Markets Weekly Update (July 26): US Q2 GDP Expanded by a Robust 2.8% Rate, Significantly Surpassing Expectations

Markets Weekly Update (July 26): US Q2 GDP Expanded by a Robust 2.8% Rate, Significantly Surpassing Expectations

Macro Matters

宏觀事項

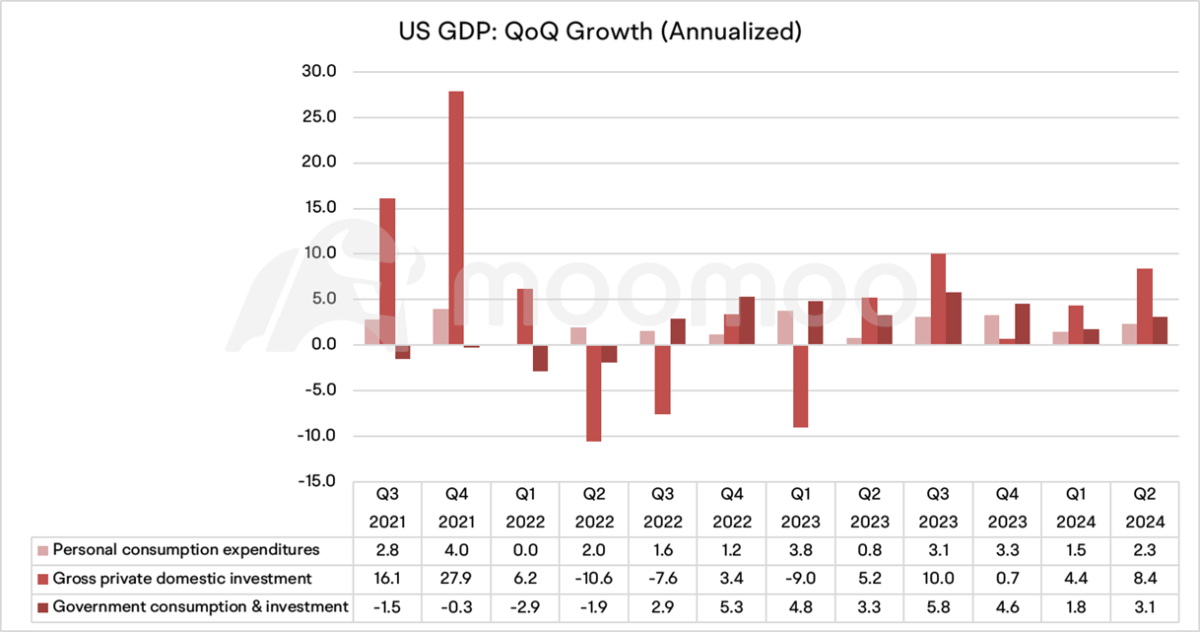

US Q2 GDP Expanded by a Robust 2.8% Rate, Significantly Surpassing Expectations

美國第二季度GDP以強勁的2.8%的比率擴張,顯著超出預期。

Real GDP increased at an annual rate of 2.8 percent in the second quarter of 2024. Economists polled by Dow Jones anticipated a 2.1% growth rate following a 1.4% rise in the first quarter.

實際GDP在2024年第二季度以年率2.8%的速度增長。道瓊斯調查的經濟學家預計,經過第一季度1.4%的上漲後,增長率將達到2.1%。

Bureau of Economic Analysis noted that, compared to the first quarter, the acceleration in real GDP in the second quarter primarily reflected an upturn in private inventory investment and an acceleration in consumer spending.

