Check Out What Whales Are Doing With Morgan Stanley

Check Out What Whales Are Doing With Morgan Stanley

Financial giants have made a conspicuous bullish move on Morgan Stanley. Our analysis of options history for Morgan Stanley (NYSE:MS) revealed 17 unusual trades.

金融巨頭對大摩資源lof看好。我們對大摩資源lof期權歷史的分析顯示,有17筆飛凡交易。

Delving into the details, we found 41% of traders were bullish, while 35% showed bearish tendencies. Out of all the trades we spotted, 9 were puts, with a value of $555,420, and 8 were calls, valued at $741,626.

具體數據顯示,41%的交易員看漲,35%的交易員看淡。我們找到的所有交易中,有9筆看跌,價值爲555,420美元,有8筆看漲,價值爲741,626美元。

Predicted Price Range

預測價格區間

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $72.5 to $115.0 for Morgan Stanley over the recent three months.

基於交易活動,看來主要投資者在近三個月內的目標價格區間爲大摩資源lof股價區間$72.5到$115.0。

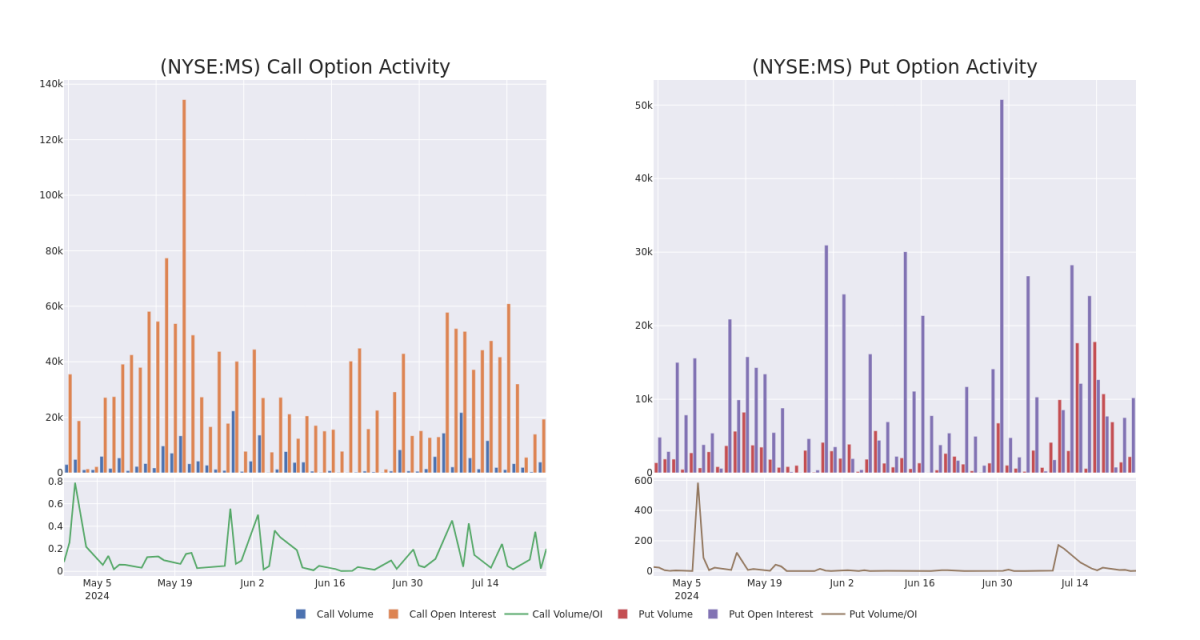

Volume & Open Interest Trends

成交量和未平倉量趨勢

In today's trading context, the average open interest for options of Morgan Stanley stands at 2953.0, with a total volume reaching 6,052.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Morgan Stanley, situated within the strike price corridor from $72.5 to $115.0, throughout the last 30 days.

