Merck & Co's Options: A Look at What the Big Money Is Thinking

Merck & Co's Options: A Look at What the Big Money Is Thinking

Investors with a lot of money to spend have taken a bullish stance on Merck & Co (NYSE:MRK).

有很多錢可以投資的投資者對默沙東(NYSE: MRK)持看好態度。

And retail traders should know.

零售交易者應該知道。

We noticed this today when the positions showed up on publicly available options history that we track here at Benzinga.

我們在這裏追蹤的公開期權歷史記錄中發現,今天這些頭寸已經出現了。

Whether these are institutions or just wealthy individuals, we don't know. But when something this big happens with MRK, it often means somebody knows something is about to happen.

不管這些人是機構還是富人,我們無從得知。但是,當這樣的大事發生在MRK身上時,通常意味着有人知道即將發生的事情。

Today, Benzinga's options scanner spotted 10 options trades for Merck & Co.

今天,Benzinga的期權掃描器發現了10個默沙東期權交易。

This isn't normal.

這不正常。

The overall sentiment of these big-money traders is split between 70% bullish and 20%, bearish.

這些資金充裕的交易者的總體情緒在70%的看好和20%的看淡之間分裂。

Out of all of the options we uncovered, there was 1 put, for a total amount of $93,721, and 9, calls, for a total amount of $344,552.

在我們發現的所有期權中,有1個看跌期權,總金額爲93721美元,還有9個看漲期權,總金額爲344552美元。

Projected Price Targets

預計價格目標

Taking into account the Volume and Open Interest on these contracts, it appears that whales have been targeting a price range from $105.0 to $130.0 for Merck & Co over the last 3 months.

考慮到這些合約的成交量和持倉量,近3個月來鯨魚們一直將默沙東的目標價區間定在105.0美元到130.0美元之間。

Volume & Open Interest Trends

成交量和未平倉量趨勢

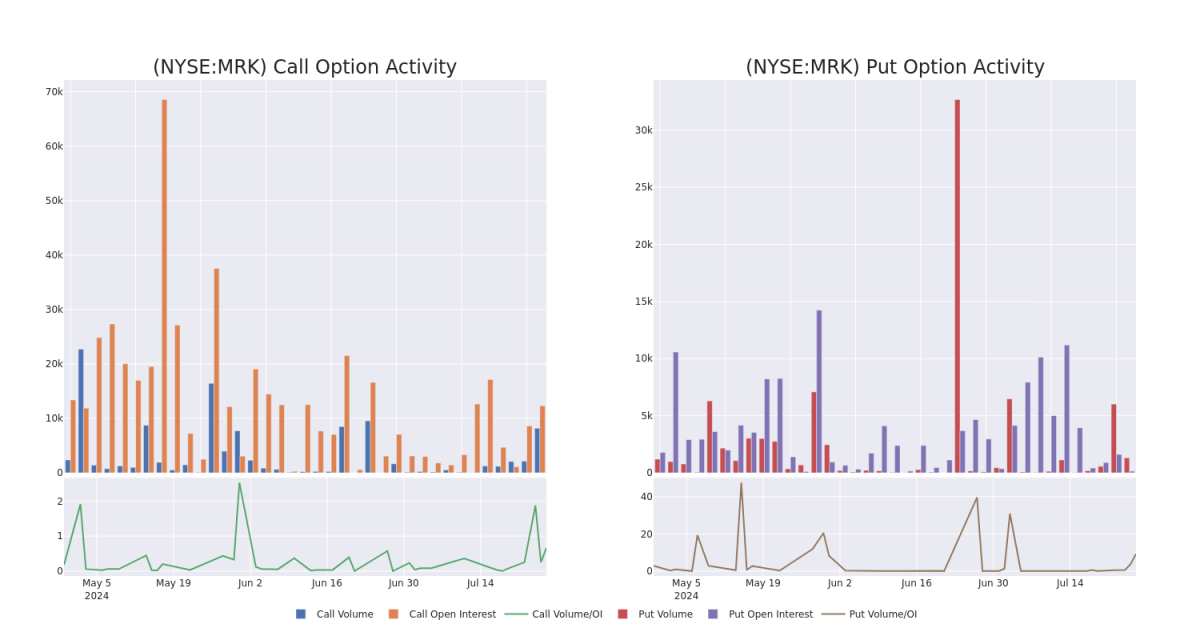

Assessing the volume and open interest is a strategic step in options trading. These metrics shed light on the liquidity and investor interest in Merck & Co's options at specified strike prices. The forthcoming data visualizes the fluctuation in volume and open interest for both calls and puts, linked to Merck & Co's substantial trades, within a strike price spectrum from $105.0 to $130.0 over the preceding 30 days.

