Behind the Scenes of Adobe's Latest Options Trends

Behind the Scenes of Adobe's Latest Options Trends

Whales with a lot of money to spend have taken a noticeably bearish stance on Adobe.

有大量資金的鯨魚對Adobe持明顯的看淡態度。

Looking at options history for Adobe (NASDAQ:ADBE) we detected 19 trades.

查看Adobe(納斯達克:ADBE)期權歷史記錄,我們檢測到19筆交易。

If we consider the specifics of each trade, it is accurate to state that 26% of the investors opened trades with bullish expectations and 36% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,有26%的投資者持看漲預期而有36%的投資者持看淡預期。

From the overall spotted trades, 13 are puts, for a total amount of $1,392,986 and 6, calls, for a total amount of $891,447.

在所有被發現的交易中,有13個交易是看跌期權,總金額爲1392986美元,有6個是看漲期權,總金額爲891447美元。

Predicted Price Range

預測價格區間

After evaluating the trading volumes and Open Interest, it's evident that the major market movers are focusing on a price band between $310.0 and $600.0 for Adobe, spanning the last three months.

在評估成交量和未平倉合約之後,很明顯,主要市場動態是集中在Adob的310.0到600.0美元之間的價格區間中,這跨越了過去三個月。

Analyzing Volume & Open Interest

分析成交量和未平倉合約

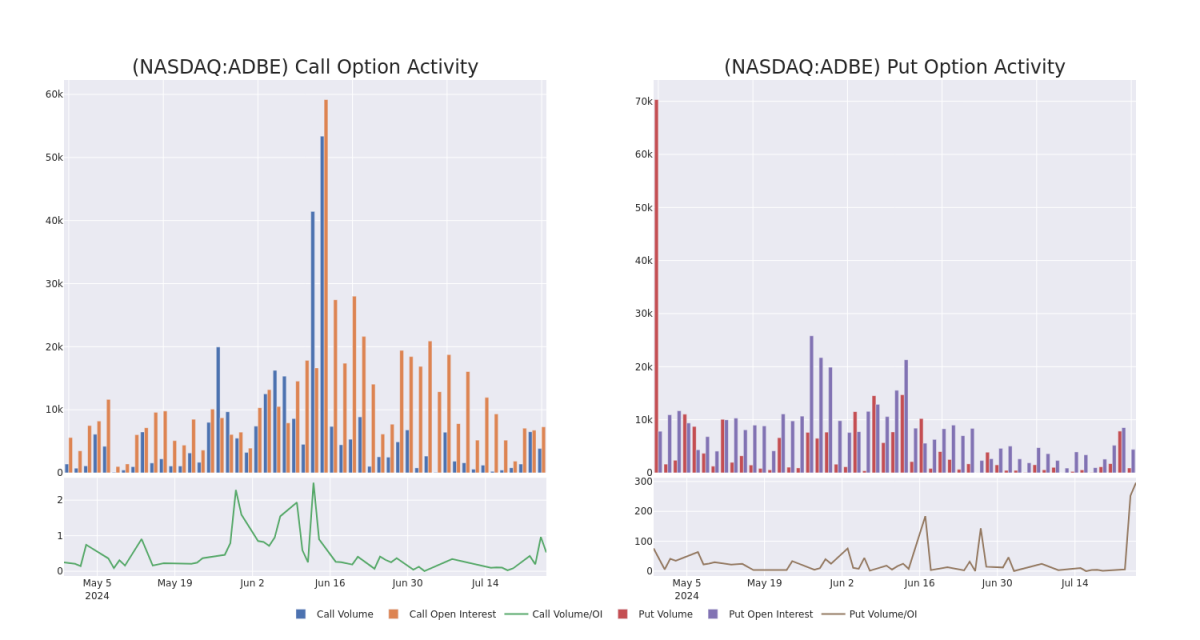

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Adobe's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Adobe's substantial trades, within a strike price spectrum from $310.0 to $600.0 over the preceding 30 days.

