Unpacking the Latest Options Trading Trends in Amgen

Unpacking the Latest Options Trading Trends in Amgen

Deep-pocketed investors have adopted a bearish approach towards Amgen (NASDAQ:AMGN), and it's something market players shouldn't ignore. Our tracking of public options records at Benzinga unveiled this significant move today. The identity of these investors remains unknown, but such a substantial move in AMGN usually suggests something big is about to happen.

資金雄厚的投資者們對安進(納斯達克:AMGN)採取了看淡的策略,市場參與者不應忽視這一點。本週財經網站Benzinga對公開期權記錄的追蹤揭示了這一重大舉措。這些投資者的身份仍然是未知的,但在AMGN中出現這樣大規模的舉動通常意味着即將發生重大事件。

We gleaned this information from our observations today when Benzinga's options scanner highlighted 8 extraordinary options activities for Amgen. This level of activity is out of the ordinary.

我們從觀察當天的Benzinga期權掃描器中,發現了8個Amgen額外的期權活動,從而獲得了這些信息。這種活動水平是不尋常的。

The general mood among these heavyweight investors is divided, with 37% leaning bullish and 62% bearish. Among these notable options, 6 are puts, totaling $287,160, and 2 are calls, amounting to $67,000.

這些重量級投資者中存在着兩派對情緒,37%看好而62%看淡。在這些重要的期權中,有6個看跌期權,總價值爲287160美元,2個看漲期權,總價值爲67000美元。

Projected Price Targets

預計價格目標

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $315.0 and $355.0 for Amgen, spanning the last three months.

在評估交易量和未平倉量後,很明顯主要的市場參與者正在關注安進的價格區間,這個區間位於315美元和355美元之間,跨度爲過去三個月。

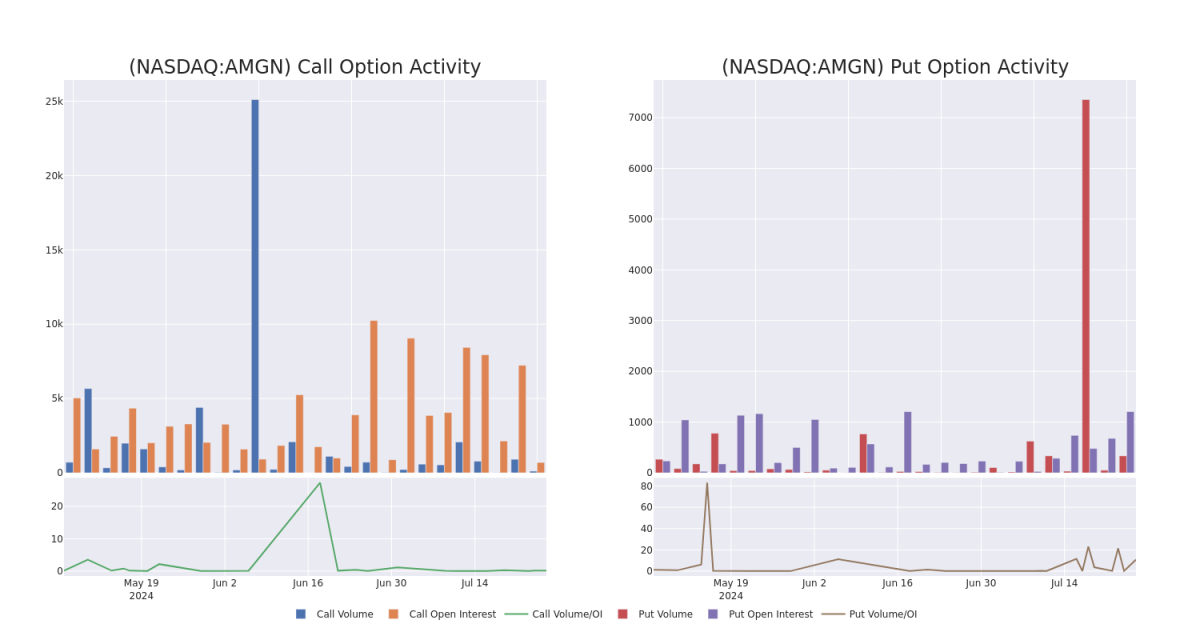

Volume & Open Interest Trends

成交量和未平倉量趨勢

Looking at the volume and open interest is an insightful way to conduct due diligence on a stock.

這些數據可以幫助您跟蹤Coinbase Glb期權的流動性和利益,以給定的行權價格爲基礎。

This data can help you track the liquidity and interest for Amgen's options for a given strike price.

這些數據可以幫助您跟蹤給定行權價格的安進期權的流動性和興趣。

Below, we can observe the evolution of the volume and open interest of calls and puts, respectively, for all of Amgen's whale activity within a strike price range from $315.0 to $355.0 in the last 30 days.