經濟分析局指出,與第一季度相比,第二季度實際GDP加速主要反映了私人庫存投資上升和消費支出加速。

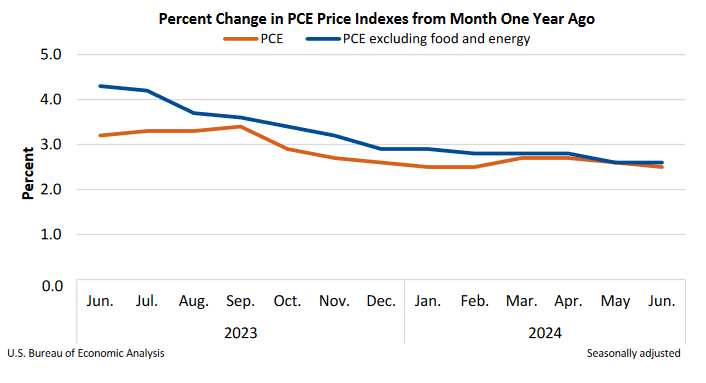

US PCE Inflation Slows to 2.5% in Jun, But Core PCE Unchanged at 2.6%

美國6月份PCE通脹放緩至2.5%,但核心PCE保持在2.6%不變。

The annual PCE inflation rate in the US decreased to 2.5% in June 2024 from 2.6% in May, in line with market forecasts. On a monthly basis, the PCE price index rose 0.1% mom in June, matched expectations.

美國年度PCE通脹率從2024年5月的2.6%降至2024年6月的2.5%,符合市場預期。月度PCE價格指數在2024年6月增長了0.1%,符合預期。

The core PCE inflation gauge for the US economy was unchanged at 2.6% in June 2024, the same as in May and above market forecasts of 2.5%. On a monthly basis, core PCE prices rose by 0.2% in June, accelerating from 0.1% in May and above market estimates of 0.1%.

美國經濟的核心PCE通脹預期在2024年6月保持在2.6%,與5月份持平,高於市場預期的2.5%。月度核心PCE價格在6月份上漲了0.2%,加速了5月份的0.1%,高於市場預期的0.1%。

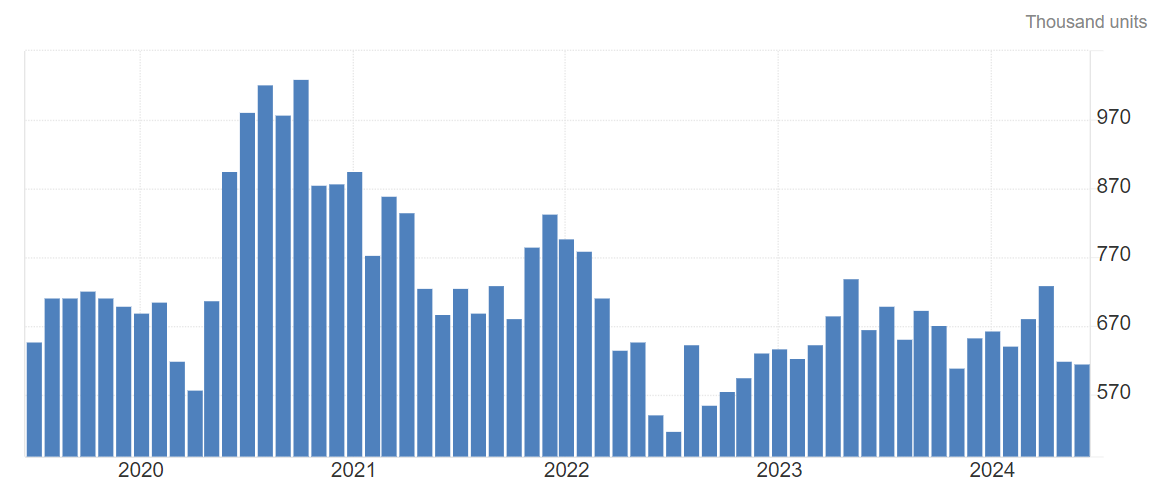

US New Home Sales Fell to a Seven-Month Low in June

美國6月份新屋銷售降至七個月低位。

Sales of new single-family houses in the United States fell 0.6% month-over-month to a seasonally adjusted annualized rate of 617K in June 2024, as high prices and mortgage rates continued to weigh on buyers' affordability. It is the lowest reading in seven months and well below forecasts of 640K.

美國新單戶住宅銷售額在2024年6月份按季節調整後年化率下降了0.6%,至61.7萬。由於高昂的房價和抵押利率繼續壓制買家的購買力,這是七個月以來的最低讀數,遠低於64萬的預期。

The median price of new houses sold in the period was $417,300, while the average sales price was $487,200, lower than $417,600 and $507,800 a year earlier, respectively. Meanwhile, there were 476K new homes listed for sale during the period, representing about 9.3 months of supply at the latest sales rate.