在今天的交易背景下,大摩資源lof期權的平均持倉量爲2953.0,總成交量達到6,052.00。附圖描繪了過去30天,大摩資源lof股票高價值飛凡交易的看漲和看跌期權成交量和持倉量的變化情況,其中的執行價格範圍在$72.5到$115.0之間。

Morgan Stanley Call and Put Volume: 30-Day Overview

摩根士丹利看漲和看跌期權成交量:30天概覽

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MS | CALL | TRADE | BEARISH | 09/19/25 | $7.25 | $6.75 | $6.95 | $115.00 | $382.2K | 113 | 550 |

| MS | PUT | SWEEP | BEARISH | 06/20/25 | $9.95 | $9.65 | $9.95 | $105.00 | $159.1K | 1.2K | 160 |

| MS | CALL | SWEEP | BULLISH | 01/17/25 | $3.4 | $3.35 | $3.35 | $115.00 | $104.5K | 5.4K | 85 |

| MS | PUT | SWEEP | BEARISH | 06/20/25 | $10.1 | $10.05 | $10.05 | $105.00 | $92.4K | 1.2K | 293 |

| MS | PUT | SWEEP | BEARISH | 06/20/25 | $7.7 | $7.4 | $7.7 | $100.00 | $69.3K | 538 | 245 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MS | 看漲 | 交易 | 看淡 | 09/19/25 | $7.25 | 其股票的收盤價格昨天爲$5.75。 | $6.95 | $115.00 | $382.2K | 113 | 550 |

| MS | 看跌 | SWEEP | 看淡 | 06/20/25 | $9.95 | $9.65 | $9.95 | $105.00 | $159.1K | 1.2K | 160 |

| MS | 看漲 | SWEEP | 看好 | 01/17/25 | $3.4 | $3.35 | $3.35 | $115.00 | $104.5千 | 5,400 | 85 |

| MS | 看跌 | SWEEP | 看淡 | 06/20/25 | $10.1 | $10.05 | $10.05 | $105.00 | $92.4K | 1.2K | 293 |

| MS | 看跌 | SWEEP | 看淡 | 06/20/25 | $7.7 | $7.4 | $7.7 | $100.00。 | $69.3K | 538 | 245 |

About Morgan Stanley

關於美銀根斯坦利

Morgan Stanley is a global investment bank whose history, through its legacy firms, can be traced back to 1924. The company has institutional securities, wealth management, and investment management segments with approximately 45% of net revenue from its institutional securities business, 45% from wealth management, and 10% from investment management. About 30% of its total revenue is from outside the Americas. The company had over $5 trillion of client assets as well as around 80,000 employees at the end of 2023.

摩根士丹利是一家全球投資銀行,在其傳統公司的歷史可以追溯到1924年。公司擁有機構證券,财富管理和投資管理業務部門,其中約45%的淨營收來自機構證券業務,45%來自财富管理,10%來自投資管理。 其總收入中約30%來自美洲以外的地區。 該公司在2023年底擁有超過5萬億美元的客戶資產以及約80,000名員工。

In light of the recent options history for Morgan Stanley, it's now appropriate to focus on the company itself. We aim to explore its current performance.

鑑於摩根士丹利最近的期權歷史,現在適當關注該公司本身。 我們旨在探究其當前業績。

Current Position of Morgan Stanley

大摩資源lof的當前倉位

- Trading volume stands at 5,580,498, with MS's price up by 0.63%, positioned at $102.61.

- RSI indicators show the stock to be may be approaching overbought.

- Earnings announcement expected in 83 days.

- 交易量爲5,580,498,大摩資源lof股價上漲0.63%,位於$102.61。

- RSI指標顯示該股票可能接近超買。

- 公告預計在83天后發佈。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Morgan Stanley options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在收益。精明的交易者通過不斷地學習、調整他們的策略、監控多種因子和密切關注市場動態來管理這些風險。通過Benzinga Pro的實時警報保持最新的摩根士丹利期權交易信息。