Texas Instruments's Options Frenzy: What You Need to Know

Texas Instruments's Options Frenzy: What You Need to Know

Whales with a lot of money to spend have taken a noticeably bearish stance on Texas Instruments.

擁有大量資金的鯨魚們已經明顯持看淡態度了,他們對德州儀器的態度如此

Looking at options history for Texas Instruments (NASDAQ:TXN) we detected 12 trades.

查看德州儀器(納斯達克:TXN)的期權歷史,我們發現了12個交易

If we consider the specifics of each trade, it is accurate to state that 25% of the investors opened trades with bullish expectations and 50% with bearish.

如果我們考慮每筆交易的具體情況,可以準確地說,25%的投資者抱着看漲期望,50%的投資者持看淡態度

From the overall spotted trades, 7 are puts, for a total amount of $309,043 and 5, calls, for a total amount of $583,472.

從總交易中發現,有7個看跌,總金額爲309,043美元,有5個看漲,總金額爲583,472美元

Projected Price Targets

預計價格目標

Based on the trading activity, it appears that the significant investors are aiming for a price territory stretching from $195.0 to $210.0 for Texas Instruments over the recent three months.

根據交易活動,大投資者似乎瞄準了德州儀器在最近三個月內從195.0美元到210.0美元的價格區間

Insights into Volume & Open Interest

成交量和持倉量分析

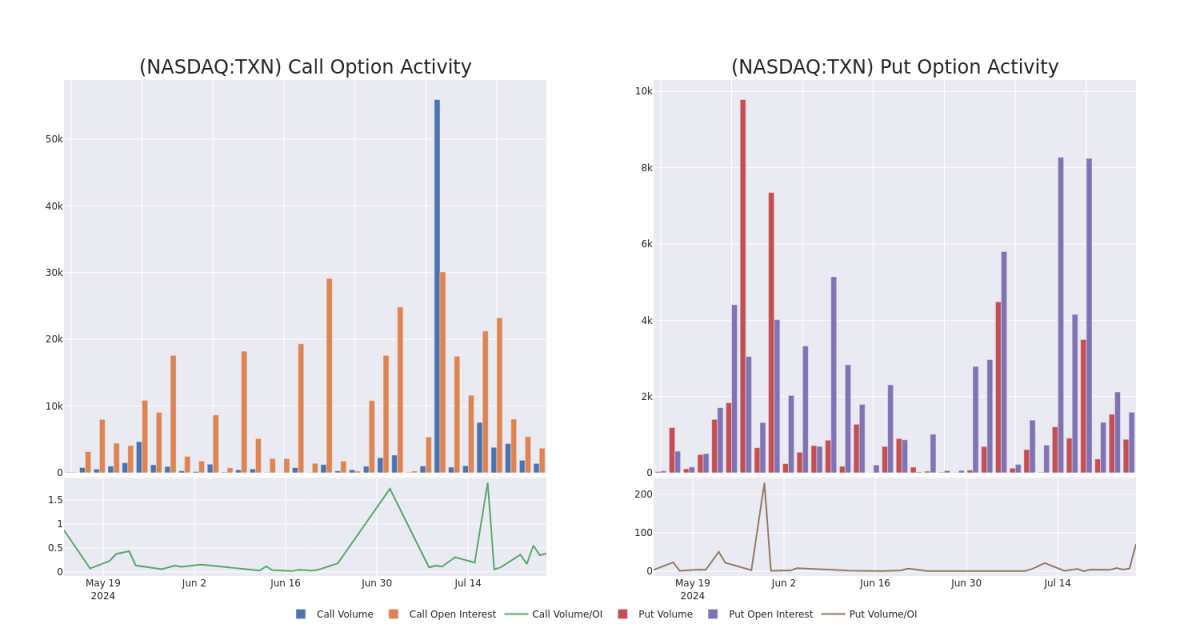

In today's trading context, the average open interest for options of Texas Instruments stands at 586.22, with a total volume reaching 2,282.00. The accompanying chart delineates the progression of both call and put option volume and open interest for high-value trades in Texas Instruments, situated within the strike price corridor from $195.0 to $210.0, throughout the last 30 days.

在今天的交易背景下,德州儀器期權的平均未平倉量爲586.22,總成交量達到2,282.00。下圖描述了過去30天內,在195.0美元至210.0美元的行權價格範圍內,德州儀器的高價值交易的看漲和看跌期權成交量和未平倉量的變化情況

Texas Instruments Call and Put Volume: 30-Day Overview

德州儀器看跌期權和看漲期權成交量:30天概覽

Biggest Options Spotted:

