/25 | $26.6 | $26.4 | $26.5 | $450.00 | $74.2K | 2.6K | 165 |

| LIN | CALL | SWEEP | BEARISH | 01/17/25 | $26.8 | $26.7 | $26.58 | $450.00 | $69.2K | 2.6K | 76 |

| LIN | CALL | SWEEP | NEUTRAL | 01/16/26 | $85.1 | $83.2 | $83.8 | $400.00 | $58.7K | 29 | 7 |

| LIN | CALL | SWEEP | BEARISH | 01/17/25 | $27.9 | $26.7 | $26.58 | $450.00 | $58.5K | 2.6K | 98 |

| 符號 | 看跌/看漲 | 交易類型 | 情緒 | Exp。日期 | 問 | 出價 | 價格 | 行使價 | 總交易價格 | 未平倉合約 | 音量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| 林 | 打電話 | 掃 | 粗魯的 | 01/17/25 | 27.4 美元 | 26.7 美元 | 26.7 美元 | 450.00 美元 | 95.9 萬美元 | 2.6K | 35 |

| 林 | 打電話 | 掃 | 中立 | 01/17/25 | 26.6 美元 | 26.4 美元 | 26.5 美元 | 450.00 美元 | 74.2 萬美元 | 2.6K | 165 |

| 林 | 打電話 | 掃 | 粗魯的 | 01/17/25 | 26.8 美元 | 26.7 美元 | 26.58 美元 | 450.00 美元 | 69.2 萬美元 | 2.6K | 76 |

| 林 | 打電話 | 掃 | 中立 | 01/16/26 | 85.1 美元 | 83.2 美元 | 83.8 美元 | 400.00 美元 | 58.7 萬美元 | 29 | 7 |

| 林 | 打電話 | 掃 | 粗魯的 | 01/17/25 | 27.9 美元 | 26.7 美元 | 26.58 美元 | 450.00 美元 | 58.5 萬美元 | 2.6K | 98 |

About Linde

關於林德

Linde is the largest industrial gas supplier in the world, with operations in over 100 countries. The firm's main products are atmospheric gases (including oxygen, nitrogen, and argon) and process gases (including hydrogen, carbon dioxide, and helium), as well as equipment used in industrial gas production. Linde serves a wide variety of end markets, including chemicals, manufacturing, healthcare, and steelmaking. Linde generated approximately $33 billion in revenue in 2023.

林德是世界上最大的工業氣體供應商,業務遍及100多個國家。該公司的主要產品是大氣氣體(包括氧氣、氮氣和氬氣)和工藝氣體(包括氫氣、二氧化碳和氦氣),以及用於工業氣體生產的設備。林德爲各種終端市場提供服務,包括化工、製造業、醫療保健和鍊鋼。林德在 2023 年創造了大約 330 億美元的收入。

Having examined the options trading patterns of Linde, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在研究了林德的期權交易模式之後,我們的注意力現在直接轉向了該公司。這種轉變使我們能夠深入研究其目前的市場地位和表現

Current Position of Linde

林德的現狀

- With a volume of 773,982, the price of LIN is up 0.57% at $446.31.

- RSI indicators hint that the underlying stock may be approaching overbought.

- Next earnings are expected to be released in 8 days.

- LIN的價格上漲了0.57%,至446.31美元,交易量爲773,982美元。

- RSI指標暗示標的股票可能接近超買。

- 下一份業績預計將在8天后公佈。

What The Experts Say On Linde

專家對林德的看法

2 market experts have recently issued ratings for this stock, with a consensus target price of $477.5.

2位市場專家最近發佈了該股的評級,共識目標價爲477.5美元。

- An analyst from UBS persists with their Neutral rating on Linde, maintaining a target price of $475.

- Maintaining their stance, an analyst from Citigroup continues to hold a Neutral rating for Linde, targeting a price of $480.

- 瑞銀的一位分析師堅持對林德的中性評級,維持475美元的目標價格。

- 花旗集團的一位分析師保持立場,繼續對林德維持中性評級,目標價格爲480美元。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Linde options trades with real-time alerts from Benzinga Pro.

期權交易具有更高的風險和潛在的回報。精明的交易者通過不斷自我教育、調整策略、監控多個指標以及密切關注市場走勢來管理這些風險。藉助Benzinga Pro的實時警報,隨時了解最新的林德期權交易。

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Linde's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Linde's substantial trades, within a strike price spectrum from $400.0 to $455.0 over the preceding 30 days.

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Linde's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Linde's substantial trades, within a strike price spectrum from $400.0 to $455.0 over the preceding 30 days.