下面我們可以觀察到在過去30天,所有安進鯨魚活動中,成交價在315美元到355美元之間的看跌期權和看漲期權的成交量和未平倉量的變化。

Amgen Option Activity Analysis: Last 30 Days

安進期權活動分析:最近30天

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | PUT | SWEEP | BEARISH | 10/18/24 | $12.5 | $12.4 | $12.5 | $325.00 | $67.4K | 789 | 98 |

| AMGN | PUT | TRADE | BEARISH | 01/16/26 | $31.75 | $30.3 | $31.75 | $320.00 | $63.5K | 162 | 25 |

| AMGN | PUT | TRADE | BEARISH | 03/21/25 | $30.55 | $30.5 | $30.55 | $340.00 | $61.1K | 2 | 20 |

| AMGN | PUT | TRADE | BEARISH | 10/18/24 | $14.45 | $14.45 | $14.45 | $330.00 | $36.1K | 253 | 50 |

| AMGN | CALL | SWEEP | BULLISH | 08/09/24 | $3.45 | $2.57 | $3.45 | $355.00 | $34.5K | 16 | 100 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| AMGN | 看跌 | SWEEP | 看淡 | 10/18/24 | $12.5 | $12.4 | $12.5 | $325.00 | $67.4K | 789 | 98 |

| AMGN | 看跌 | 交易 | 看淡 | 01/16/26 | $31.75 | $30.3 | $31.75 | $320.00 | $63.5K | 162 | 25 |

| AMGN | 看跌 | 交易 | 看淡 | 03/21/25 | $30.55 | $30.5 | $30.55 | $340.00 | $61.1K | 2 | 20 |

| AMGN | 看跌 | 交易 | 看淡 | 10/18/24 | $14.45 | $14.45 | $14.45 | $330.00 | $36.1K | 253 | 50 |

| AMGN | 看漲 | SWEEP | 看好 | 08/09/24 | $3.45 | $2.57 | $3.45 | $355.00 | $34.5K | 16 | 100 |

About Amgen

關於安進

Amgen is a leader in biotechnology-based human therapeutics. Flagship drugs include red blood cell boosters Epogen and Aranesp, immune system boosters Neupogen and Neulasta, and Enbrel and Otezla for inflammatory diseases. Amgen introduced its first cancer therapeutic, Vectibix, in 2006 and markets bone-strengthening drug Prolia/Xgeva (approved 2010) and Evenity (2019). The acquisition of Onyx bolstered the firm's therapeutic oncology portfolio with Kyprolis. Recent launches include Repatha (cholesterol-lowering), Aimovig (migraine), Lumakras (lung cancer), and Tezspire (asthma). The 2023 Horizon acquisition brings several rare-disease drugs, including thyroid eye disease drug Tepezza. Amgen also has a growing biosimilar portfolio.

安進是生物技術製藥領域的領導者。旗艦藥物包括增加紅細胞計數的艾普畢與阿拉尼許、增強免疫系統的奈帕姆和奈烏細胞移植因子、以及針對炎症性疾病的恩布瑞爾和歐特茲拉。安進在2006年推出了首個癌症治療藥物Vectibix,並推出了增強骨密度的藥物Prolia/Xgeva(於2010年獲批)和Evenity(於2019年獲批)。對Onyx的收購增強了該公司在治療腫瘤領域的藥物組合,其中包括Kyprolis。最近推出的藥物包括Repatha(降低膽固醇)、Aimovig(緩解偏頭痛)、Lumakras(治療肺癌)以及Tezspire(治療哮喘)。2023年Horizon收購帶來了幾種罕見疾病藥物,其中包括治療甲狀腺眼病的Tepezza。安進還擁有不斷增長的生物類似物組合。

Current Position of Amgen

安進的當前位置

- Currently trading with a volume of 164,369, the AMGN's price is down by -0.04%, now at $334.17.

- RSI readings suggest the stock is currently may be overbought.

- Anticipated earnings release is in 11 days.

- 目前交易量爲164,569股,AMGN的價格下跌了-0.04%,現價爲334.17美元。

- RSI讀數表明股票目前可能超買。

- 預期利潤髮布時間爲11天后。

Expert Opinions on Amgen

安進的專家意見

2 market experts have recently issued ratings for this stock, with a consensus target price of $321.5.

兩名市場專家最近對這隻股票發表了評級,共識目標價格爲321.5美元。

- An analyst from Argus Research has decided to maintain their Buy rating on Amgen, which currently sits at a price target of $340.

- An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Amgen, which currently sits at a price target of $303.

- 雅運股份的一位分析師決定維持安進的買入評級,目標價爲340美元。

- 摩根士丹利的一位分析師決定維持對安進的中性評級,目標股價目前爲303美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $315.0 and $355.0 for Amgen, spanning the last three months.

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $315.0 and $355.0 for Amgen, spanning the last three months.