評估成交量和未平倉合約是期權交易的一個戰略步驟。這些指標揭示了Adobe在指定的執行價處期權的流動性和投資者興趣。隨後的數據將可視化顯示過去30天內,集中於價格區間從310.0到600.0美元的看漲和看跌期權交易的成交量和未平倉合約的波動。

Adobe Option Volume And Open Interest Over Last 30 Days

Adobe過去30天的期權成交量和持倉量

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| ADBE | PUT | TRADE | NEUTRAL | 11/15/24 | $18.45 | $17.35 | $18.0 | $500.00 | $540.0K | 23 | 0 |

| ADBE | CALL | TRADE | BULLISH | 06/20/25 | $52.8 | $50.3 | $52.0 | $600.00 | $468.0K | 559 | 90 |

| ADBE | CALL | TRADE | NEUTRAL | 07/26/24 | $61.75 | $52.5 | $57.27 | $480.00 | $125.9K | 29 | 23 |

| ADBE | PUT | TRADE | NEUTRAL | 08/16/24 | $60.95 | $55.55 | $58.34 | $595.00 | $122.5K | 0 | 0 |

| ADBE | PUT | TRADE | BEARISH | 08/16/24 | $60.55 | $55.55 | $58.78 | $595.00 | $117.5K | 0 | 61 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| adobe | 看跌 | 交易 | 中立 | 11/15/24 | $18.45 | $17.35 | $18.0 | $500.00 | $540.0K | 23 | 0 |

| adobe | 看漲 | 交易 | 看好 | 06/20/25 | $52.8 | $50.3 | $52.0 | $600.00 | $468.0K | 559 | 90 |

| adobe | 看漲 | 交易 | 中立 | 07/26/24 | $61.75 | $52.5 | $57.27 | 該公司的股票上週五收於$74.31。 | $125.9K | 29 | 23 |

| adobe | 看跌 | 交易 | 中立 | 08/16/24 | $60.95 | $55.55 | $58.34 | $595.00 | $122.5K | 0 | 0 |

| adobe | 看跌 | 交易 | 看淡 | 08/16/24 | $60.55 | $55.55 | $58.78 | $595.00 | $117.5K | 0 | 61 |

About Adobe

關於Adobe

Adobe provides content creation, document management, and digital marketing and advertising software and services to creative professionals and marketers for creating, managing, delivering, measuring, optimizing,g and engaging with compelling content multiple operating systems, devices, and media. The company operates with three segments: digital media content creation, digital experience for marketing solutions, and publishing for legacy products (less than 5% of revenue).

Adobe爲創意專業人員和營銷人員提供內容創建、文檔管理和數字營銷和廣告軟件和服務,以創建、管理、交付、衡量、優化和吸引有吸引力的內容,適用於多個操作系統、設備和媒體。該公司運營三個業務領域:數字媒體內容創建、數字化營銷解決方案體驗以及出版用於傳統產品(佔營業收入不到5%)。

In light of the recent options history for Adobe, it's now appropriate to focus on the company itself. We aim to explore its current performance.

針對Adobe最近的期權歷史,現在適當關注該公司本身。我們旨在探討其當前的表現。

Where Is Adobe Standing Right Now?

Adobe現在處於什麼位置?

- With a trading volume of 734,356, the price of ADBE is up by 1.63%, reaching $540.81.

- Current RSI values indicate that the stock is is currently neutral between overbought and oversold.

- Next earnings report is scheduled for 48 days from now.

- 隨着成交量爲734356,ADBE的價格上漲1.63%,達到540.81美元。

- 目前的RSI值表明該股票目前處於超買和超賣之間的中立狀態。

- 下一次業績將在48天后公佈。

Professional Analyst Ratings for Adobe

Adobe的專業分析師評級

In the last month, 1 experts released ratings on this stock with an average target price of $635.0.

上個月,有1位專家對這支股票進行了評級,平均目標價爲635.0美元。

- An analyst from Piper Sandler persists with their Overweight rating on Adobe, maintaining a target price of $635.

- 來自派傑投資的分析師仍然堅持對Adobe的看好評級,維持目標價635美元。

Options are a riskier asset compared to just trading the stock, but they have higher profit potential. Serious options traders manage this risk by educating themselves daily, scaling in and out of trades, following more than one indicator, and following the markets closely.

期權與僅交易股票相比是一種更具風險的資產,但它們具有更高的利潤潛力。認真的期權交易者通過每日學習,進出交易,跟隨多個指標並密切關注市場來管理這種風險。