銷售期間新房的中位價爲417,300美元,平均銷售價格爲487,200美元,分別低於去年同期的417,600美元和507,800美元。與此同時,銷售期內有47.6萬套新房出售,相當於最新銷售速度的9.3個月的供應。

Exhibit: United States New Home Sales, Trading Economics

展示:美國新房銷售,Trading Economics

US Mortgage Rates Climb Slightly, Holding Near a Four-Month Low

美國房貸利率略有上升,保持在四個月低位附近。

Mortgage rates in the US increased slightly, with the average for a 30-year fixed loan rising to 6.78% from 6.77% last week, according to Freddie Mac. Despite being down from recent highs, elevated borrowing costs continue to deter house hunters amid record-high prices. Sales of previously owned homes fell for the fourth consecutive month in June, and new-home purchases also declined. Consequently, listings are staying on the market longer, and more sellers are reducing their asking prices.

根據房地美數據,美國30年固定貸款平均利率從上週的6.77%升至6.78%。儘管從最近的高點下降,但高額的借款成本繼續阻礙房屋購買者,因爲價格創下歷史新高。6月份,二手房銷售量連續第四個月下降,新房購買量也下降。因此,房屋的銷售時間變長,更多的賣家在降低他們的要價。

Smart Money Flow

智能資金流

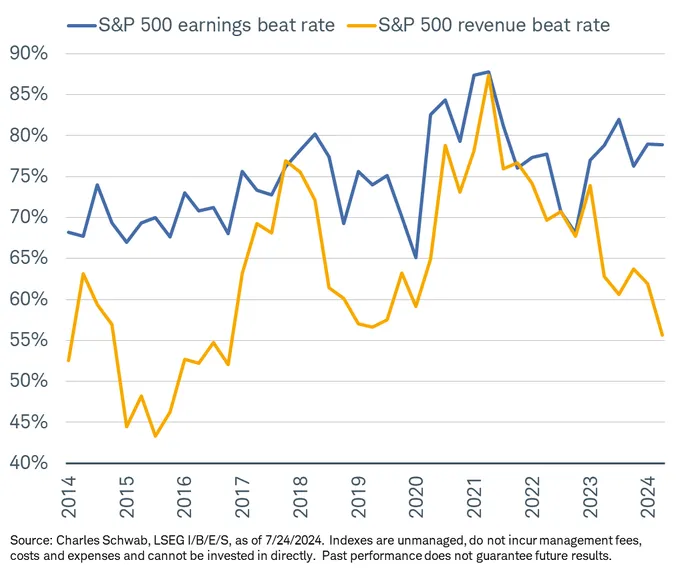

S&P 500's earnings beat rate is still healthy at nearly 79%, but the revenue beat rate is currently at its lowest since the fourth quarter of 2016.

標普500指數的收益率仍然健康,近79%,但營收超預期的比率目前是自2016年第四季度以來的最低點。

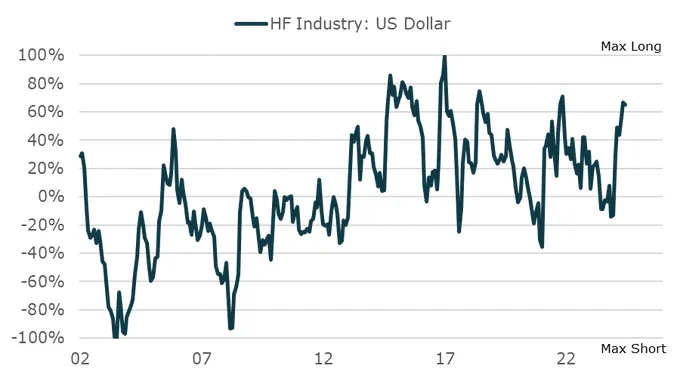

Hedge funds have increased their long dollar positions in recent months reflecting their relative optimism on the US economy and likely tighter monetary policy ahead.

近幾個月來,對美國經濟和未來可能更緊的貨幣政策持相對樂觀態度的對沖基金加大了其多頭美元頭寸。

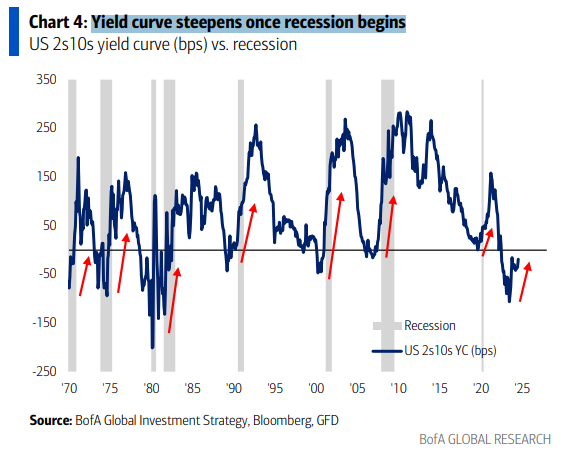

Yield Curve Steepens Once Recession Begins.