最大的期權交易:

| Symbol | PUT/CALL | Trade Type | Sentiment | Exp. Date | Ask | Bid | Price | Strike Price | Total Trade Price | Open Interest | Volume |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TXN | CALL | TRADE | BEARISH | 10/18/24 | $6.6 | $6.45 | $6.5 | $210.00 | $455.0K | 2.0K | 700 |

| TXN | PUT | SWEEP | BEARISH | 08/30/24 | $6.45 | $6.4 | $6.4 | $200.00 | $76.8K | 20 | 126 |

| TXN | PUT | SWEEP | BEARISH | 08/09/24 | $4.75 | $4.7 | $4.7 | $202.50 | $52.1K | 2 | 113 |

| TXN | PUT | SWEEP | BEARISH | 09/20/24 | $5.6 | $5.45 | $5.6 | $195.00 | $45.3K | 1.4K | 106 |

| TXN | PUT | SWEEP | NEUTRAL | 08/02/24 | $3.85 | $3.75 | $3.75 | $202.50 | $37.3K | 71 | 201 |

| 標的 | 看跌/看漲 | 交易類型 | 情緒 | 到期日 | 賣盤 | 買盤 | 價格 | 執行價格 | 總交易價格 | 未平倉合約數量 | 成交量 |

|---|---|---|---|---|---|---|---|---|---|---|---|

| TXN | 看漲 | 交易 | 看淡 | 10/18/24 | 6.6 | $6.45 | $6.5 | 目標股價爲$210.00。 | $455.0K | 2.0K | 700 |

| TXN | 看跌 | SWEEP | 看淡 | 08/30/2024 | $6.45 | 6.4美元 | 6.4美元 | 。 | $76.8K | 20 | 126 |

| TXN | 看跌 | SWEEP | 看淡 | 08/09/24 | $4.75 | $4.7 | $4.7 | $202.50 | $52.1K | 2 | 113 |

| TXN | 看跌 | SWEEP | 看淡 | 09/20/24 | $5.6 | $5.45 | $5.6 | $195.00 | $45.3K | 1.4千 | 106 |

| TXN | 看跌 | SWEEP | 中立 | 08/02/24 | $3.85 | $3.75 | $3.75 | $202.50 | $37.3K | 71 | 201 |

About Texas Instruments

關於德州儀器

Dallas-based Texas Instruments generates over 95% of its revenue from semiconductors and the remainder from its well-known calculators. Texas Instruments is the world's largest maker of analog chips, which are used to process real-world signals such as sound and power. Texas Instruments also has a leading market share position in processors and microcontrollers used in a wide variety of electronics applications.

總部位於達拉斯的德州儀器有超過95%的營業收入來自半導體,剩下的來自其著名的計算器。德州儀器是世界上最大的模擬芯片製造商,用於處理實時信號(如聲音和電源)。德州儀器還在處理器和微控制器方面擁有領先的市場份額,用於各種電子應用。

Current Position of Texas Instruments

德州儀器的當前持倉

- Currently trading with a volume of 3,109,633, the TXN's price is up by 1.61%, now at $200.33.

- RSI readings suggest the stock is currently may be approaching overbought.

- Anticipated earnings release is in 88 days.

- 當前成交量爲3,109,633,TXN的價格上漲了1.61%,目前爲200.33美元

- RSI讀數表明該股目前可能接近超買水平。

- 預計發佈收益的時間還有88天

What The Experts Say On Texas Instruments

關於德州儀器,專家有何說法

A total of 5 professional analysts have given their take on this stock in the last 30 days, setting an average price target of $198.8.

最近30天中,共有5位專業分析師對這支股票發表了看法,並確定了平均目標價爲198.8美元

- An analyst from Baird has decided to maintain their Neutral rating on Texas Instruments, which currently sits at a price target of $200.

- An analyst from Deutsche Bank persists with their Hold rating on Texas Instruments, maintaining a target price of $185.

- Maintaining their stance, an analyst from Rosenblatt continues to hold a Buy rating for Texas Instruments, targeting a price of $250.

- An analyst from Morgan Stanley has decided to maintain their Underweight rating on Texas Instruments, which currently sits at a price target of $156.

- An analyst from Truist Securities has decided to maintain their Hold rating on Texas Instruments, which currently sits at a price target of $203.

- Baird的一位分析師決定維持他們對德州儀器的中立評級,該評級目前爲200.0美元

- 德意志銀行的一位分析師堅持對德州儀器的持有評級,維持目標價爲185.0美元

- Rosenblatt的一位分析師繼續持有德州儀器的買入評級,目標價爲250.0美元

- 大摩資源lof的一位分析師決定保持他們的“輕倉”評級關於德州儀器,該股票目標價格目前爲156美元。

- Truist Securities的一位分析師決定維持他們對德州儀器的持有評級,該評級目前爲203.0美元

Trading options involves greater risks but also offers the potential for higher profits. Savvy traders mitigate these risks through ongoing education, strategic trade adjustments, utilizing various indicators, and staying attuned to market dynamics. Keep up with the latest options trades for Texas Instruments with Benzinga Pro for real-time alerts.

交易期權涉及更大的風險,但也提供了更高收益的潛力。明智的交易者通過持續教育、戰略性交易調整、利用各種因子和保持對市場動態的敏銳感來減輕這些風險。使用Benzinga Pro獲取實時警報,了解德州儀器的最新期權交易。

From the overall spotted trades, 7 are puts, for a total amount of $309,043 and 5, calls, for a total amount of $583,472.

From the overall spotted trades, 7 are puts, for a total amount of $309,043 and 5, calls, for a total amount of $583,472.