Aeso Holding's (HKG:8341) Soft Earnings Don't Show The Whole Picture

Aeso Holding's (HKG:8341) Soft Earnings Don't Show The Whole Picture

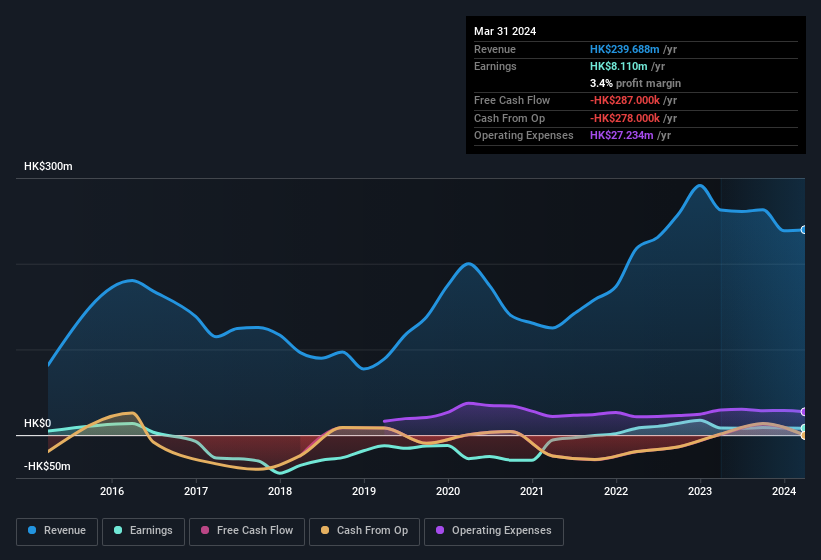

Aeso Holding Limited's (HKG:8341) recent weak earnings report didn't cause a big stock movement. Our analysis suggests that along with soft profit numbers, investors should be aware of some other underlying weaknesses in the numbers.

艾碩控股有限公司(HKG:8341)最近發佈的疲弱業績報告未引起股票大起大落。我們的分析表明,除了盈利數字不佳,投資者還應該注意一些其他基礎數據方面的弱點。

Our Take On Aeso Holding's Profit Performance

我們的對艾碩控股利潤表現的看法

Therefore, it seems possible to us that Aeso Holding's true underlying earnings power is actually less than its statutory profit. If you'd like to know more about Aeso Holding as a business, it's important to be aware of any risks it's facing. For example, we've discovered 2 warning signs that you should run your eye over to get a better picture of Aeso Holding.

因此,我們認爲艾碩控股真正的基礎盈利能力實際上低於其法定利潤水平。如果您想更了解艾碩控股的業務,重要的是要注意任何面臨的風險。例如,我們發現了2個警示信號,您應該仔細觀察以更好地了解艾碩控股的情況。

In this article we've looked at a number of factors that can impair the utility of profit numbers, as a guide to a business. But there are plenty of other ways to inform your opinion of a company. Some people consider a high return on equity to be a good sign of a quality business. So you may wish to see this free collection of companies boasting high return on equity, or this list of stocks with high insider ownership.

在本文中,我們已經審視了很多可能影響財務數據作爲企業指標的因素。但是還有很多其他方法可以了解公司的信譽。有些人認爲,高淨資產收益率是高質量企業的良好標誌。因此,您可能希望查看這個免費列表,其中包括許多淨資產收益率高的公司,或這個擁有高內部持股的股票清單。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。

這篇文章是Simply Wall St的一般性文章。我們根據歷史數據和分析師預測提供評論,只使用公正的方法論,我們的文章並不意味着提供任何金融建議。文章不構成買賣任何股票的建議,也不考慮您的目標或您的財務狀況。我們的目標是帶給您基本數據驅動的長期關注分析。請注意,我們的分析可能不考慮最新的價格敏感公司公告或定性材料。Simply Wall St沒有任何股票頭寸。

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

對本文有任何反饋?對內容有任何疑慮?請直接與我們聯繫。或者,發送電子郵件至editorial-team@simplywallst.com。