當經濟衰退開始後,收益率曲線將加速。

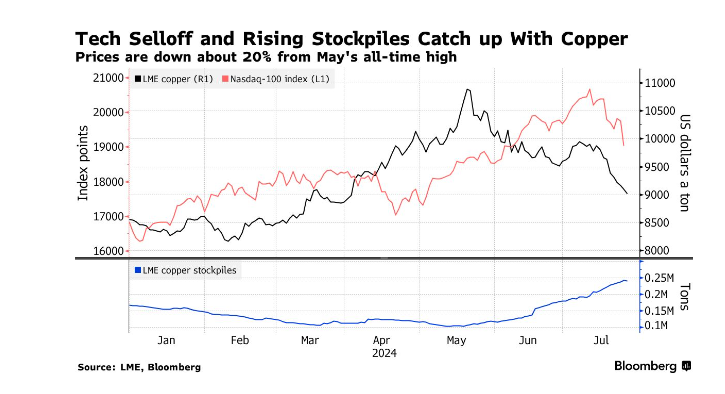

Copper Sinks Below $9,000 Threshold as Metals Selloff Deepens

由於全球股市拋售和對中國需求的悲觀預期,銅價下跌至9000美元以下的水平。這種工業金屬自5月中旬以來下跌約20%,因最初對供應緊縮和增加使用的樂觀交易已轉爲對中國現貨市場的庫存上升和疲軟狀況的擔憂。此外,全球科技股的拋售也對人工智能行業的實力產生了懷疑,投資者曾預計人工智能將推動數據中心和電力基礎設施的銅使用大幅增加。

Copper prices fell below $9,000 a ton for the first time since early April due to a global stock market selloff and rising pessimism about demand in China. The industrial metal is down about 20% since its mid-May peak, as initial bullish bets on tightening supply and increased usage have shifted to concerns about rising inventories and weak conditions in China's spot market. Additionally, a selloff in global technology stocks has cast doubt on the strength of the artificial intelligence industry, which investors had expected to drive a surge in copper usage for data centers and power infrastructure.

Alphabet的邊際擔憂和YouTube的放緩超越了人工智能的提振。

Top Corporate News

頭條公司新聞

Alphabet Margin Fears, Youtube Slowdown Eclipse AI Boost

在第二季度,Alphabet的資本支出增加至132億美元,超過預期,並大量投資於人工智能,並與微軟競爭。儘管採取了裁員等節約成本的措施,但分析師指出,更高的季節性僱用和比平常早的Pixel發佈可能會影響第三季度的利潤率。此外,YouTube面臨着年同比的嚴峻挑戰,以及在網絡廣告視頻市場上與亞馬遜的競爭。

In the second quarter, Alphabet's capital expenditure rose to $13.2 billion, exceeding expectations as it invested heavily in AI and competed with Microsoft. Despite cost-cutting measures, such as layoffs, analysts noted that higher seasonal hiring and the earlier-than-usual Pixel launch could impact third-quarter margins. Additionally, YouTube faces tough year-on-year comparisons and competition from Amazon.com in the online ad video market.