評估成交量和持倉量是期權交易的一項戰略性步驟。這些指標揭示了默沙東的期權在指定行權價上的流動性和投資者興趣。即將到來的數據可視化了過去30天內在105.0美元到130.0美元行權價範圍內,關聯默沙東實質性交易的看跌和看漲期權的成交量和持倉量的波動。

Merck & Co Option Activity Analysis: Last 30 Days

默沙東期權活動分析:最近30天

Noteworthy Options Activity:

值得注意的期權活動:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRK | PUT | SWEEP | BULLISH | 08/02/24 | $0.93 | $0.8 | $0.8 | $120.00 | $93.7K | 142 | 1.3K |

| MRK | CALL | SWEEP | BEARISH | 08/02/24 | $1.6 | $1.38 | $1.45 | $130.00 | $72.6K | 1.7K | 1.5K |

| MRK | CALL | SWEEP | BULLISH | 08/16/24 | $2.7 | $2.16 | $2.7 | $130.00 | $54.0K | 5.1K | 200 |

| MRK | CALL | SWEEP | BULLISH | 08/02/24 | $1.48 | $1.42 | $1.48 | $130.00 | $37.9K | 1.7K | 2.1K |

| MRK | CALL | SWEEP | BEARISH | 08/02/24 | $2.12 | $2.02 | $2.02 | $128.00 | $36.3K | 3.0K | 1.1K |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| MRK | 看跌 | SWEEP | 看好 | 08/02/24 | $0.93 | $0.8 | $0.8 | $120.00 | $93.7K | 142 | 1.3K |

| MRK | 看漲 | SWEEP | 看淡 | 08/02/24 | $1.6 | $1.38應翻譯爲1.38美元 | $1.45 | $130.00 | $72.6K | 1.7K | 1.5K |

| MRK | 看漲 | SWEEP | 看好 | 08/16/24 | $2.7 | $2.16 | $2.7 | $130.00 | $54.0K | 5.1K | 200 |

| MRK | 看漲 | SWEEP | 看好 | 08/02/24 | 1.48美元 | $1.42 | 1.48美元 | $130.00 | $37.9K | 1.7K | 2.1K |

| MRK | 看漲 | SWEEP | 看淡 | 08/02/24 | $2.12 | $2.02 | $2.02 | 128.00美元 | $36.3千 | 3.0K | 1.1千 |

About Merck & Co

關於默沙東

Merck makes pharmaceutical products to treat several conditions in a number of therapeutic areas, including cardiometabolic disease, cancer, and infections. Within cancer, the firm's immuno-oncology platform is growing as a major contributor to overall sales. The company also has a substantial vaccine business, with treatments to prevent pediatric diseases as well as human papillomavirus, or HPV. Additionally, Merck sells animal health-related drugs. From a geographical perspective, just under half of the company's sales are generated in the United States.

默沙東生產多種藥品,治療多種領域的疾病,包括心代謝症、癌症和感染。在癌症領域,該公司的免疫腫瘤學平台正在成爲總銷售額的主要貢獻者。該公司還具有實質性的疫苗業務,包括預防兒童疾病以及人類乳頭瘤病毒(HPV)治療。此外,默沙東出售與動物健康相關的藥品。從地理角度來看,公司銷售額的近一半來自於美國境內。

Having examined the options trading patterns of Merck & Co, our attention now turns directly to the company. This shift allows us to delve into its present market position and performance

在檢查了默克和有限公司的期權交易模式之後,我們現在將直接關注該公司。這種轉變使我們能夠深入研究其現有市場地位和表現。

Present Market Standing of Merck & Co

默沙東的現市場地位

- With a trading volume of 3,124,311, the price of MRK is up by 0.09%, reaching $125.96.

- Current RSI values indicate that the stock is may be approaching overbought.

- Next earnings report is scheduled for 4 days from now.

- 成交量爲3,124,311,默沙東的股價上漲了0.09%,達到125.96美元。

- 當前RSI值表明該股票可能接近超買狀態。

- 下一個盈利報告將在4天內發佈。

What Analysts Are Saying About Merck & Co

關於默沙東的分析師觀點

1 market experts have recently issued ratings for this stock, with a consensus target price of $134.0.

1名市場專家最近對這支股票發表了評級,預計目標價爲134.0美元。

- An analyst from Morgan Stanley has decided to maintain their Equal-Weight rating on Merck & Co, which currently sits at a price target of $134.

- 大摩資源lof的一位分析師決定維持對默沙東的等權重評級,當前價格目標爲$134。

Options trading presents higher risks and potential rewards. Astute traders manage these risks by continually educating themselves, adapting their strategies, monitoring multiple indicators, and keeping a close eye on market movements. Stay informed about the latest Merck & Co options trades with real-time alerts from Benzinga Pro.

期權交易存在更高的風險和潛在回報。機智的交易者通過不斷學習、調整他們的策略、監測多個因子和密切關注市場動向來控制這些風險。通過Benzinga Pro實時提醒了解最新的默沙東期權交易。