馬斯克表示,特斯拉董事會將討論500 million美元的x人工智能投資。

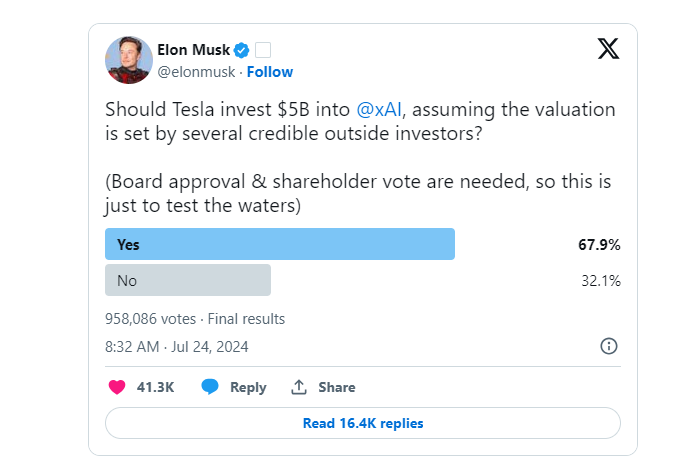

Musk Says Tesla Board to Discuss $5 Billion xAI Investment

馬斯克表示特斯拉董事會將討論50億美元的人工智能投資

Elon Musk announced that Tesla Inc.'s board will discuss a potential $5 billion investment in his AI startup, xAI. Earlier this week, Musk conducted a poll on X, where over two-thirds of respondents supported the idea. Following the favorable public response, Musk stated on Thursday that Tesla would consider the investment. He also noted that Tesla board approval and a shareholder vote would be required before proceeding.

特斯拉董事會將討論向他的AI初創企業xAI投資50億美元的可能性。本週早些時候,馬斯克在X上進行了一項民意調查,超過三分之二的受訪者支持此想法。在獲得良好的公衆反響後,馬斯克於週四表示,特斯拉將考慮此項投資。他還表示,在進行此項投資之前,需要獲得特斯拉董事會批准和股東投票支持。

Ford Falls Most in 15 Years as Warranty Costs Erode Profit

由於舊車保修費用飆升8000萬美元,福特汽車股價週四暴跌18%,創下15年來最大跌幅。福特報告的每股調整後收益爲47美分,低於彭博社對分析師調查的估計平均值67美分。這一跌幅抹去了該公司2024年的收益,使該股份今年下跌超過8%。

Ford Motor Co. shares plummeted 18% on Thursday, their worst drop in over 15 years, following a significant earnings miss due to an $800 million surge in warranty repair costs for older vehicles. Ford reported adjusted earnings per share of 47 cents, falling short of the 67-cent average estimate from analysts surveyed by Bloomberg. This decline wiped out the company's 2024 gains, leaving the stock down more than 8% for the year.

由於第三季度的營收表現不佳,Visa的股票價格遭到多家券商下調,引發了對美國整個支付行業的擔憂,擔心消費者支出放緩。令人失望的結果凸顯出行業的挑戰,通貨膨脹和高借貸成本導致消費者減少購買,工資增長放緩。

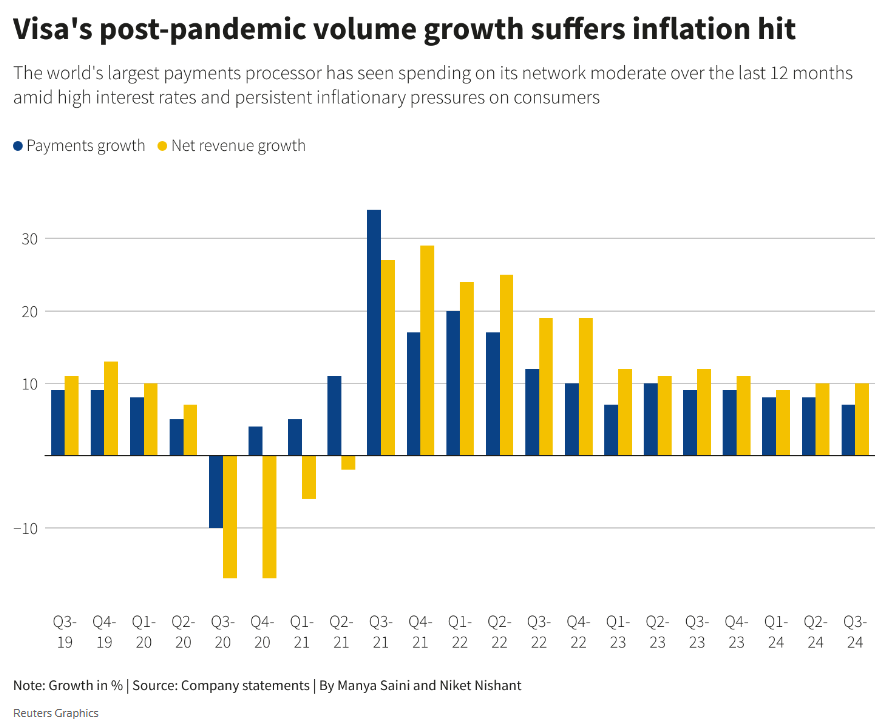

Visa's Revenue Miss Prompts Caution on Wall Street

沒有跡象表明微軟計劃限制Crowdstrike對Windows的訪問權限。據一位了解此事的人士表示,在全球技術故障導致運行Windows的許多計算機崩潰後。

Visa's underwhelming third-quarter revenue led several brokerages to cut their price targets on the stock, raising concerns about slowing customer spending and impacting the broader U.S. payments industry. The disappointing results highlight industry challenges, as inflation and high borrowing costs cause customers to reduce purchases, and wage growth slows.

福特汽車股價下跌了15年最多,由於舊車保修費用飆升8000萬美元而導致盈利減少。股票下跌了18%。福特報告的每股調整後收益爲47美分,低於彭博社對分析師調查的估計平均值67美分。這一跌幅抹去了該公司2024年的收益,使該股份今年下跌超過8%。

No Sign Microsoft Plans to Limit Crowdstrike Access to Windows After Outage, Source Says

Visa的營收表現不佳,導致多家券商下調股票價格,引發對消費者支出減緩的擔憂,從而影響了美國整個支付行業。令人失望的結果凸顯出行業的挑戰,通貨膨脹和高借貸成本導致消費者減少購買,工資增長放緩。

There is no sign Microsoft Corp plans to limit Crowdstrike's access to the Windows operating system, a person familiar with the issue said, after a global tech outage caused by the cybersecurity software product caused many computers running Windows to crash.

全球網絡安全概念軟件產品Crowdstrike導致許多運行Windows的計算機崩潰後,沒有跡象表明微軟公司計劃限制Crowdstrike對Windows操作系統的訪問權限,一位熟悉此事的人表示。

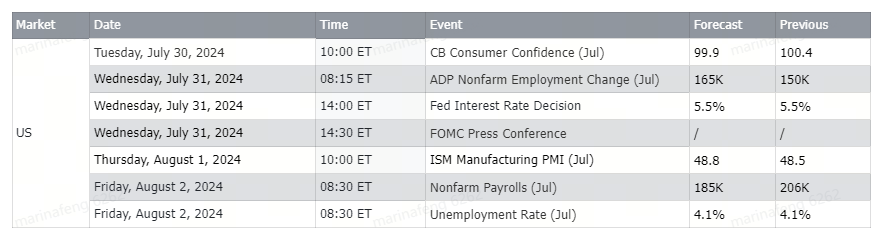

Upcoming Economic Data

免責聲明:本演示僅供信息和教育目的;不是任何特定投資或投資策略的建議或認可。在此提供的投資信息具有一般性質,僅供說明目的,並可能不適合所有投資者。它是在沒有考慮個人投資者的財務知識水平、財務狀況、投資目標、投資時間範圍或風險承受能力的情況下提供的。在做出任何投資決策之前,您應考慮此信息是否適合您的相關個人情況。過去的投資業績並不表明或保證未來的成功。收益將有所不同,所有投資都存在風險,包括本金損失。

Disclaimer: This presentation is for informational and educational use only and is not a recommendation or endorsement of any particular investment or investment strategy. Investment information provided in this content is general in nature, strictly for illustrative purposes, and may not be appropriate for all investors. It is provided without respect to individual investors’ financial sophistication, financial situation, investment objectives, investing time horizon, or risk tolerance. You should consider the appropriateness of this information having regard to your relevant personal circumstances before making any investment decisions. Past investment performance does not indicate or guarantee future success. Returns will vary, and all investments carry risks, including loss of principal.

moomoo 是由 Moomoo Technologies Inc 提供的一款金融信息和交易應用程序,在美國,Moomoo Financial Inc 爲投資者提供投資產品和服務,爲 FINRA/SIPC 的成員。

Moomoo is a financial information and trading app offered by Moomoo Technologies Inc. In the U.S., investment products and services on Moomoo are offered by Moomoo Financial Inc., Member FINRA/SIPC.

Moomoo 是由 Moomoo Technologies Inc 提供的一款金融信息和交易應用程序,在美國,Moomoo Financial Inc 爲投資者提供投資產品和服務,爲 FINRA/SIPC 的成員。